Nevada Quarterly Business Tax Return

Clark County Tax Rate Increase - Effective January 1 2020. These Where to File addresses are to be used ONLY by TAXPAYERS AND TAX PROFESSIONALS filing individual federal tax returns in Nevada during Calendar Year 2021.

Irs And Many States Announce Tax Filing Extension For 2020 Returns

SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business.

Nevada quarterly business tax return. Your business will be automatically registered for the MBT. In other words most Nevada businesses with employees are subject to the MBT. Select the available appropriate format by clicking on the icon and following the on screen.

STATE OF NEVADA DEPARTMENT OF EMPLOYMENT TRAINING AND REHABILITATION EMPLOYMENT SECURITY DIVISION 500 E. Enter your Nevada Tax Pre-Authorization Code. If your Nevada gross revenue during a taxable year is over 4000000 you are required to file a Commerce Tax return.

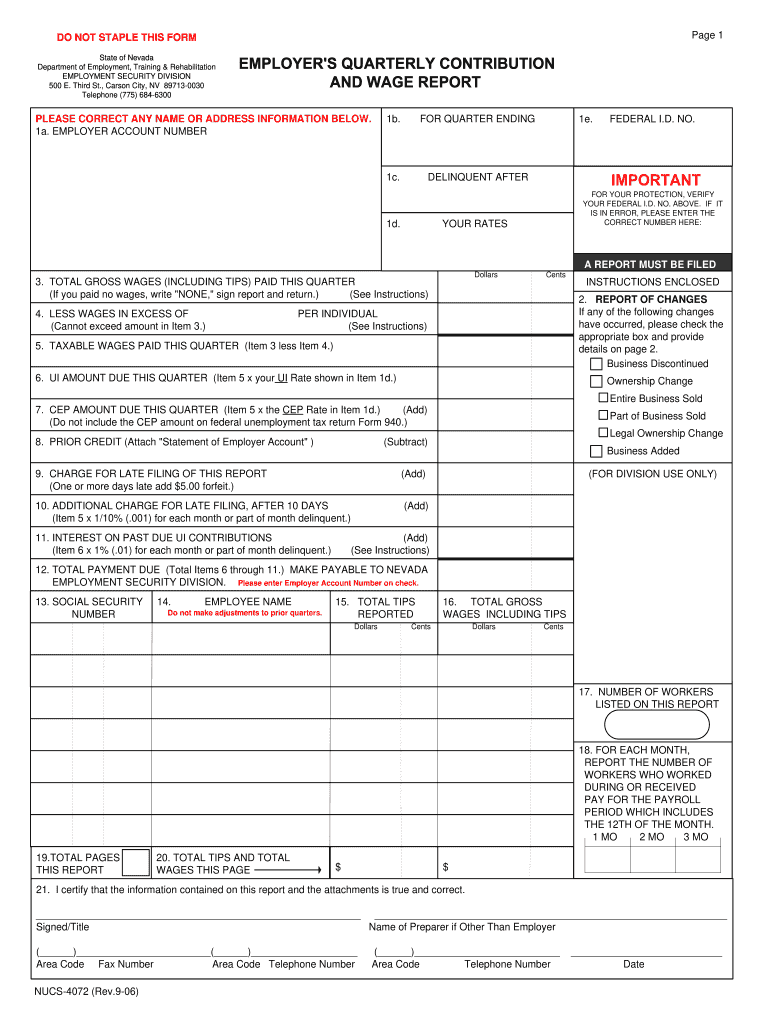

Form NUCS-4072 Employers Quarterly Contribution and Wage Report is due the last day of the month following the end of the quarter April 30 July 31 October 31 and January 31 to report your quarterly taxes for your unemployment insurance. W2s sent with Annual Filing. On this page we have compiled a calendar of all sales tax due dates for Nevada broken down by filing frequency.

You have until April 15 to file your 2020 income tax return Form 1040 or Form 1040-SR. Effective January 1 2020 the Clark County sales and use tax rate increased to 8375. The Cannabis Business Tax Quarterly Return.

And you ARE NOT ENCLOSING A. Ask the Advisor Workshops. The Departments Common Forms page has centralized all of our most used taxpayer forms for your convenience.

Transportation Manifest and Transfer Report. If this tax return is LATE add 15 interest of the Tax Due beginning the day after the due date and on the first day of each subsequent month until paid in full. The County cannot accept a tax filing without payment in full.

If sales do occur then payment in full must also be submitted. How often you are required to file sales tax in Nevada follows this general rule. In Nevada you will be required to file and remit sales tax either monthly quarterly or annually.

Nevada Code and Statutes. Modified Business Tax Return Filing Frequency Quarterly Filing Due Dates Due the last day of the month following the end of the quarter. METRC data for the quarter listed on this form is REQUIRED.

Additionally the new threshold is. Sales Use Tax Return 7111 to Current This is the standard monthly or quarterly Sales and Use Tax return used by retailers. A Cannabis Business Tax Quarterly Return form and METRC data must be submitted by the due date each quarter even if no sales occur.

A six-month extension to file is available. However if your Nevada gross revenue during a taxable years is 4000000 or less you are no longer required to file a Commerce Tax return for 2018-2019 tax year and after. Nevada Small Business Development Center.

Nevada State Purchasing Division. To file and remit payment online please click here. If you dont pay your estimated tax by January 15 you must file your 2020 return and pay any tax due by March 1 2021 to avoid an estimated tax.

The documents found below are available in at least one of three different formats Microsoft Word Excel or Adobe Acrobat PDF. Click Here for details. April 30 July 31 October 31 and January 31.

Penalties and interest will accrue until full payment is received. Depending on the volume of sales taxes you collect and the status of your sales tax account with Nevada you may be required to file sales tax returns on a monthly semi-monthly quarterly semi-annual or annual basis. SB 483 of the 2015 Legislative Session became effective July 1 2015 and changes the tax rate to 1475 from 117.

If it is NOT LATE enter 0. No File Zero Wages Rule Yes File Zero Liability Rules Yes. Quarterly Tax Returns.

This is an increase of 18 of 1 percent on the sale of all tangible personal property that is taxable. The MBT is a quarterly state payroll tax. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses.

Forms required to be filed Nevada payroll taxes are. And you are filing a Form. Instead the owner attaches a Schedule C Profit or Loss From Business to their individual Form 1040 which is filed on April 15th.

If you live in NEVADA. State Agencies and Departments. Click here to schedule an appointment.

For example for the quarter running from July 1st to September 30th the return and payment are due on October 31st. All Nevada LLCs regardless of revenue used to have to file a Commerce Tax Return however thats no longer the case due to Senate Bill 497. Please note that any extension is merely an extension of time to file the return and not an extension of time to pay.

LLCs with revenue over 4 million still must file a Commerce Tax Return. Nevada sales tax returns are always due the last day of the month following the reporting period. If the sum of all the wages paid by the employer exceeded 62500 for the calendar quarter the tax was 31250 plus 117 of the amount the wages exceeded 62500.

Beginning in the 2018-2019 taxable year LLCs with revenue below 4 million dont have to file a Commerce Tax Return. In addition as of July 2015 Nevada imposes a commerce tax on gross revenue. Small Business Administration - Nevada.

I am a small business owner and my revenue is less. The business itself does not file a tax return. The sum of all taxable wages after health care deduction paid by the employer not exceeding 62500 for the calendar quarter was calculated at 05.

Third Street Carson City Nevada 89713-0030 CONTINUATION SHEET EMPLOYERS QUARTERLY LIST OF WAGE S PAID Report Not Complete if Social Security Numbers Are Missing NUCS-4073 REV 9-00 FOR QUARTER ENDING ENCLOSE. The tax is due on the last day of the first month following the end of a payroll quarter. Farmers and Fishermen - Pay your estimated tax for 2020 using Form 1040-ES.

The Department is now accepting credit card payments in Nevada Tax OLT.

Nv Dot Nucs 4072 2006 2021 Fill Out Tax Template Online Us Legal Forms

Https Tax Nv Gov Uploadedfiles Taxnvgov Content Onlineservices Mbt 1 Pdf

What Business Owners Need To Know About Filing Taxes In 2021

3 Squares Vt Printable Application Fill Online Printable Fillable Blank Pdffiller

Incorporate In Nevada Do Business The Right Way

How To File And Pay Sales Tax In Nevada Taxvalet

Irs And Many States Announce Tax Filing Extension For 2020 Returns

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Nevada Department Of Taxation Forms Pdf Templates Download Fill And Print For Free Templateroller

Cleaning Business Tax Basics For Self Employed Housecleaners

Nevada Mbt Fill Online Printable Fillable Blank Pdffiller

Nv Dot Tid 020 Tx 2016 2021 Fill Out Tax Template Online Us Legal Forms

Https Tax Nv Gov Uploadedfiles Taxnvgov Content Onlineservices Mbt 1 Pdf

Https Tax Nv Gov Uploadedfiles Taxnvgov Content Onlineservices Mbt 1 Pdf

How To File And Pay Sales Tax In Nevada Taxvalet

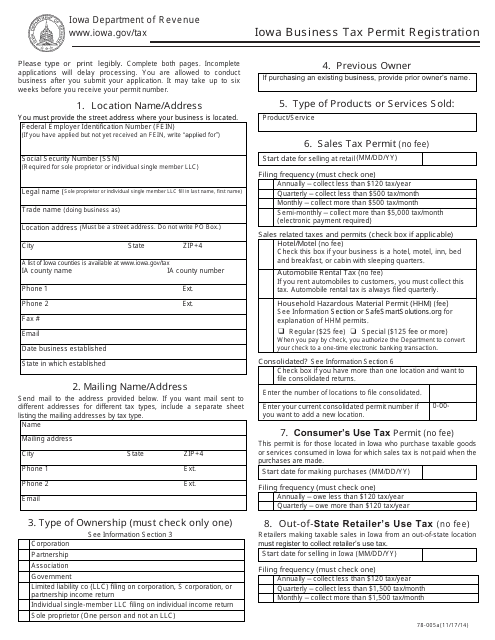

Form 78 005a Download Printable Pdf Or Fill Online Business Tax Permit Registration Iowa Templateroller

Https Tax Nv Gov Uploadedfiles Taxnvgov Content Onlineservices Mbt 1 Pdf

Https Tax Nv Gov Uploadedfiles Taxnvgov Content Onlineservices Mbt 1 Pdf

Https Tax Nv Gov Uploadedfiles Taxnvgov Content Onlineservices Mbt 1 Pdf

Post a Comment for "Nevada Quarterly Business Tax Return"