Can I Deduct Unreimbursed Business Expenses In 2019

Itemized deductions are no longer allowed for unreimbursed employee expenses such as your per diem. You can deduct capital expenses and special care expenses for disabled persons.

Can I Deduct Work Expenses In 2019 In 2020

The Tax Cut and Jobs Act repealed this provision until 2025.

Can i deduct unreimbursed business expenses in 2019. My guess is that I cant deduct on 2019 return since Im using cash accounting and the company didnt actually incur the cost until 2020 when the reimbursement happened. To claim unreimbursed travel expenses reservists must be stationed away from the general area of their job or business and return to their regular jobs once released. If you were an employee who was used to deducting your unreimbursed employee business expenses EBE you might have been unpleasantly surprised while preparing your 2018 federal tax return when you realized this deduction had gone away.

This wasnt the most generous deduction in the worldsuch expenses were deductible only if and to the extent they exceeded 2 of an employees adjusted gross income. For returns filed before tax year 2018 employees can deduct any unreimbursed expenses that exceed 2 of their adjusted gross income. However Im asking the question because on a previous years return where I had HR block do my return the same situation arose and they deducted it in the year the items were purchased rather than the year the reimbursement.

Prior to the passage of the Tax Cuts and Jobs Act employees were able to deduct unreimbursed job expenses as a personal itemized deduction. Expenses are deductible only if the reservists pay for meals and lodging at their official military. You can deduct only unreimbursed employee expenses that are paid or incurred during your tax year for carrying on your trade or business of being an employee and ordinary and necessary.

Luckily the deduction is not entirely lost. Before this change these expenses were deductible as a miscellaneous itemized deduction on Form 1040 Schedule A. The Tax Cuts and Jobs.

You can include medical and dental bills you paid in 2019. You may be allowed to deduct unreimbursed ordinary and necessary expenses you paid on behalf of the partnership including qualified expenses for the business use of your home if you were required to pay these expenses under the partnership agreement and they are. You dont have to reduce your expenses if youre claiming the federal credit for business or health coverage.

One of these changes is that unreimbursed employee business-related expenses are no longer deductible as an itemized deduction on your Federal tax return. We all know that most churches dont have a lot of extra money floating around. But if you have unreimbursed business expenses as an employee what used to be known as Employee Business Expenses EBE then those expenses are generally no longer deductible for the 2019 tax year on.

By Amy Monday February 11 2019 While pastors can no longer deduct unreimbursed business expenses on Schedule A they can subtract them from their taxable income on Schedule SE. The deduction for unreimbursed employee business expenses was one of those that were affected. Tax reform not only eliminated this deduction for unreimbursed employee business expenses but also eliminated all other miscellaneous itemized deductions.

If you are organized under another business form then the business may deduct the ordinary and necessary expenses of operating or conducting that business. Employee ministers should seek to have their work-related expenses reimbursed by their church. For many employees this ability to deduct employment-related expenses that were not.

You can still claim this deduction if you havent yet filed your 2017 tax return however. The TCJA restriction lasts until 2026 when miscellaneous itemized deductions are slated to return for all employees. These deductions belong on Schedule A as miscellaneous itemized deductions.

June 1 2019 1019 AM They have changed yes. Such reimbursements are tax-free so long as the expenses are properly documented. An expense is ordinary if it is common and accepted in your trade business or profession.

December 23 2019 by Carolyn Richardson EA MBA. The TCJA eliminated all deductions for unreimbursed employee expenses for 2018 through 2025. Publication 535 Business Expenses PDF Subscribe to IRS Tax Tips.

This has been a significant deduction for many of my clients in the past. However certain taxpayers may still deduct unreimbursed employee travel expenses this includes Armed Forces reservists qualified performing artists and fee-basis state or local government officials. However it was better than nothing.

Whose medical and dental expenses can be included. The Tax Cuts and Jobs Act TCJA introduced many new changes to the tax law. The TCJA eliminates it for tax years 2018 through 2025.

Under these older rules an employees tax deduction for their unreimbursed employee business expenses could only be claimed if they itemized their deductions as opposed to claiming the standard deduction and was only allowed to the extent the total of these expenses exceeded 2 of their adjusted gross income AGI.

Instructions For Form 8995 2019 Internal Revenue Service Internal Revenue Service Federal Income Tax Business Card Design

Important 2019 Dates For The Self Employed Small Business Bookkeeping Employment Application Small Business Finance

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Hair Stylist Salon 2019 Tax Deduction Checklist Simply Organic Beauty Hair Salon Business Hairstylist Quotes Small Hair Salon

14 Tax Updates Everyone Needs To Know For 2019 Love Love Love Business Tax Deductions Business Tax Financial Tips

How To File Taxes The Easy And Organized Way Filing Taxes Tax Prep Checklist Tax Checklist

Deduct Car Expenses Small Business Tax Deductions Business Tax Deductions Small Business Tax

Looking For Ways To Make Some Extra Cash Maybe You Want To Off Set Your Online Business Expenses Plan A Vacation Money Make Side Money Pinterest For Business

What Is Irs Schedule C Business Profit Loss Irs Tax Forms Irs Taxes Tax Forms

Can I Deduct Unreimbursed Job Expenses The Official Blog Of Taxslayer

Small Business Accounting Cheat Sheet Important Info Small Business Accounting Business Tax Small Business Tax

Ir 2018 251 Internal Revenue Service Operating Expense Cpa

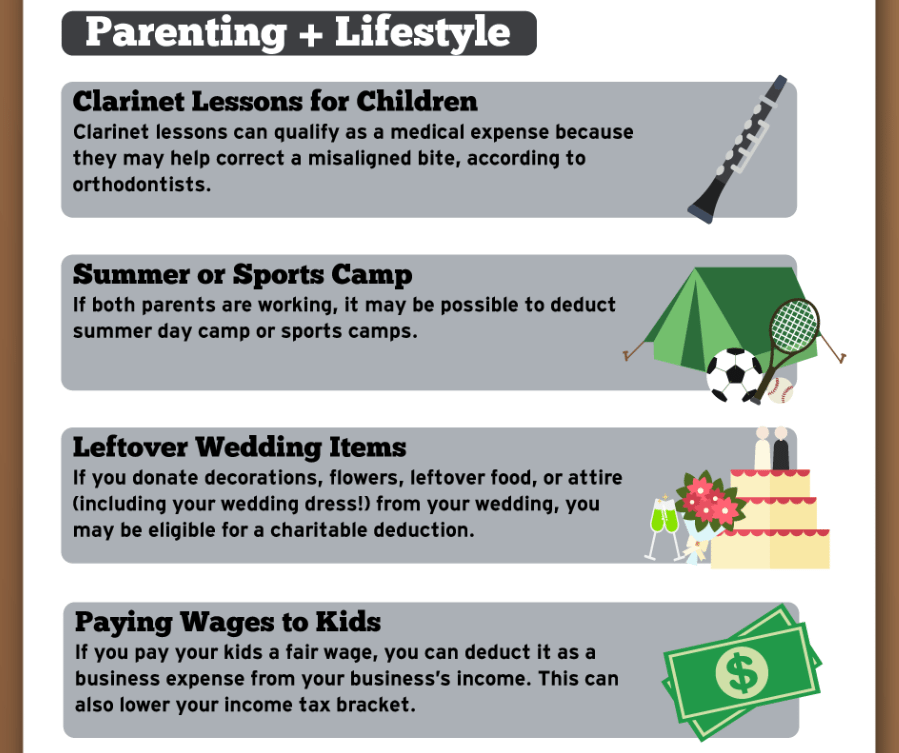

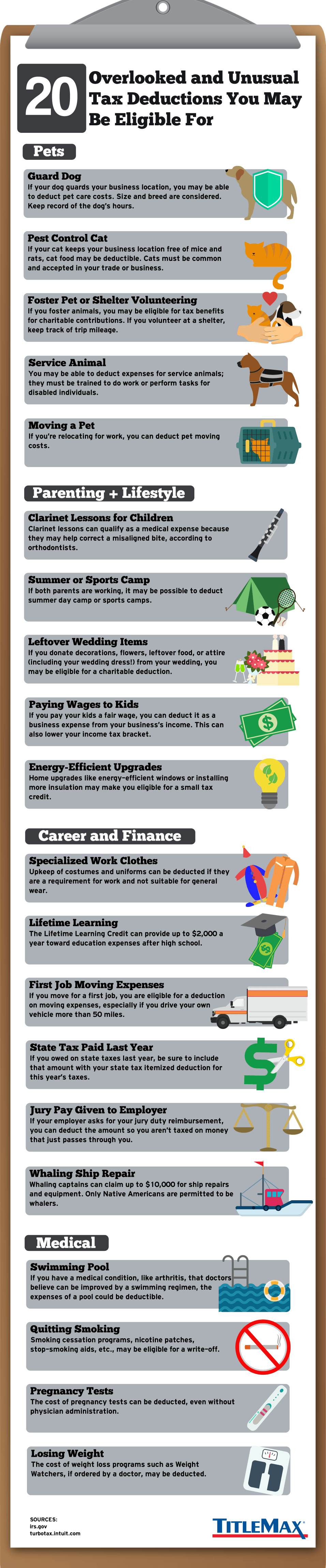

20 Overlooked And Unusual Tax Deductions You May Be Eligible For Titlemax

2019 Irs Standard Mileage Rate Irs Mileage Employee Management

7 Tax Deductions You Shouldn T Miss Business Tax Deductions Small Business Tax Deductions Tax Deductions

Hair Stylist Salon 2019 Tax Deduction Checklist Simply Organic Beauty Hair Salon Business Salons Salon Business

Income Tax Deductions Fy 2019 2020 Tax Deductions List Income Tax Tax Refund

20 Overlooked And Unusual Tax Deductions You May Be Eligible For Titlemax

Post a Comment for "Can I Deduct Unreimbursed Business Expenses In 2019"