Nhs Business Mileage Rate 2020

GP trainees in Northern Ireland Scotland and Wales employed under the 2002 TCS have the below entitlement to home to base mileage. Enter your route details and price per mile and total up your distance and expenses.

25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Mileage Deduction Templates How Are You Feeling

Travel in or on the students own vehicle.

Nhs business mileage rate 2020. Reimburse employees for company car business travel. TDAE guidance booklet V7 122020. Find out more about the NHS.

If you are referred to hospital or other NHS premises for non emergency tests or treatment you. Summary of private mileage Mode of transport Total number of miles including community mileage. 26 May 2020.

Routes are automatically saved. Rates of reimbursement from 1 January 2015 Column 1 Column 2 Column 3 Column 4 Type of vehicleallowance Annual mileage up to 10000 miles standard rate Annual mileage over 10000 miles standard rate All eligible miles travelled Car all types of fuel 45 pence per. Exclusively for NHS business.

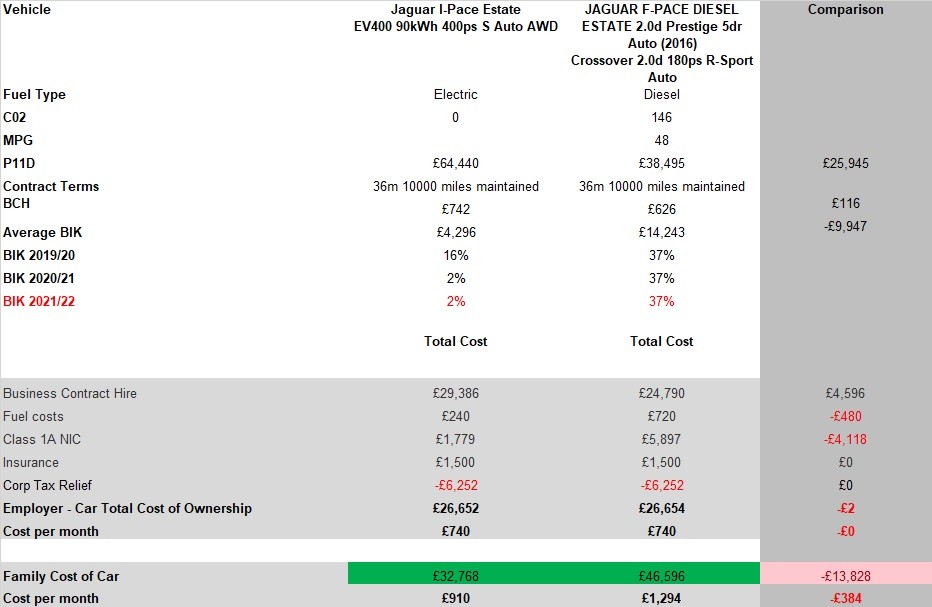

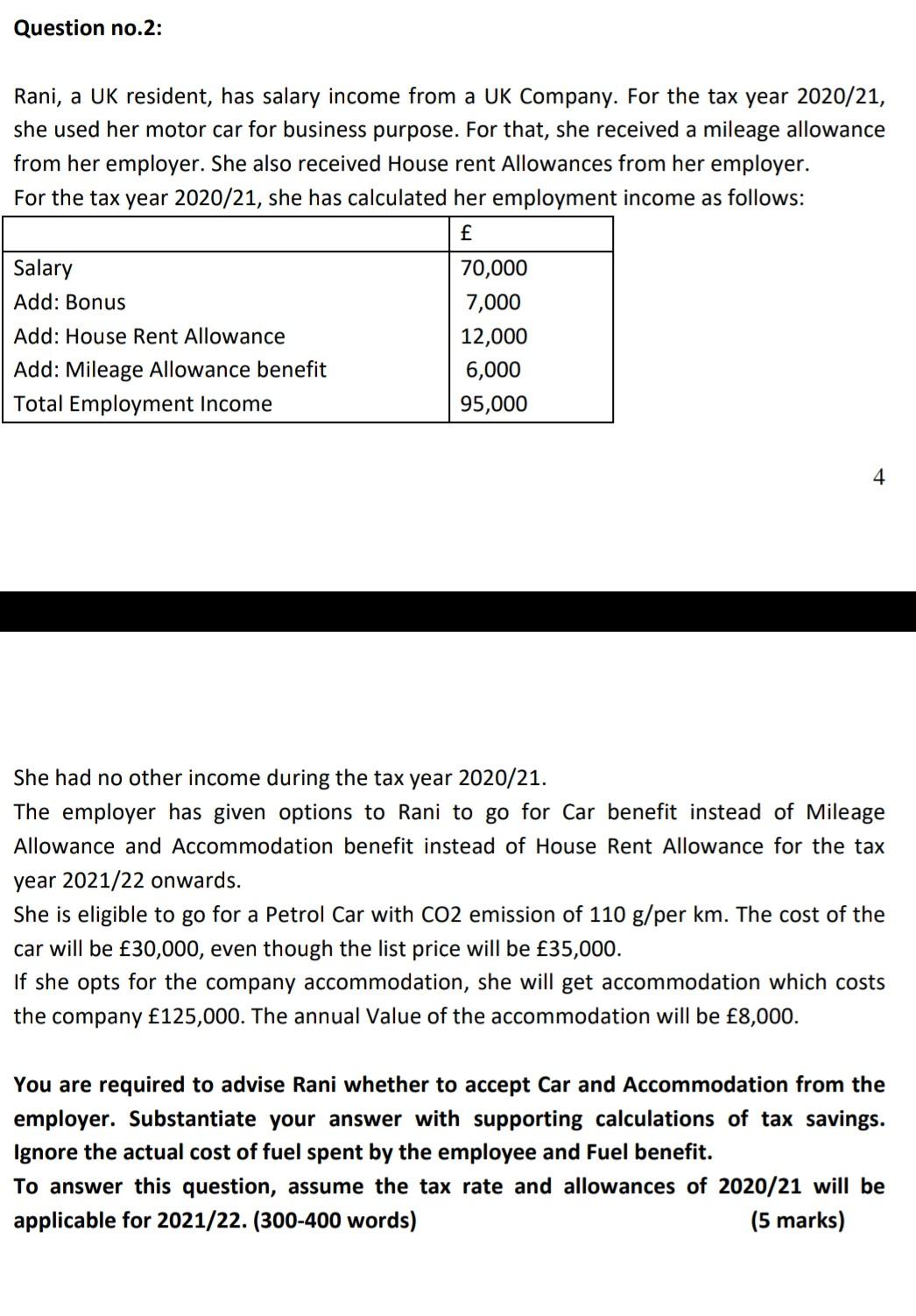

42 Cars may be provided for NHS business and private use or for NHS business use only. If the employer pays lower rates the employee will be able to get tax relief called Mileage Allowance Relief or MAR on the unused balance of the approved amount. This charge also applies to cars which are returned under contract for business mileage where the allowance.

How rates are calculated. Page 52 of 52. The NHS mileage allowance may not cover all the extra costs of driving for work but it is intended to be a meaningful contribution towards it.

Read more information about car running costs in our driving advice section. Where possible the aim of this policy is to encourage employees to reduce unnecessary travel and encourage the. 20 pence Motor vehicle x.

Travel and subsistence policy Last amended. These rates of reimbursement will be adjusted in accordance with the published AMAP rate. Business standard mileage rate treated as depreciation is 24 cents per mile for 2016 25 cents per mile for 2017 25 cents per mile for 2018 26 cents per mile for 2019 and 27 cents per mile for 2020.

Rates payable 202021. 531 Annex A point 1 shows mileage rates to be applied to all staff on agenda for change. Mileage will be reimbursed at the reserve rate 28p per mile as stated within the NHS staff handbook.

28 pence Passengers If you took other NHS students tofrom placement enter their details below. If you travel by car and your claim is approved you will be reimbursed for fuel costs at a mileage rate based on direct distance from home to the treatment centre. As an alternative to reimbursement of NHS mileage rates at current rates paid for the use of a private vehicle and is open to all staff on that basis.

You can improve your MPG with our eco-driving advice. Do colleagues have lease cars or would colleagues be given an allowance for use of their own vehicle. Each passenger must be an NHS bursary funded student.

Read more about this in the 2016 TCS. Pedal cycle 20p per mile Motor vehicle 28p per mile Parking tolls and ferries Actual cost. All mileage rates are regularly recalculated by the NHS Staff Council taking into account the changing costs of motoring overall and fuel.

Staff using their own vehicles to undertake business mileage are reimbursed in line with nationally agreed mileage rates. 1710 The rates of reimbursement are set out in Table 7 below. 1711 The rates of reimbursement in Table 7 columns 2 and 3 and the rate of reimbursement for motor cycles in column 4 will apply from 1 January 2015 and are those set out by HMRC as approved mileage allowance payments AMAP rates.

To reclaim tax relief through Mileage Allowance Relief MAR it is vital that a worker maintains accurate records of business trips and reimbursement payments. Business Travel NHS Greater Glasgow and Clyde is committed to reducing the financial and environmental impact arising from its business travel. Staff with lease cars are paid at lower rates again based on a rate per mile.

If the mileage rate you pay is no higher than the advisory fuel rates for the engine size and fuel type of the company car there will be no. Patients who are not in receipt of a qualifying benefit but are on a low income and whose savings are 16000 or less or 23250 or less if in a care home or 24000 or less if residents in Wales may be eligible for assistance with their NHS travel expenses. Cost Claim limited to Public transport.

Easy Ways To Track Mileage For Your Small Business Sabrina S Admin Services Business Mentor Mileage Business

Nhs Business Mileage Rate 2020

Nhs Business Mileage Rate 2020

Should You Take A Company Car Or A Car Allowance

Mileage Rate Calculator 2021 Uk

Marketing Project Request Form Template Inspirational Expenses Claim And Reimbursement Form Sample For Excel Excel Templates Invoice Template Templates

3 Right Sizing Through Performance Targets And Trade Offs White Papers For Right Sizing Transportation Investments The National Academies Press

Does An Employer Have To Reimburse Travel Expenses

Free 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Report Template Templates Business Template

Http Www Nhsggc Org Uk Media 226792 Expenses 20policy Pdf

Mileage Allowances Section 17 Nhs Employers

Images For Gt Time Card Template Card Templates Free Excel Templates Timesheet Template

Images For Gt Time Card Template Card Templates Free Excel Templates Timesheet Template

Https Www Unison Org Uk Content Uploads 2019 04 Vehicle Allowances Pdf

Mileage Log Mileage Tracker For Tax Purposes Printable Etsy In 2021 Work Planner Weekly Work Planner Mileage Tracker

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Wo Mileage Templates How Are You Feeling

Should You Take A Company Car Or A Car Allowance

How To Claim For Your Mobile Phone Expense When Self Employed

Post a Comment for "Nhs Business Mileage Rate 2020"