Business Auto Mileage Rate 2020

575 cents per mile for business. Carrying through the example above.

What Are The Irs Mileage Rates Updated 2021 Bench Accounting

Ed drove his car 2000 miles for his real estate business in 2020.

Business auto mileage rate 2020. 575 per mile for business miles driven 58 per mile in 2019. Check the IRS website for the current years rate. To figure out your deduction simply multiply your business miles by the applicable standard mileage rate.

The automobile allowance rates for 2019 are. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and. Only payments specifically for carrying passengers count and.

Beginning January 1 2020 the Internal Revenue Service IRS adjusted the standard mileage rates resulting in a decrease of 05 cents per mile in the rate used for business mileage and a decrease of 3 cents per mile in the rate used for medicalmoving mileage. The New Standard Mileage Rates. These new rates will apply for the use of cars vans pickups and panel trucks.

Business Mileage Rate Decreasing in 2020 January 2 2020 D Payroll Administration Effective Jan. The 2020 rate for business use of your vehicle is 575 cents 0575 a mile. 56 cents per mile for business miles this is a decrease of 15 cents from 2020 16 cents per mile for medical or moving expenses this is a decrease of 1 cent from 2020 14 cents per mile driven in service of charitable organizationsthis rate is set by law and hasnt changed from previous years 4.

Once you have determined your business mileage for the year simply multiply that figure by the Standard Mileage rate. If the mileage rate you pay is no higher than the advisory fuel rates for the engine size and fuel type of the company car there will be no. In the Northwest Territories Yukon and Nunavut there is an additional 4 per kilometre allowed for travel.

Reimburse employees for company car business travel. However if you use the car for both business and personal purposes you may deduct only the cost of its business use. Uber makes it easy to track your online miles.

The automobile allowance rates for 2020 are. E ffective Jan. The total number of miles driven during the year The total number of miles driven just for business.

53 per kilometre driven after that. 14 rows Standard Mileage Rates. Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

58 per kilometre for the first 5000 kilometres driven. 5000 business miles x 0575 standard rate 2875 Standard Mileage deduction. Jan 01 2020 Beginning on January 1 2020 the standard mileage rates for the use of a car van pickup or panel truck will be.

56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate for 2020 and. Starting January 1st 2020 new mileage rates will apply. To determine the number of miles driven for business you need two numbers for each business vehicle.

Depreciation limits on vehicles. 1 2020 the optional standard mileage rate used in deducting the costs of operating an automobile for business is 575 cents per mile down one-half cent from 2019 the IRS. Effective January 1 2020 the IRS mileage rates.

The IRS allows employees and self-employed individuals to use a standard mileage rate which for 2020 business driving is 575 cents per mile. The following table summarizes the optional standard mileage. 59 per kilometre for the first 5000 kilometres driven.

The additional first-year limit on depreciation for vehicles acquired before September 28 2017 is no longer allowed if placed in service after 2019. A mileage rate is used in lieu of the payment of actual and necessary expenses such as gas oil and wear and tear on the vehicle associated with the use of a. Employees while using their personal vehicles for business reasons.

For 2020 the standard mileage rate is 575 cents per mile down from 58 cents per mile in 2019. 1 2020 the standard mileage rates for the use of a car. 5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work journeys for them.

You can generally figure the amount of your deductible car expense by using one of two methods. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. 1 2020 the standard mileage rates for the use of a car including vans pickups and panel trucks are.

The standard mileage rate. Taxpayers will use this rate when computing deductible costs when using a vehicle for business charitable medical or moving expense purposes. For 2020 the standard mileage rates are.

Table of Contents Travel and Conference Expense Management 1. Like the GSA rates this rate. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later.

Personal Vehicle Standard Rate. For tax year 2020 the Standard Mileage rate is 575 centsmile.

![]()

25 Printable Irs Mileage Tracking Templates Gofar

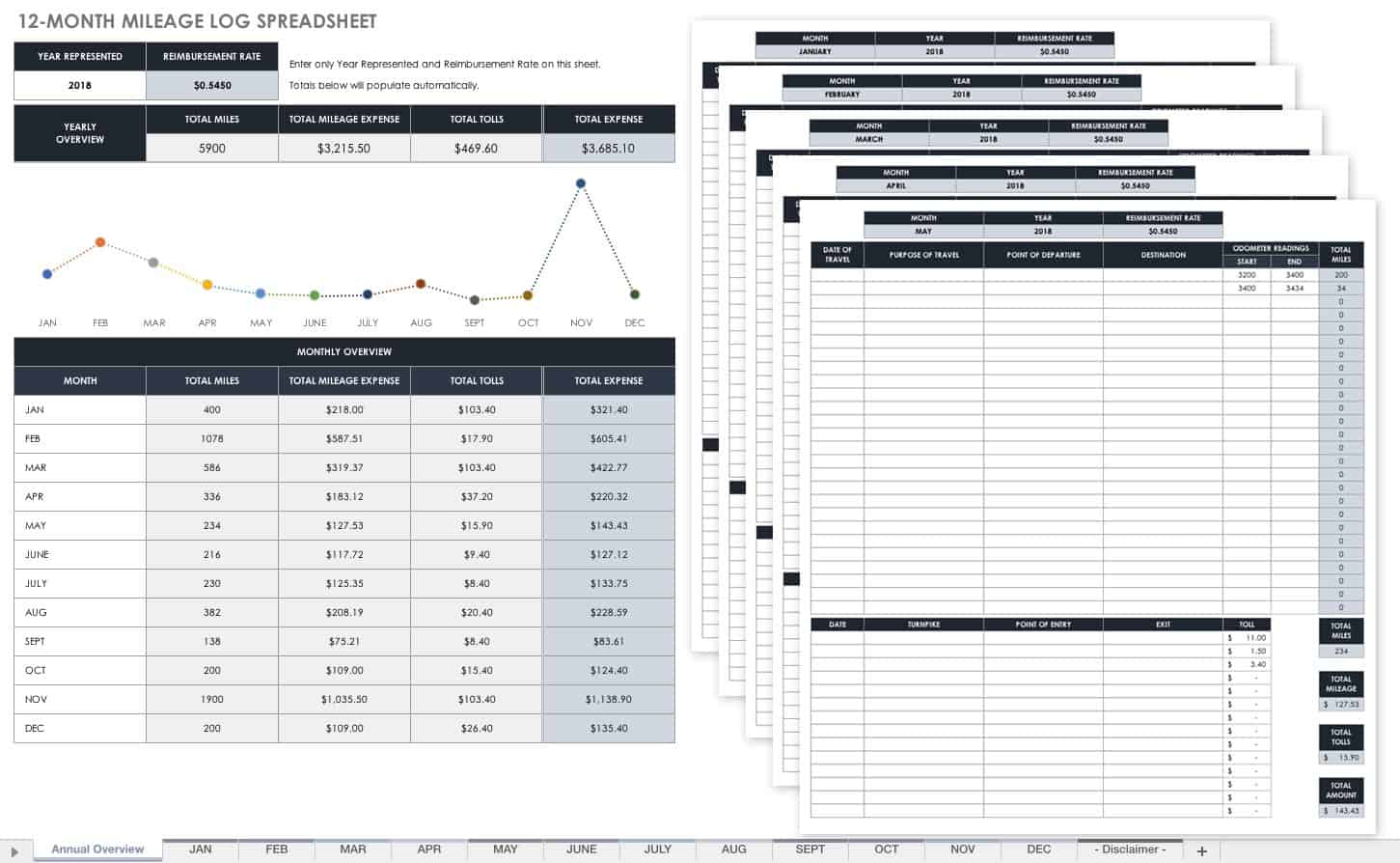

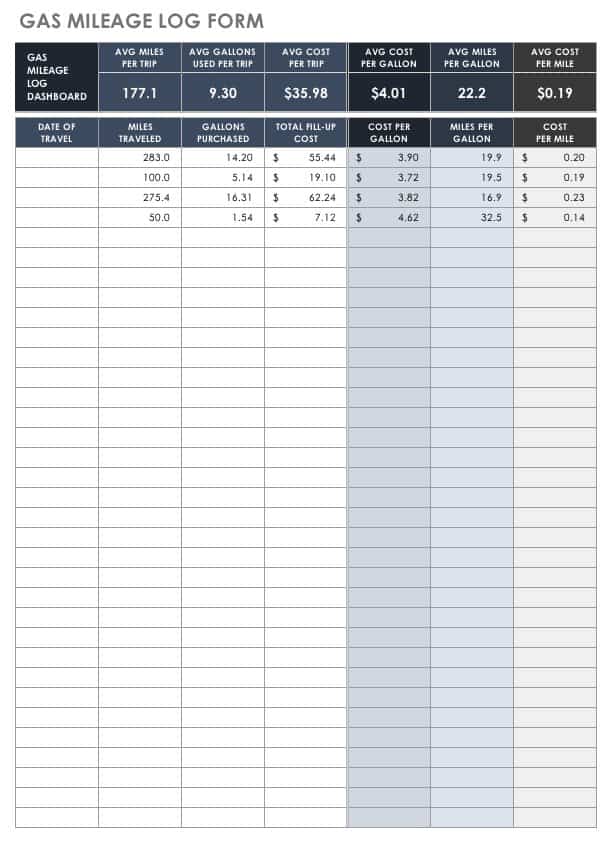

Free Mileage Log Templates Smartsheet

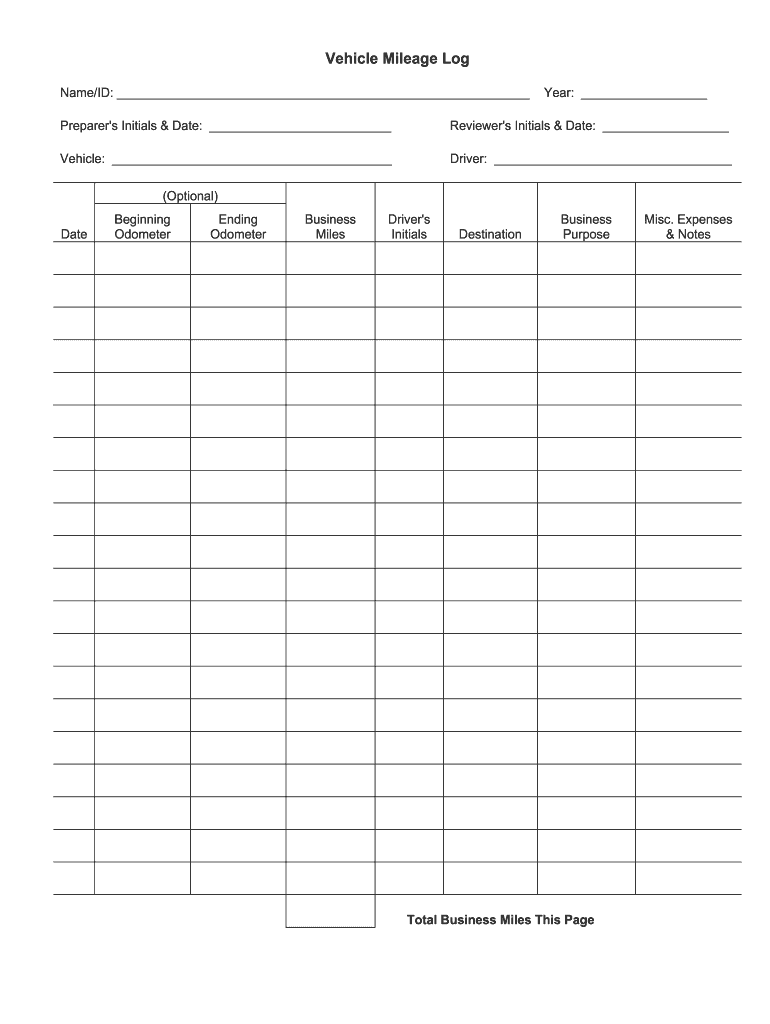

Printable Mileage Log Fill Online Printable Fillable Blank Pdffiller

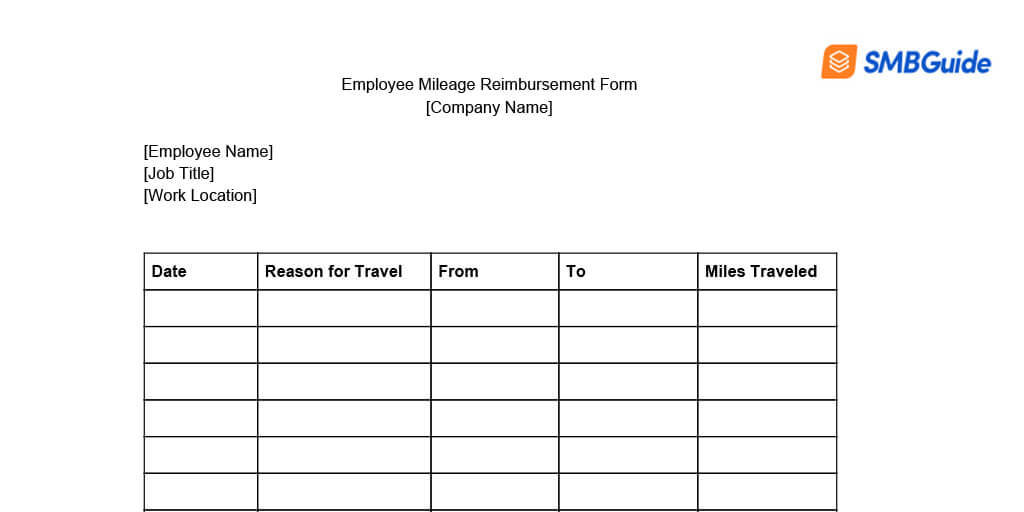

Mileage Reimbursement For Employees Info Free Download

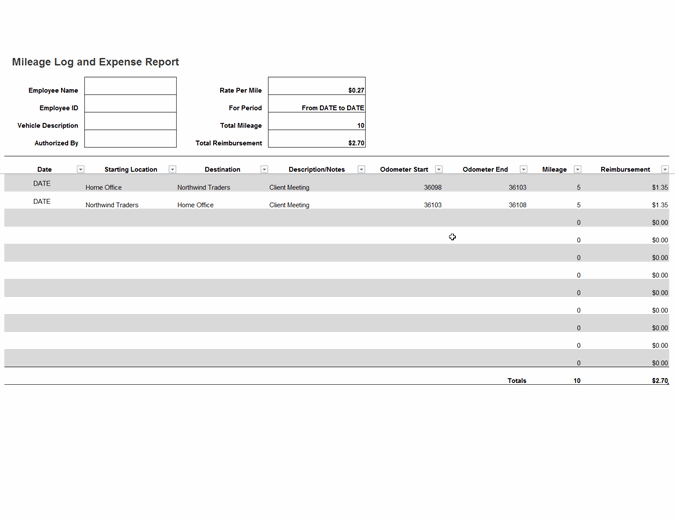

Mileage Log And Expense Report

What Is The Average Company Car Allowance For Sales Reps

Company Mileage Reimbursement How To Reimburse Employees For Mileage

Free Mileage Log Templates Smartsheet

![]()

25 Printable Irs Mileage Tracking Templates Gofar

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Free Mileage Log Templates Smartsheet

Https Mn Gov Mmb Assets 20200102 Tcm1059 414823 Pdf

Instructions For Form 2106 2020 Internal Revenue Service

Free Mileage Log Templates Smartsheet

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form

Business Use Of Vehicles Turbotax Tax Tips Videos

Free Mileage Log Templates Smartsheet

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

Post a Comment for "Business Auto Mileage Rate 2020"