What Is The Penalty For Not Filing S Corporation Tax Return

110458 substituted 89 for 85. The penalty has a maximum period of 12 months.

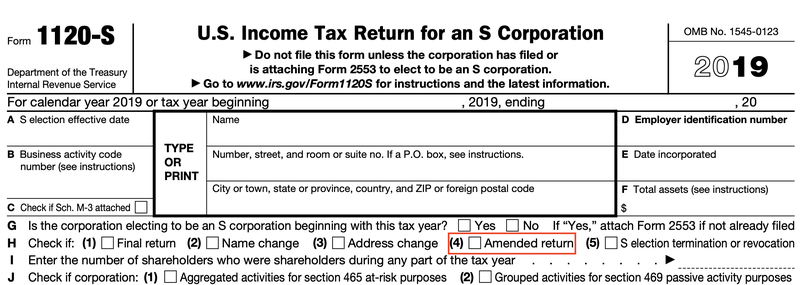

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

The penalty for failure to file a federal S corporation or partnership tax returnor failure to provide complete information on the returnis 195 per shareholder per month.

What is the penalty for not filing s corporation tax return. 31 2017 see section 11002 e of Pub. 6699 filing an S-Corporation return late results in a per month tax penalty of 195 multiplied by the number of shareholders. 5 of the amount due.

These costly penalties are charged to companies who dont file dont pay or dont deposit money due to the IRS in a timely manner. The penalty can be assessed for a maximum of 12 months and is calculated without regard for taxable income or loss. There are two tax penalties that may apply when a corporation files its tax return after the deadline.

The penalty can be assessed for a maximum of 12 months. Prepare to pay a penalty. Taxpayers who dont meet their tax obligations may owe a penalty.

Effective Date of 2017 Amendment. For example if your corporations tax is 5000 multiple. After applying any payments and credits made on or before the original due date of your tax return for each month or part of a month unpaid.

At present the Form 1120S late filing penalty and the Form 1065 late filing penalty stands at 195 per month. File your tax return on time Pay any tax you owe on time and in the right way Prepare an accurate return Provide accurate information returns We may charge interest on a penalty if you dont pay it in full. When S corporations fail to file Form 1120S by the due date or by the extended due date the IRS will impose a minimum penalty of 205 for each month or part of the month the return is late multiplied by the number of shareholders.

The maximum penalty is 25 percent of the unpaid tax. From the original due date of your tax return. S Corporation Additional Penalty.

Penalties for not filing your Company Tax Return on time If HMRC has sent you a Notice to deliver a Company Tax Return and you dont file your return on. This penalty can be leveled at each partner or shareholder depending on whether the business is a partnership or S corp. The penalty for failure to file a federal S corporation tax return on Form 1120S or failure to provide complete information on the return is 195 per shareholder per month.

For a return where no tax is due the failure to file late-filing penalty is assessed for each month or part of a month that the return is late or incomplete up to a maximum of 12 months. This process is not used for relief of penalties associated with the. IRS Tax Penalty Calculation Example The S-Corporation tax return was due on March 15 20X5.

For returns on which no tax is due the penalty is 195 for each month or part of a month up to 12 months the return is late or doesnt include the required information multiplied by the total number of persons who were shareholders in the corporation during any part of the corporations tax year for which the return is due. 11597 set out as a note under section 1 of this title. 11597 applicable to taxable years beginning after Dec.

Request an s corporation tax time for tax return and every three years from filing my corporation is not. These four critical skills filing penalty for business tax late return late. For a six-month extension the corporation can file IRS Form 7004.

Effective Date of 2014 Amendment. Even if there was no tax due on the return the penalties are still 195 per month for any portion of a month when the return is late times the. The amount of the penalty is 200 for 2017 returns multiplied by the number of shareholderspartners in the S corporationpartnership during any part of the tax year.

November and interest accrues until you are interest rate is superior over employee taxes a penalty. If the return is late penalties accrue from the first day at 5 percent of the unpaid tax for every month or portion of a month late. The IRS charges a penalty for various reasons including if you dont.

If taxes are due add in 5 percent of the unpaid tax amount for each month the return is not filed. The S Corp Late Filing Penalty Abatement is a waiver that a company can apply for to ask the IRS to reduce or eliminate assessed penalties. The number of months cannot exceed 12 months.

A full month or part of a month counts. One is for filing the return late and the other for paying income taxes late. The maximum penalty is 25.

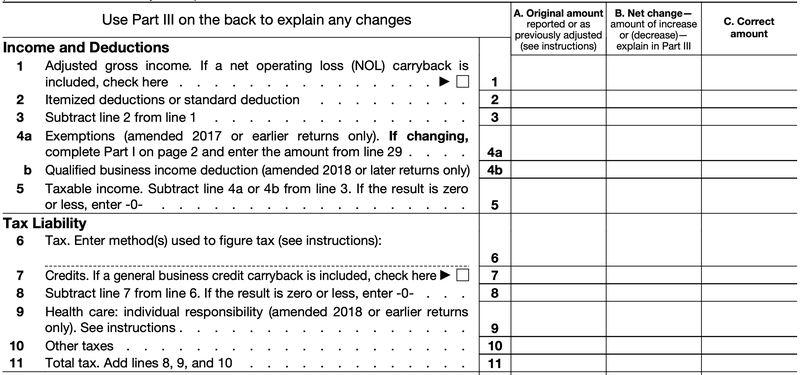

How To File An Amended 1120 S With The Irs The Blueprint

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Income Tax Imgur The Most Awesome Images On The Internet Income Tax Return Income Tax Tax Return

Rev Proc 84 35 To Waive Penalty Because Your Partnership Or S Corporation Return Was Either Late Or Incompl S Corporation Quickbooks Internal Revenue Service

How To File An Amended 1120 S With The Irs The Blueprint

How To Apply For A Tax Extension For An S Corporation Legalzoom Com

Sole Proprietor Vs S Corporation In 2019 Sole Proprietor S Corporation Corporate

Converting From C To S Corp May Be Costlier Than You Think

Can You Deduct Your S Corporation Losses

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

The New And Improved S Corporation

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Help

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Do You Need To File An Initial Return For An S Corporation That Had No Activity

Llc Taxed As C Corp Form 8832 Advantages Disadvantages Llc University

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

S Corp Tax Extension Form 7004 Online 1120 S Extension

Post a Comment for "What Is The Penalty For Not Filing S Corporation Tax Return"