Business Use Of Home Depreciation Life

As long as you determine actual expenses and the correct amount of allowed or allowable depreciation the depreciation reduces the. Specifically these debit the Depreciation Expense account and credit Accumulated Depreciation a contra-asset that diminishes the assets book value.

4 Form Deductions 4 Benefits Of 4 Form Deductions That May Change Your Perspective 1099 Form Deductions Handy Printabl Tax Prep Checklist Business Tax Tax Prep

When a daycare providers home is also a place of business the IRS generally only allows you to depreciate the portion of your home that is used 100 percent for daycare purposes only unless you have an active daycare license certification or approved daycare registration from the state or you are exempt from having a state license or registration.

Business use of home depreciation life. The depreciation life of your home office is 39 years since its business says the Illinois CPA. To deduct expenses for business use of the home you must use part of your home as one of the following. Straight-line is a depreciation method that gives you the same deduction year after year over the assets useful life.

Depreciation on your home is deductible only if you use your home for business. Depreciation is a procedure for subtracting the reduced value during an assets usable life. You can enter depreciation data either on screen 4562 and point it using the For box to 8829 or you can enter the data directly on screen 8829.

In this case count the number of months or partial months you used your home for business. You might also have a number of other business expenses and assets you can depreciate or claim as Section 179 deductions. Annually you record the amount of depreciation by making journal entries.

If you began using your home for business before 2020 continue to use the same depreciation method you used. If I dont use Form 4562 can I get Form 8829 Office in Home to figure depreciation for business use of a taxpayers home. Use a prorated depreciation percentage if you stopped using your home for business during the year.

Exclusively and regularly as your principal place of business for your trade or business. Information about Form 8829 Expenses for Business Use of Your Home including recent updates related forms and instructions on how to file. The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168a of the IRC or the alternative depreciation system provided in section 168g.

Exclusively and regularly as a place where you. The IRS has determined the costs associated with business real property must be spread out. Youre effectively claiming a tax deduction equal to the cost of the portion your home dedicated to your office.

However your deduction is limited to the percentage of your home that is dedicated exclusively to your business. You can generally figure depreciation on the business use portion of your home up to the gross income limitation over a 39-year recovery period and using the mid-month convention. For example if only 10 of the square footage of your house is reserved exclusively for business use you can only use 10 of your home expenses as a business deduction.

Use Form 8829 to figure the allowable expenses for business use of your home on Schedule C Form 1040 and any carryover to next year of amounts not deductible this year. For example you could depreciate 15 of your homes value if your office takes up 15 of your homes square footage. If you began using your home for business before 2016 continue to use the same depreciation method you used.

Tax law also provides that you can depreciate the portion of your property used for business purposes. The deduction amount is simply the assets cost basis divided by its years of useful life. All allowed or allowable depreciation must be considered at the time of sale.

Depreciation on your home is deductible only if you use your home for business. The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674. Depreciation is a method used to determine how much of the assets eg.

Freelancers and others who operate their businesses from home can often claim a tax deduction for their home office expenses. Depreciating these assets in accordance with the rules from the IRS will allow you to claim a portion of the cost as a deduction on your taxes each year. In other words you can divide your cost basis in the property by 275 to determine your annual depreciation expense If.

Per IRS Publication 587 Business Use of Your Home Including Use by Daycare Providers on page 8. Figuring the depreciation deduction for the current year. Some rules apply but theyre not particularly burdensome.

For Airbnb rental owners the cost of buying or improving your home can be depreciated. Business - Use of Home - Depreciation 39 Years. Figuring the Depreciation Deduction for the Current Year.

On a graph the assets value over time would appear as a straight line sloping downward hence the name. The IRS says you can treat these as having a useful life of 275 years. Business - Use of Home - Depreciation 39 Years.

Your home value has been used up.

Tax Documents Infographic Tax Appointment Business Tax Tax Organization

List Of Business Ideas Reddit Round Home Business Ideas In Kannada These Home Business Depreciation Money Blogging Make Money Blogging Best Business Ideas

Pin By Best Home Decor On Yarn Business Board Granite Flooring Table Guide Flooring

Depreciation In Excel Accounting Classes Excel Tutorials Bookkeeping Templates

Depreciation In Excel Rv Chart Need To Know

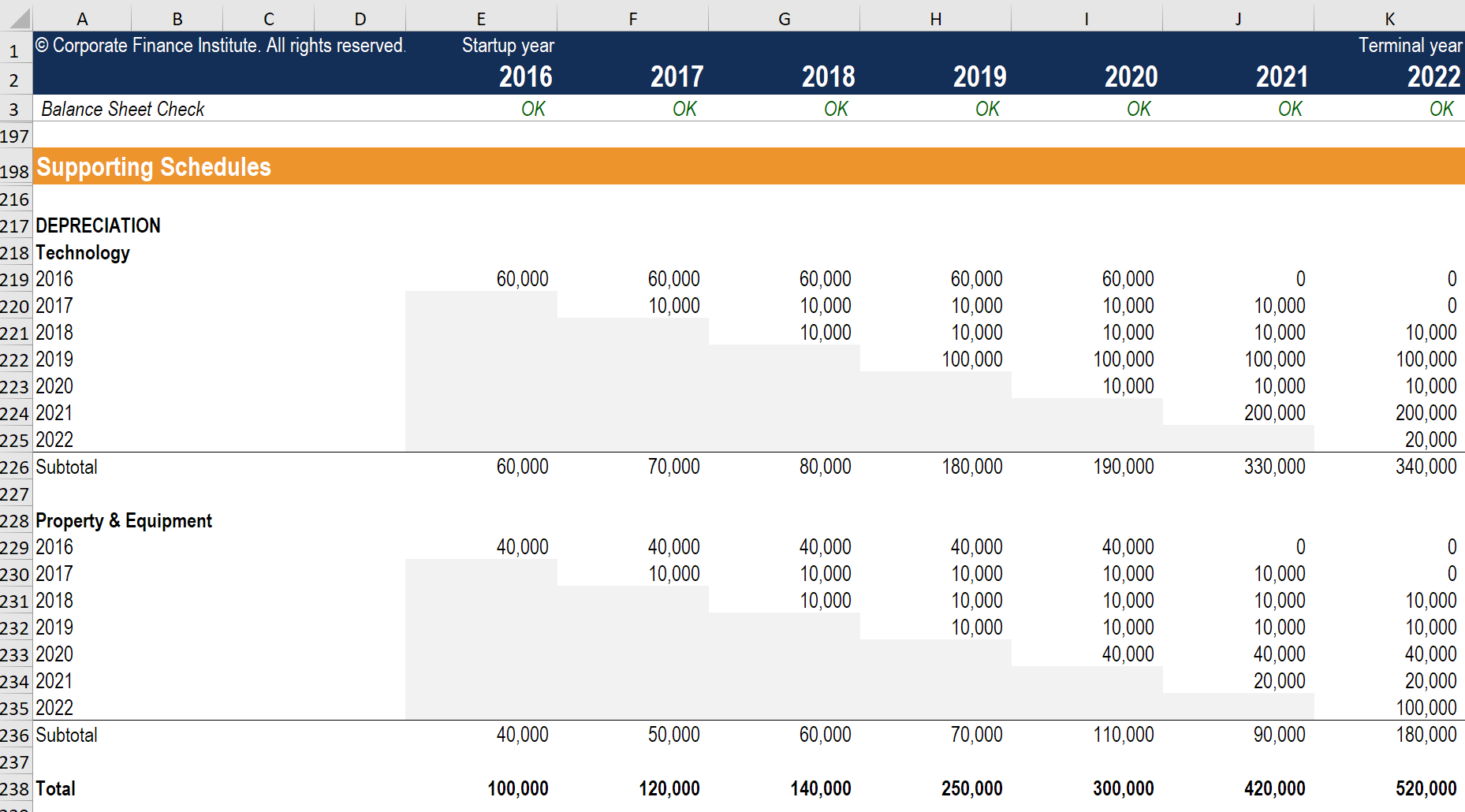

Depreciation Schedule Guide Example Of How To Create A Schedule

To Figure Out Your Deduction For Depreciation You Would Use A Form 4562 See Attached To Get An Idea Of What It Loo Form Instruction Internal Revenue Service

Depreciation Definition Life Is Good Method Life

How To Deduct Rental Property Depreciation Wealthfit

For Improvements To A Rental Property E G Remodeling What Is The Useful Life For Depreciation For More Information Rental Property Business Tax Remodel

Pin By Williams Accounting Consulti On Tax Tips Small Business Tax Business Tax Small Business

How To Calculate Depreciation Expense For Business

Depreciation In Business Is An Accounting Term Here Are Examples Of Depreciation And How To Work Fixed Asset Life Insurance Facts Life Insurance For Seniors

How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator

Depreciation Of Fixed Assets In Your Accounts Accounting Small Business Office Fixed Asset

Do You Claim All The Rental Property Tax Deductions Available Here Are 5 Commonly Missed In 2020 Rental Property Investment Rental Property Management Rental Property

Deducting Your Home Office Expenses For All The Visual Learners Out There This Board Is For You We Ve Condensed Complic Home Office Expenses Tax Guide Tax

Understanding Depreciation For Real Estate Investing Morris Invest Real Estate Investing Investing Real Estate

Post a Comment for "Business Use Of Home Depreciation Life"