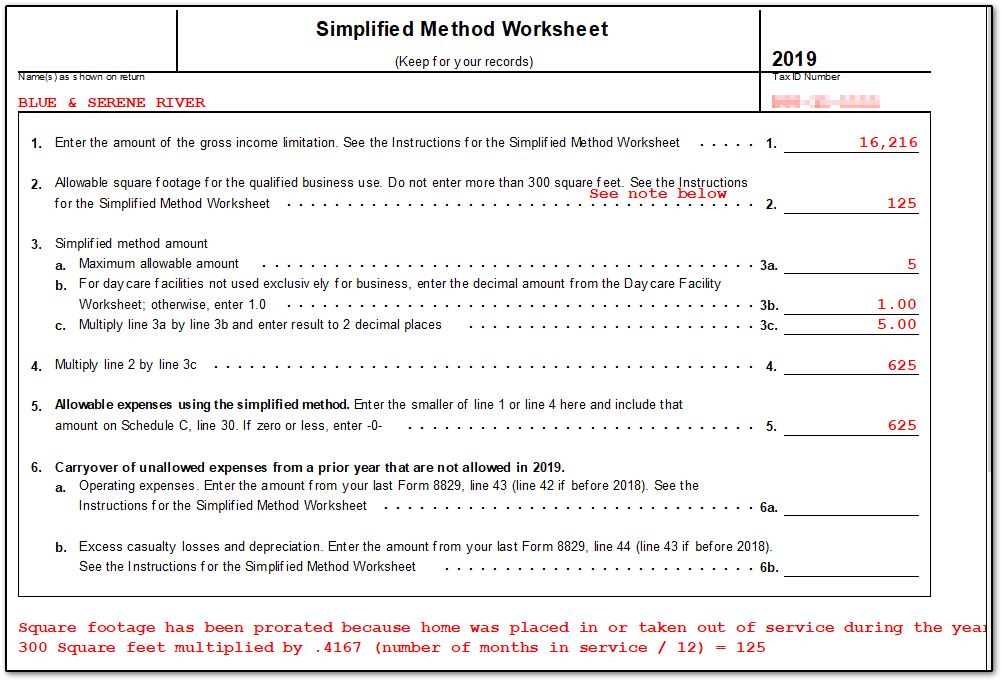

Business Use Of Home Simplified Method Worksheet 2019

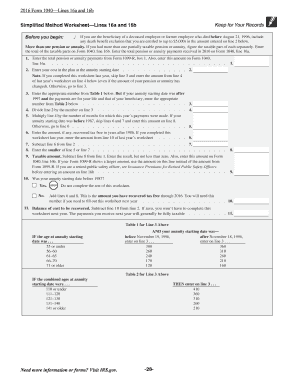

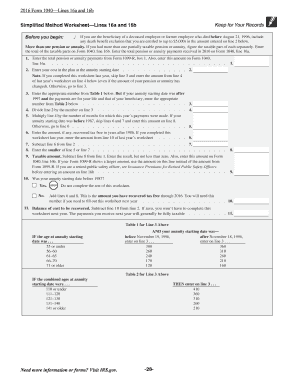

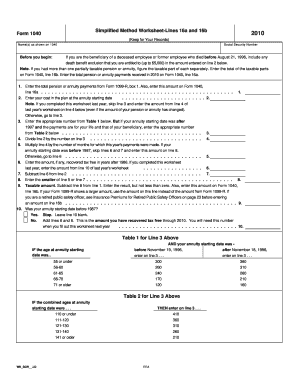

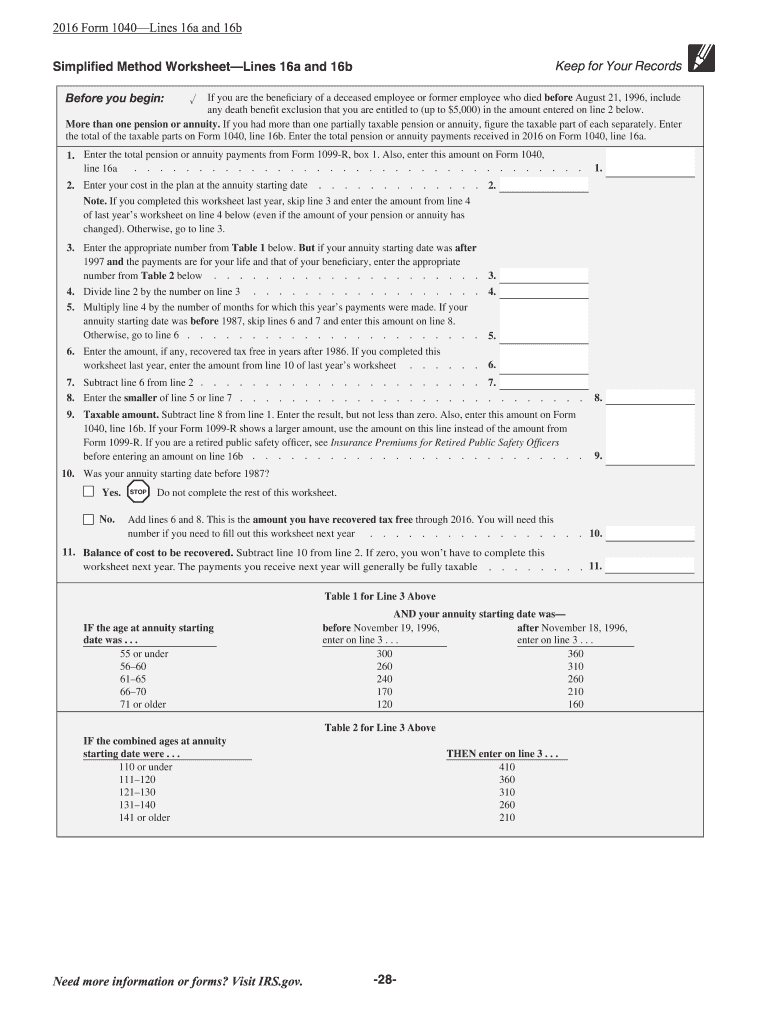

If your annuity starting date was before this year and you completed this worksheet last year skip line 3 and enter the amount from line 4 of last years worksheet on line 4 below even if the amount of your pension or annuity has changed. Your home business space deduction includes two parts.

Solved What Is The Simplified Method Worksheet In The Ins Chegg Com

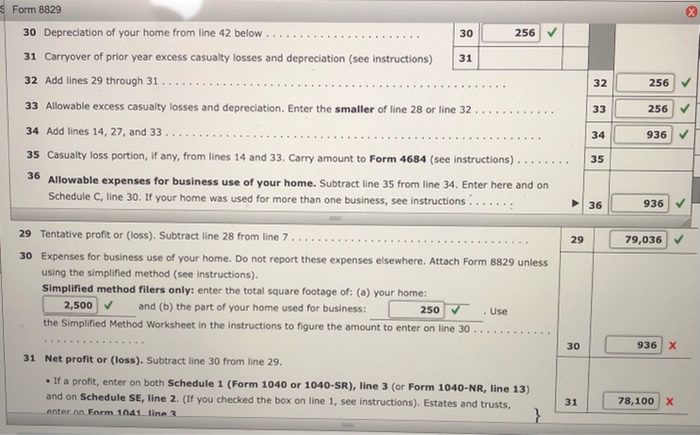

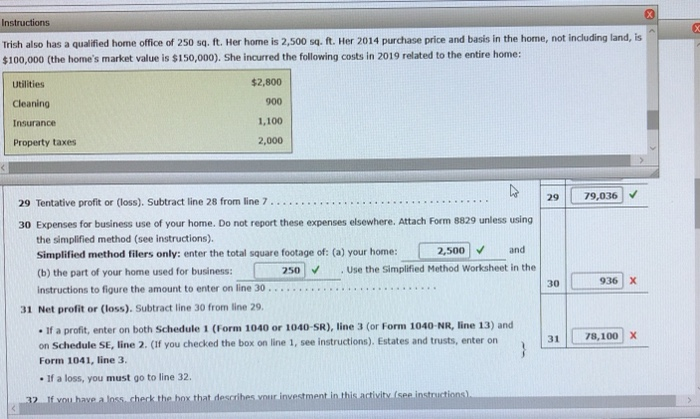

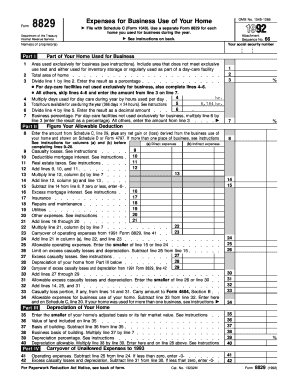

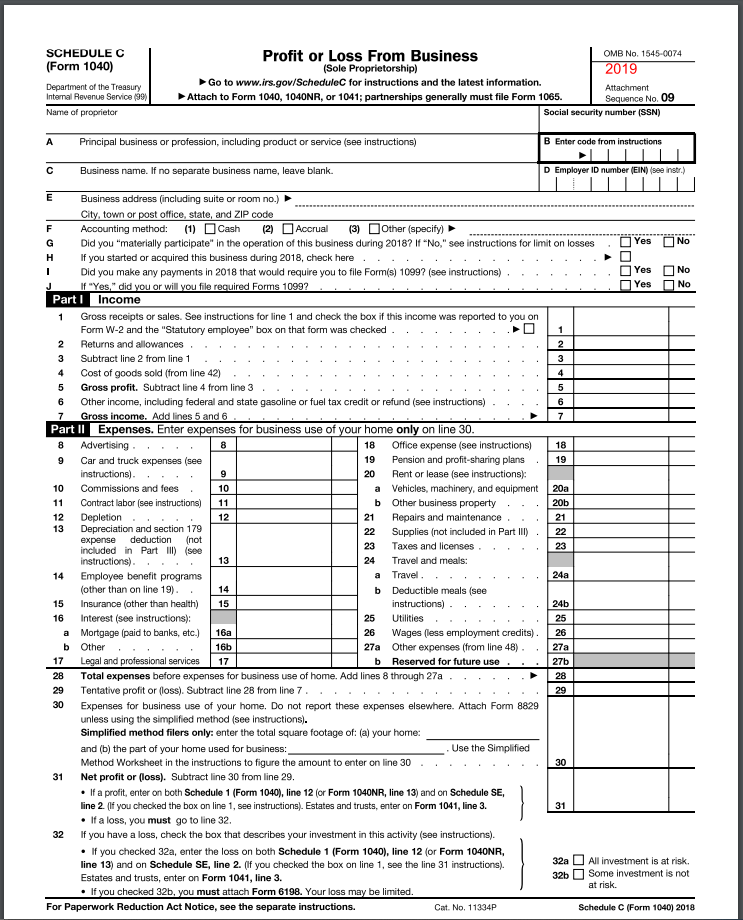

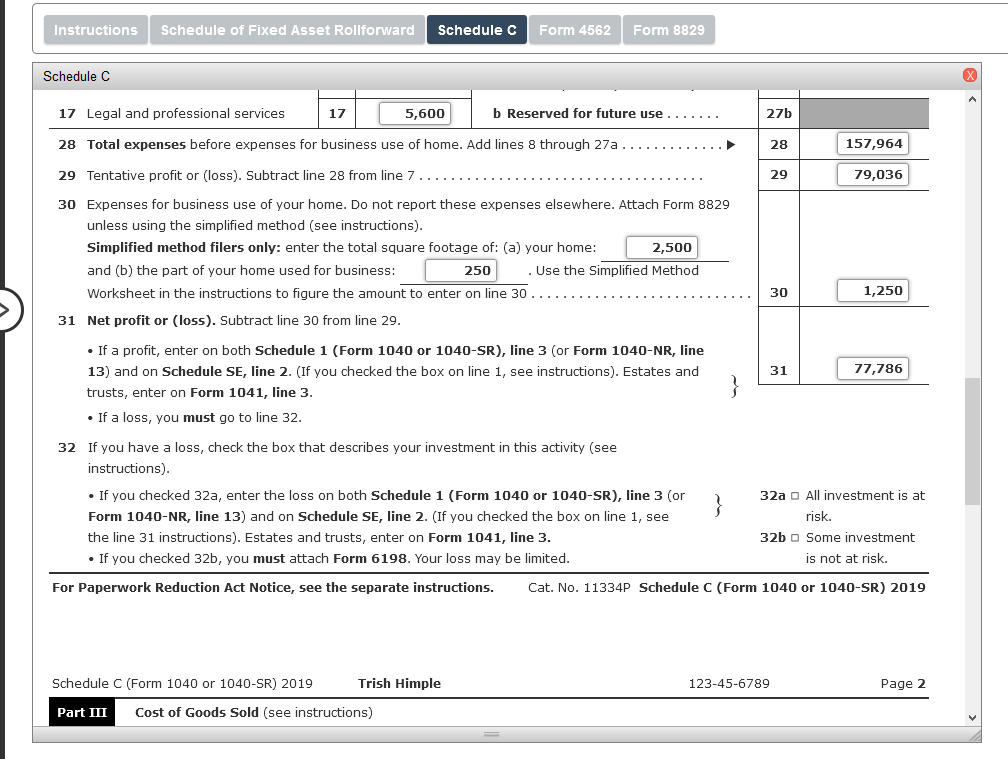

Expenses for business use of your home.

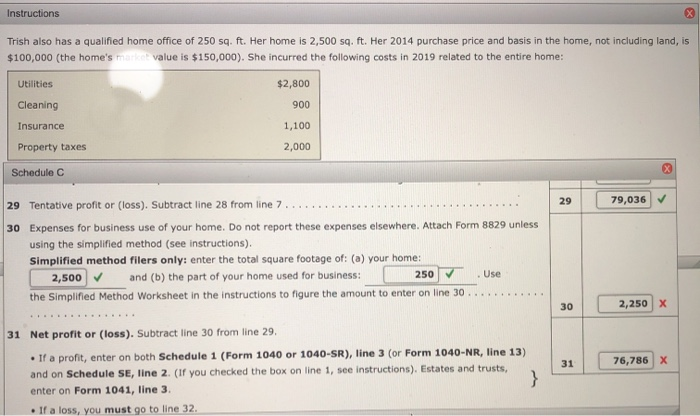

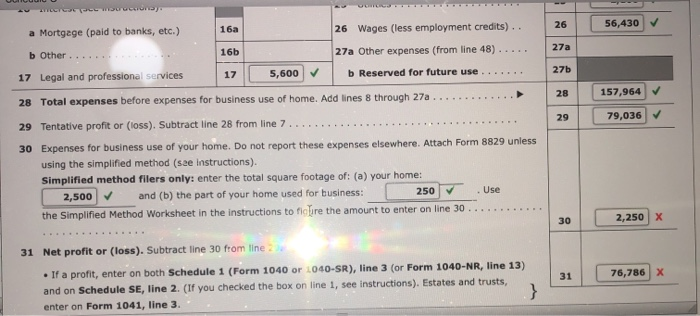

Business use of home simplified method worksheet 2019. What is the simplified method for determining the home office deduction. Assume you use 40 of your house for a daycare business that operates 12 hours a day five days a week for 50 weeks of the year. 250 the Simplified Method Worksheet in the instructions to nofire the amount to enter on line 30 Use 30 2250 x 31 Net profit or loss.

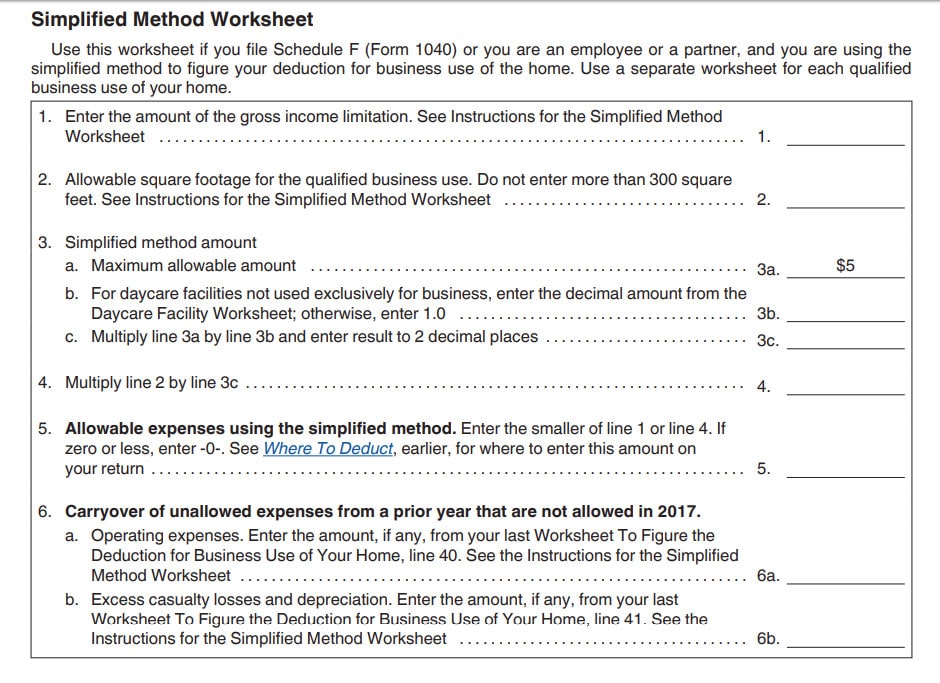

The simplified method as announced in Revenue Procedure 2013-13 PDF is an easier way than the method provided in the Internal Revenue Code the standard method to determine the amount of expenses you can deduct for a qualified business use of a home. The maximum deduction is 1500. If you need information on deductions for renting out your property see Pub.

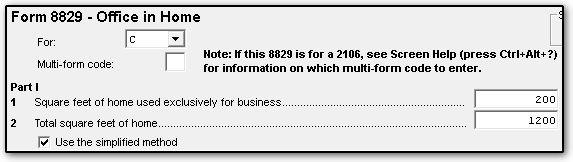

You can only use simplified expenses if you work for 25 hours or more a month from home. When the taxpayer elects to use the simplified method Form 8829 is not produced. 10 rows Simplified Option Regular Method.

Reserved for future use. You can claim the business proportion of these bills by working out the actual costs. Simplified method filers only.

Enter a Multi-Form code if applicable. Tentative profit or loss. Click Business Income to expand the category and then click Partnership income Form 1065 Schedule K-1 Click Add Partnership Schedule K-1 to create a new copy of the form or Review to review a form already created.

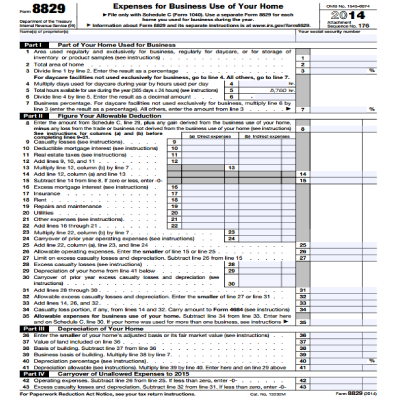

First list all direct expenses such as paint wallpaper and other expenses directly related to and used in the business space. Form 8829 or Simplified Method Worksheet Business Miles Page 2 Part IV Line 44a or Related 4562 Line 30. If you use a home office exclusively for business purposes you can deduct as a business expenses a portion of the cost of operating your home.

These expenses may be deducted at 100. The deduction may not exceed business net income gross income derived from the qualified business use of the home minus business deductions. If you used your home for business and you are filing Schedule C Form 1040 you will use either Form 8829 or the Simplified Method Worksheet in your Instructions for Schedule C.

Allowable square footage of home use for business not to exceed 300 square feet Percentage of home used for business. You will have to use one of the attached worksheets to figure the actual home office deduction. There is a separate worksheet to enter the business use of your home expenses.

527 Residential Rental Property. If you used the simplified method in 2019 enter on line 23 the amount from line 6a of your 2019 Simplified Method Worksheet. Actual expenses determined and records maintained.

The calculation is shown on the Simplified Method Worksheet Form. The rules in this publication apply to individuals. Either use your detailed expenses on the Worksheet to Figure the Deduction for Business Use of Your Home or the simplified office square footage method basically 5 per square foot of office max of 300 sf up to on the Worksheet to Figure the Deduction for Business Use of Your Home Simplified Method.

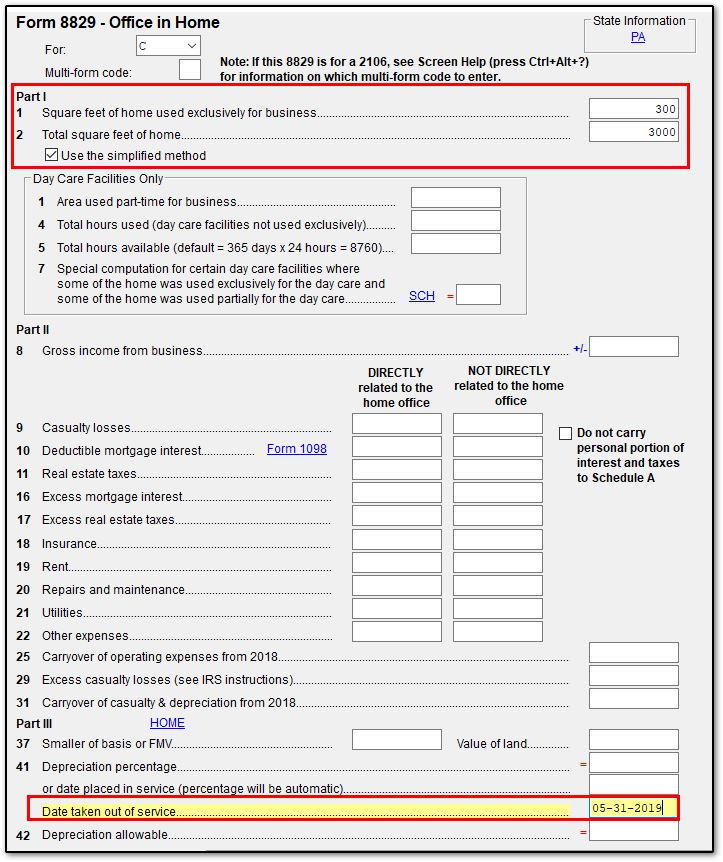

Add lines 8 through 27a. 2500 and b the part of your home used for business. Then enter the square footage of office on line 1 the total square footage of the home on line 2 and select the checkbox Use the simplified method.

Subtract line 28 from line 7. You need to keep good records of your home expenses allocate the expenses of operating your home between business and the personal uses and complete a special IRS form Form 8829. Enter the total square footage of.

Hours of business use. 34 of available hours x 40 of the house used for business 136 business write-off percentage. Before expenses for business use of home.

Under the simplified method the standard home office deduction amount is 5 per square foot up to 300 square feet of the area used regularly and exclusively for business. Home-related itemized deductions claimed in. 12 hours x 5 days x 50 weeks 3000 hours per year.

If you deducted actual expenses for the business use of your home on your 2019 tax return enter on line 23 the amount from line 41 of your 2019 worksheet. Standard 5 per square foot used to determine home business deduction. Then calculate home business space and use the percentage to calculate all indirect expenses.

The calculated amount will flow to the applicable schedule instead. However the home office deduction can be complex. Deduction for home office use of a.

Simplified Method Smart Worksheet Line A gross income limitation imports Schedule C Line 28 Total expenses when it should import Line 29 Tentative profitloss. 2020-27 and 2019-26 Total Mileage Depreciation Subtotal from Schedule C Business 2. Business use of home only if.

Continue to the screen Partnership - Unreimbursed Partnership Expenses and enter the expenses Note. Its impossible to take the Home Office Deduction using the Simplified Method with the current TurboTax software. Simplified square footage method.

Attach Form 8829 unless using the simplified method see Instructions.

Solved What Is The Simplified Method Worksheet In The Ins Chegg Com

Home Based Businesses Have Simplified Way To Claim Home Office Deduction Arizona Daily Independent

Solved Schedule C Profit Or Loss From Business Omb No 1545 0074 Form 1040 Or 1040 Sr Sole Proprietorship 2019 Go To Www Gov Schedulec For Inst Course Hero

Irs Offers An Easier Way To Deduct Your Home Office Don T Mess With Taxes

23 Printable Worksheet Template Forms Fillable Samples In Pdf Word To Download Pdffiller

S I M P L I F I E D M E T H O D W O R K S H E E T Zonealarm Results

Solved What Is The Simplified Method Worksheet In The Ins Chegg Com

Solved What Is The Simplified Method Worksheet In The Ins Chegg Com

8829 Simplified Method Schedulec Schedulef

S I M P L I F I E D M E T H O D W O R K S H E E T Zonealarm Results

Solved Instructions Comprehensive Problem 8 1 Trish Himpl Chegg Com

S I M P L I F I E D M E T H O D W O R K S H E E T Zonealarm Results

How To Claim The Home Office Deduction As A Digital Nomad Blog Nuventure Cpa Llc

8829 Simplified Method Worksheet Fill Out And Sign Printable Pdf Template Signnow

8829 Simplified Method Schedulec Schedulef

Simplified Home Office Deduction When Does It Benefit Taxpayers

Given The Following Information Complete The 2019 Chegg Com

S I M P L I F I E D M E T H O D W O R K S H E E T Zonealarm Results

Post a Comment for "Business Use Of Home Simplified Method Worksheet 2019"