What Is Classed As Business Mileage Hmrc

Travelling to appointments such as those taken by meter readers or sales people Travelling to temporary workplaces such as a surveyor or an auditor. Travel to and from home to a permanent workplace where an employee works on a permanent basis as part of their employment duties is classed as part of.

Self Employed Guide How To Claim For Business Mileage

When your employer works out your wages they total up your salary and then deduct certain allowable expenses including business mileage to ascertain the total taxable pay.

What is classed as business mileage hmrc. The relief calculation is based on. Business mileage refers to journeys you undertake in the course of your work with the exception of your regular commute. Mileage Allowance Relief MAR is a tax relief that allows you to pay less tax based on how much your employer has paid you when reimbursing you for your work-related mileage.

Another point which could be relevant is Section 339 2 ITEPA 2003. If it is not it is likely that none of the. First work out the total number of miles travelled on business in the given tax year.

Mileage Allowance Relief is based on the number of business miles you travel in the year. Business mileage is defined as travel an individual is obliged to make in order to complete the duties of their employment. According to HMRC here are the following types of journeys that are classed as business mileage.

Business mileage covers the miles you travel for business purposes such as travelling to a client. For the purpose of deciding if tax relief is applicable on paid mileage expenses- a Does the fact that due to COVID-19 we have been forced to work from home whilst our office is shut can we consider the mileage from our home address when travelling to building sites to undertake inspections as dedicated business miles. HMRCs current AMAP rates are.

HMRC has clear rules for claiming mileage expenses. A car drive to the clients office or some other facility counts as well. Mileage Allowance Payments MAPs are what you pay your employee for using their own vehicle for business journeys.

Since your employer has already reimbursed you at a rate of 10p per mile you can only claim 45p less 10p so 35p per mile. HMRC guidelines define travel between your home and your regular permanent place of employment as a non-work journey making it ineligible to. Then multiply the current approved mileage rate by the business miles to reach the.

To give you an idea here are the present HMRC business mileage rates for vans cars motorcycles and bikes. So we know that you can claim mileage allowance for business trips but what actually counts as business purposes according to HMRC. Authorised rates for business mileage reimbursement AMAP for private cars and vans utilised for business use are set by HMRC at 45p per mile for the first 10000 business miles and then 25p per mile thereafter.

In a nutshell you can claim for any trip thats outside your usual journey to work. What can be classified as business mileage. What are other travel expenses that are tax deductible.

HMRC have a formula for working out the amount of tax relief Mileage Allowance Relief which you can get. To find your tax-deductible business mileage costs youd multiply 9000 miles by 35p which would give you 3150. Mileage Allowance Relief works by reducing your taxable pay.

What is classed as business mileage. Conversely if the journey takes them away from the direction of the office or is significantly further than the normal commute over 10 miles then the travel would be classed as business mileage. Youre allowed to pay your employee a.

A mileage rate for business travel only paid in arrears on an actual basis a payment based on estimated mileage as long as the estimate is reasonable. Its also sometimes known as Mileage Relief or Mileage Tax Relief. Business mileage is an important but often overlooked expense for sole traders contractors and directors employed by their limited companies.

The delivery of any good to the client counts. In basic terms it is as follows. For the first 10000 miles the rate for cars and vans is 045 the rate for motorcycles is 024 while the rate for bikes is 020.

45p for the fist 10000 miles travelled 25p for every mile thereafter. Any travel the employee needs in order to perform their work duties can be claimed as business mileage. At the time of writing you are allowed up to 45p per mile tax-free for every business mile you travel in your personal car.

This does not include ordinary commuting from home to a permanent workplace or private travel. - Office to site - business mileage - Home to site non-stop - business mileage - Home to office - private mileage But note only the office to site part of a home to site journey is claimable if the employee stops off at the office on the way to the site. Mileage Allowance Relief.

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

How To Understand Hmrc S Rules On Commuting In The Uk Mileiq Uk

How To Claim Business Mileage Why It S Ok For The Business

What Is Classed As Business Mileage Fresh Fleet Thinking

Reclaiming Vat On Business Mileage Expenses Travelperk

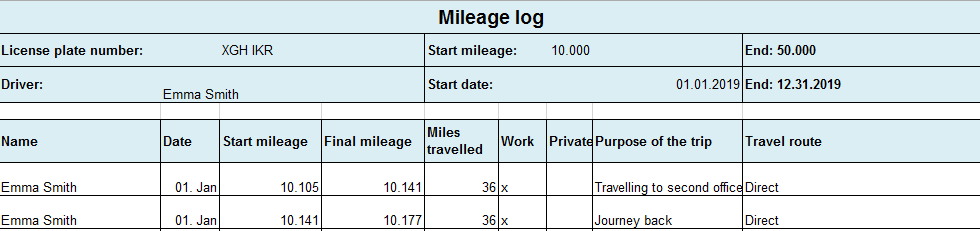

A Fleet Manager S Guide Logging Driver Mileage

Do You Need To Keep A Mileage Log

What Amount To Business Mileage In The Uk Gpa

Hmrc Business Mileage Get Tax Relief For Miles

Do You Need To Keep A Mileage Log

Self Employed Guide How To Claim For Business Mileage

Keep A Mileage Log And Save Taxes Ionos

What Amount To Business Mileage In The Uk Gpa

A Guide To Business Mileage Allowance News

7 Benefits Of Business Bank Accounts Vs Employee Expenses

Self Employed Guide How To Claim For Business Mileage

A Beginner S Guide To Mileage Expenses And Small Business Zervant Blog

Your Guide To Claiming Mileage Allowance Tripcatcher

Claiming Business Mileage Expenses Caseron Cloud Accounting

Post a Comment for "What Is Classed As Business Mileage Hmrc"