Business Use Of Home Simplified Method 2020

The new temporary flat rate method simplifies your claim for home office expenses. If you itemize deductions and use the simplified method for a taxable year you can deduct expenses for the home that are otherwise deductible for example mortgage interest and property taxes as itemized deductions on Form 1040 or 1040-SR Schedule A without reducing these expenses by the amounts allocable to the portion of the home used in a qualified business use.

13 Offline Home Business Ideas Work At Home Thbo Home Business Work From Home Moms Business

You can claim 2 for each day you worked from home during that period plus any additional days you worked at home in 2020 due to the.

Business use of home simplified method 2020. April 9 2020 223 PM The home office deduction issues are pretty complicated. Select the home office asset type from the drop-down list and press TAB. Standard deduction of 5 per square foot of home used for business maximum 300 square feet.

TaxSlayer Editorial Team May 11 2020 If your client is self-employed and uses part of their home for business purposes they may be eligible for a tax write-off on their federal income tax return. You use your home office as your primary place of business. You are eligible to use this new method if you worked more than 50 of the time from home for a period of at least four consecutive weeks in 2020 due to the COVID-19 pandemic.

You have a separate outbuilding you use purely for the purposes of business. Highlights of the simplified option. The simplified method allows a standard deduction of 5 per square foot of home used for business with a maximum of 300 square feet.

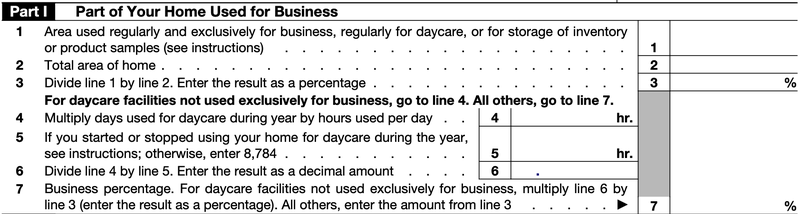

Expenses for the business use of your home. I suggest you do as you said in the last post then before you submit your tax return print it out and look on schedule 8829 Expenses for Business Use of Your Home On line 36 you will see the allowable expenses for the business use of your home amount. Under this new method employees will not have to get Form T2200 or Form T2200S completed and signed by their employer.

In other words it must be a place where you meet with patients clients or customers. How to Qualify for a Home Business. 10 rows Simplified Option Regular Method.

Allowable home-related itemized deductions such as mortgage interest and real estate taxes are claimed in full on Schedule A. Exclusively and regularly as your principal place of business see Principal Place of Business later. Any actual expenses related to the qualified business use of the home for the taxable year are not deductible.

In 2020 you can write-off 5 per square foot. Allowable home-related itemized deductions claimed in full on Schedule A. First you must be able to show that your residence is your primary place of business.

You meet customers or clients in your home office. The allowable deduction for home office expense is 5 per square foot maximum of 300 square feet of qualified home office space used up to a maximum yearly deduction of 1500. Deduction for home office use of a.

Second your home office must be used for conducting business only. Rules for using the safe harbor method. The allowable square footage must still meet the regular and exclusive rule and be your principal place of business.

If you select Improvements the field in the Improvements group box becomes available. A new temporary flat rate method will allow eligible employees to claim a deduction of 2 for each day they worked at home in that period plus any other days they worked from home in 2020 due to COVID-19 up to a maximum of 400. What is the benefit of using the simplified method.

Form 8829 or Simplified Method Worksheet Business Miles Page 2 Part IV Line 44a or Related 4562 Line 30 x Depreciation Rate 2020-27 and 2019-26 Total Mileage Depreciation Subtotal from Schedule C Business 1 Page 1 of 6. July 4 2020 by Prashant Thakur If homeowners and renters carry on business or profession from a part of the home the expense incurred on the said office -directly or indirectly- are allowed to be deducted from gross income to compute your taxable business income. If you select Home the fields in the Business use of a home and Allowable deductions group boxes become available.

You use your home office for management or administrative duties regularly and exclusively without another fixed location where these same duties are carried out. Type of home office asset. Whether youre a seasoned work-from- home business owner or you installed a home office in 2020 you can claim a deduction for making part.

Mortgage interest real estate taxes. Business use of home -. When you use the simplified method you will deduct this amount instead of calculating the direct and indirect expenses related to your in-home business things like mortgage interest repairs insurance utilities etc.

This tax break also referred to as the home office deduction can be calculated using the standard method or the simplified method. To qualify to deduct expenses for business use of your home you must use part of your home. The simplified calculation is done by multiplying the allowable square footage of the home business space using a prescribed rate.

How To Complete And File Irs Form 8829 The Blueprint

.png)

Quiz Do I Qualify For The Home Office Deduction

What If Your Bookkeeping Was On A Schedule In 2020 Bookkeeping Bookkeeping Training Bookkeeping Services

How To Price Cleaning Foreclosure Cleaning Commercial Cleaning Cleaning Business

How To Complete And File Irs Form 8829 The Blueprint

2020 Daily Simplified Planner Happy Stripe Simplified By Emily Ley Simplified Planner Planner Emily Ley Simplified Planner

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Download Taxpayer S Comprehensive Guide To Llcs And S Corps Pdf Free Economics Books Business Valuation S Corporation

Pin On Search Engine Optimization

Emily Ley Simplified By Emily Ley In 2020 Declutter Small Spaces Staying Organized

Best Order Management Software Simple And Effective Solutions In 2020 Order Management System Management Chartered Accountant

How To Start Affiliate Marketing In 4 Easy Steps Affiliate Marketing Financial Motivation Marketing

Quiz Do I Qualify For The Home Office Deduction

U S Tax Form 8829 Expenses For Business Use Of Your Home Freshbooks Blog

Mileage Tracker Mileage Rates Deductions Quickbooks Small Business Tax Deductions Business Tax Deductions Tax Deductions

What Is Irs Form 8829 Expenses For Business Use Of Your Home Turbotax Tax Tips Videos

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Gorgeous Website For Home Organizer Built On Showit Website Template Ecommerce Website Template Minimal Website Design

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Post a Comment for "Business Use Of Home Simplified Method 2020"