Is K1 Income Ordinary Income

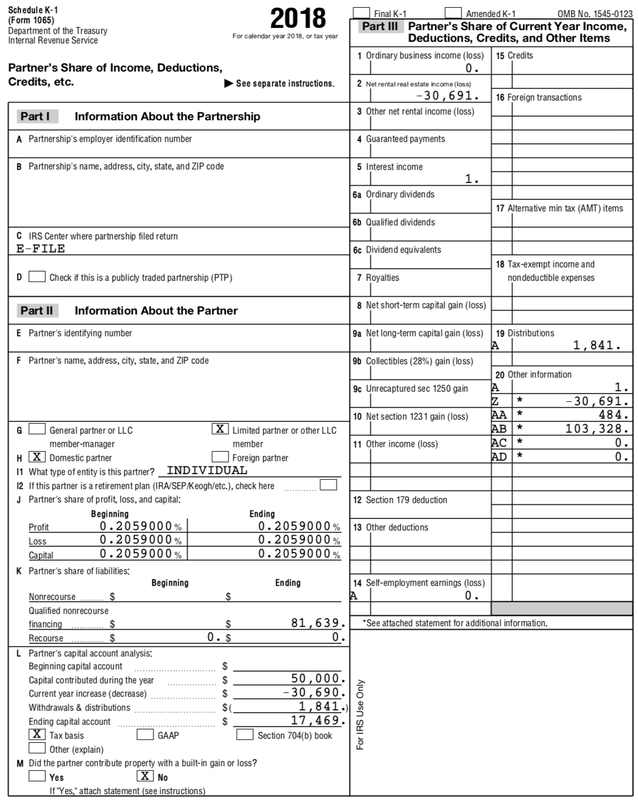

K1 Line 1 Ordinary Income _____ Schedule E Part II Net Income _____ 1040 Line 17 Net Income SchE _____ Taxed at a personal rate H 20. The borrower confirmed he took the whole 276K.

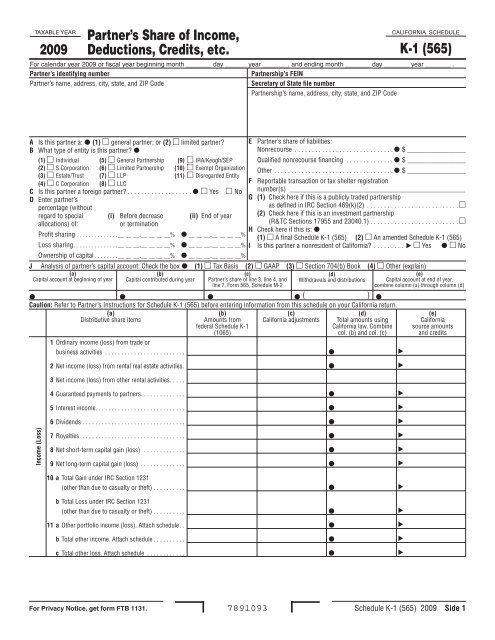

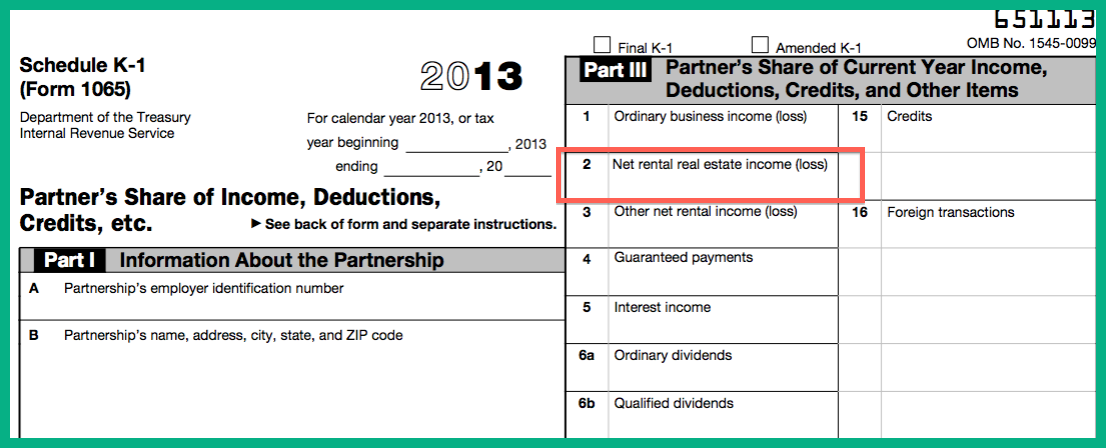

2009 Schedule K 1 565 Partner S Share Of Income Deductions

However Im not sure if I should give him the full 276970 due to the fact it is listed as Ordinary Business Income in Box 1 of the K-1.

Is k1 income ordinary income. Schedule K-1 page 2 lists the appropriate forms and schedules where taxpayers income. Line 1 - Ordinary IncomeLoss from Trade or Business Activities - Ordinary business income loss reported in Box 1 of the K-1 is entered as either Non-Passive IncomeLoss or as Passive IncomeLoss. Generally a taxpayers share of ordinary income reported on a Schedule K-1 from a partnership engaged in a trade or business is subject to the self-employment tax.

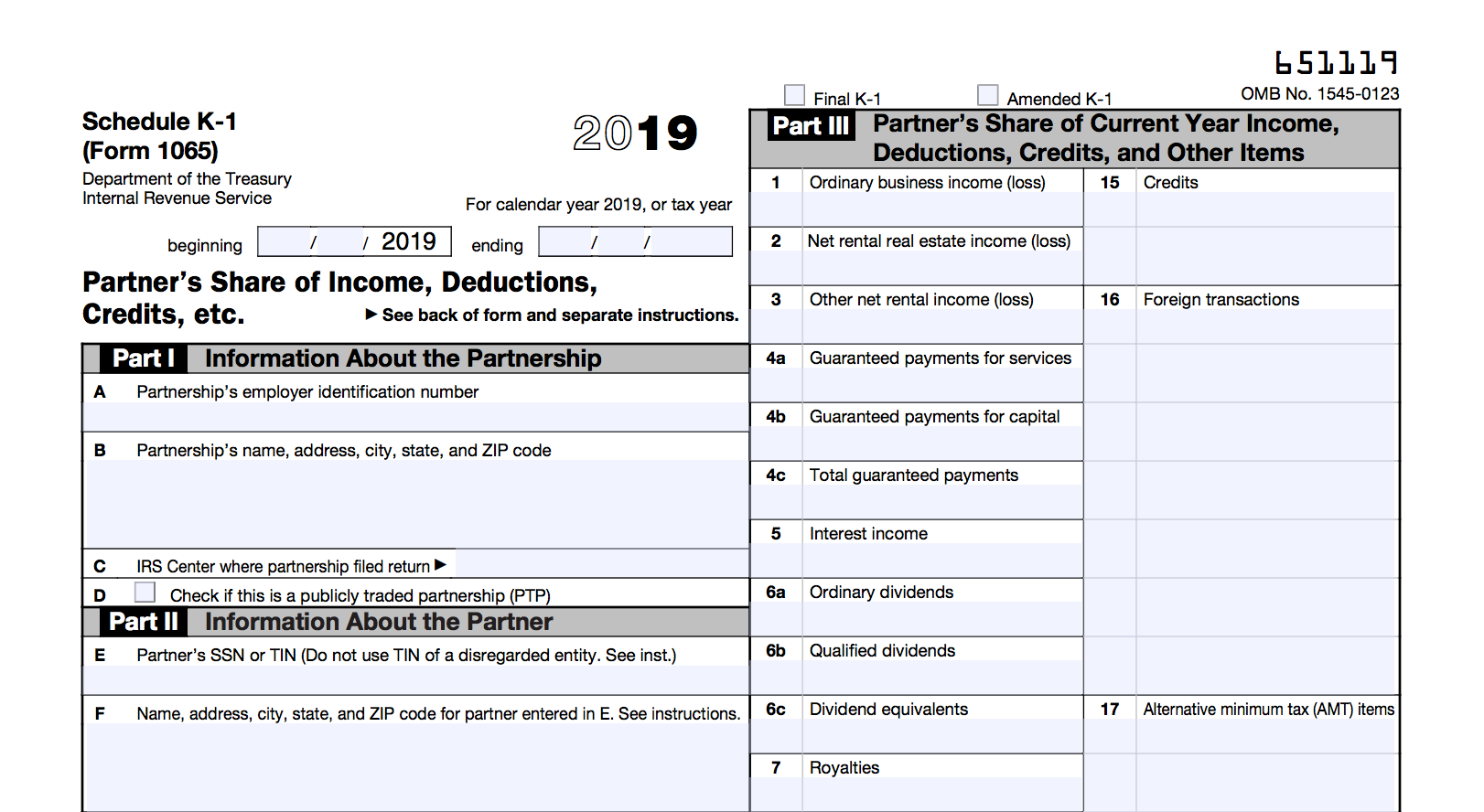

Taxpayers receive a Schedule K-1 Form 1065 or Form 1120S reporting their share of income from interest dividends ordinary and qualified and capital gains net short-term and net long-term from partnerships and corporations. Several factors determine whether the income is considered Passive or Non-Passive including whether the taxpayer was a general or limited partner in the entity and their actual participation in the. However Uber Writers recommended distribution total doesnt cap the.

The K-1 indicates 276970 in ordinary business income and 176914 in Distributions. For trust and estate beneficiaries limited partners and passive investors Schedule K-1 income is more akin to unearned income. A typical corporations regular dividend is taxed as long-term capital gains while much of the income paid and shown on a Schedule K-1 can be classified as regular income.

Ln 16 B Other tax-exempt income 525329. We received a K1 and ordinary income in box 1 and box 16d is a number that is significantly higher than the ordinary income amount. If you are a Partner or Shareholder and file Schedule K-1 on your individual tax return you may be able to claim the Qualified Business Income Deduction QBID on that income.

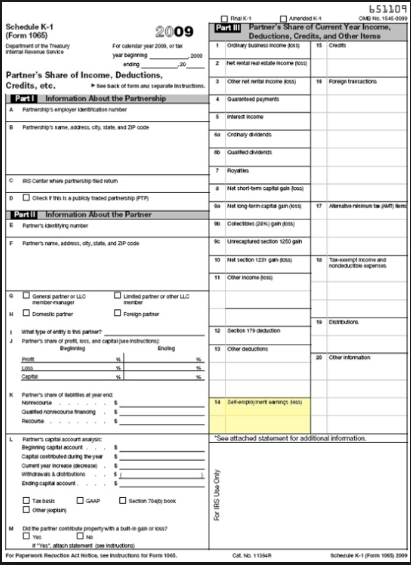

Schedule K -1 Box 1 Ordinary business income loss Income Schedule E page 2 Material participation rules for passive or non-passive Schedule SE for an active business Loss is it deductible. End of the year 3473. Beside this is K 1 income considered earned income.

Is k1 income taxed as ordinary income. Partnerships S Corporations estates and trusts provide K-1 forms to partners and shareholders for filing their individual tax returns. No distributions you receive as a shareholder of an S corporation do not constitute earned income for retirement plan purposes.

Generally a taxpayers share of ordinary income reported on a Schedule K-1 from a partnership engaged in a trade or business is subject to the self-employment tax. K-1 income or loss is passed through to the individual tax return. My understanding is that the usable income should never exceed the ordinary business income even if distributions are higher.

The deduction allows an individual to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income. As a test case I used an example where the borrower received a distribution well over the ordinary business income on the K-1 the last two years. Evaluate basis At-Risk rules Passive activity.

This is the K1 information. View more on it here. We will use the 1040 to identify the if any wages were reported line.

For general partners and active owners in a business or pass. Im giving him the 176914 distribution as real income for sure. Ln 1 ordinary business income 62500 Ln 4 interest income 1735.

Income and tax liabilities are passed through the corporation or entity to the taxpayer. Ln 12 A Other deduction cash contribution 49. Schedule K-1 is a tax document similar to a W-2 form.

However like any general rule there are a myriad of exceptions including one excepting a limited partners share of ordinary income from a. Does ordinary business income from Schedule K-1 qualify as earned income for purposes of IRA contribution deductability. Ln16 C Other tax-exempt income 2375.

Form 1040 Reports to Line 17 Tax return Series Form 1120 with K1 Page 2. However like any general rule there are a myriad of exceptions including one excepting a limited partners share of ordinary income from a partnership. Part II Loans from shareholder Beginning of the year 3473.

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Dissecting And Understanding A Schedule K 1

What Is A Schedule K 1 Form Zipbooks

What Is A Schedule K 1 Form Zipbooks

Mlps And K 1s And Ubti Oh My Seeking Alpha

Https New Content Mortgageinsurance Genworth Com Documents Training Course Partnershipincome1065formk1 Presentation 1218 Pdf

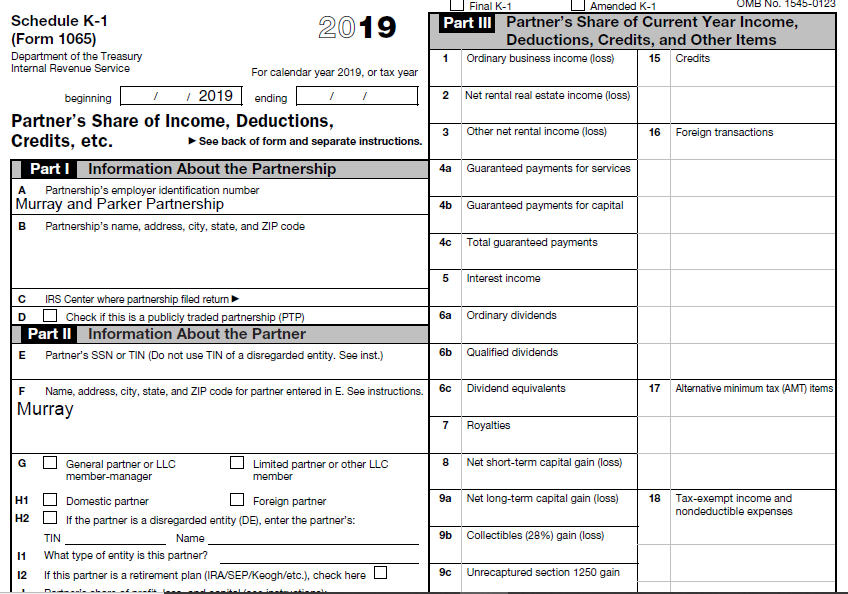

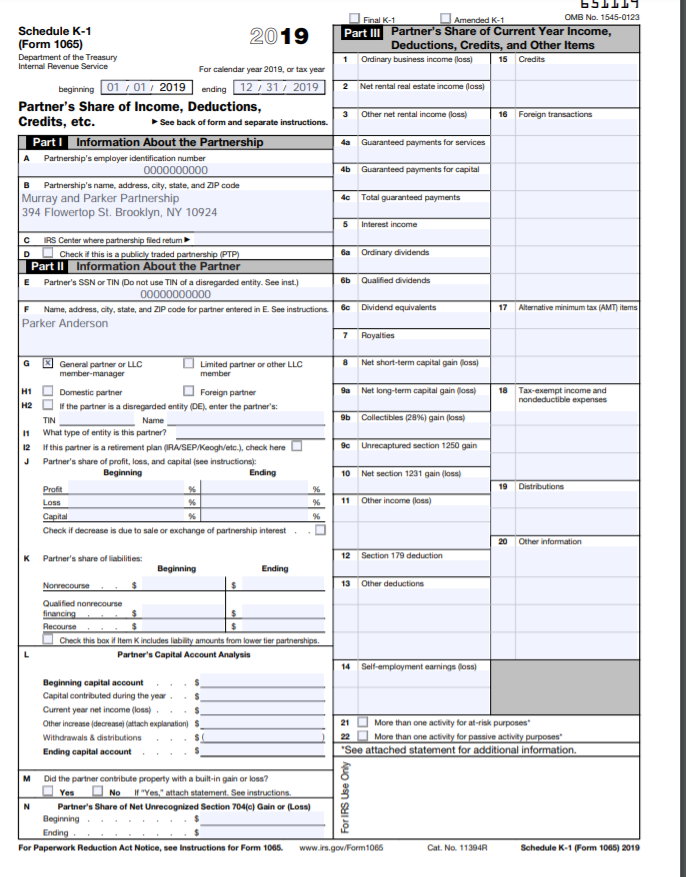

Solved Based Only On The Example Provided Fil Out The Fo Chegg Com

4 Steps To Filing Your Partnership Taxes The Blueprint

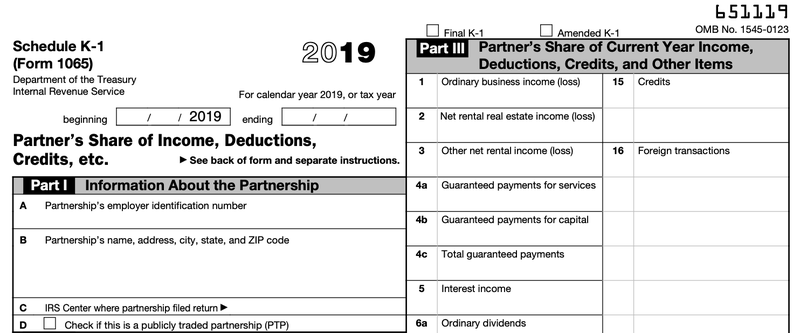

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Https New Content Mortgageinsurance Genworth Com Documents Training Course Partnershipincome1065formk1 Presentation 0420 Pdf

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

3 Ways To Fill Out And File A Schedule K 1 Wikihow

What Is A Schedule K 1 Form Zipbooks

Linda Keith Cpa All About The 8825

3 0 101 Schedule K 1 Processing Internal Revenue Service

Https Www Irs Gov Pub Irs Utl 2017ntf Dealingpartnershipk1 Pdf

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

Please Refer To The Multiple Choice Solution Below Chegg Com

Post a Comment for "Is K1 Income Ordinary Income"