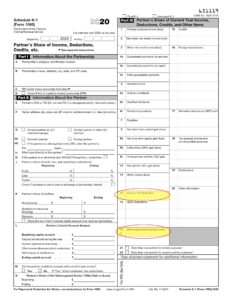

Unreimbursed Business Expenses K-1

Partners in partnership and members of an LLC often incur significant out of pocket expenses for travel to conduct business with clients professional education seminars. Add another K-1 enter UPE as the Partnership name and enter the.

Https Www Irs Gov Pub Irs Utl 2017ntf Dealingpartnershipk1 Pdf

The K-1 income and expenses may be reported many different places on the 1040 but NOT on Schedule C.

Unreimbursed business expenses k-1. Otherwise do the following. Screen K1-6 - Schedule K-1 10651120S - Other Unreimbursed Ptr Expense 1040 Interest dividends royalties portfolio short- and long-term capital gains and other portfolio income are treated as investment income. Continue to the screen Partnership - Unreimbursed Partnership Expenses and enter the expenses Note.

Where to enter unreimbursed partnership expenses - UPE is entered in the K-1 interview. Partnership expA link to the 8829 screen is available next to line 20. Unreimbursed expenses for a partnership are not reported on Schedule K-1 as they are expenses.

Where your unreimbursed business expenses are reported depends on the type of partner you are. 67g for tax years 2018 through 2025 as added by the legislation known as the Tax. Proceed through the K-1 path for partnerships and LLCs answering the questions as you go.

The expense may be limited. Unreimbursed expenses incurred by a business partner arent reported to the IRS on Schedule K-1. Thats literally what cash basis means.

Select the Detail - Items tab. The Partnership will report the PARTNERSHIPs income expenses etc to the partners via a K-1. If the partnership reports a loss youto or if a loss occurs as a result of adjustments for qualified unreimbursed business expenses you will enter the loss for that partnership on Schedule NJ -BUS-1 and use it to offset income from other partnerships.

There are two partners in this business. With your return open search for K-1 and then click the jump-to link in the search results. In the K-1 - Line 20 Oth Info Code Z - Item 1 field enter the unreimbursed Expenses.

Go to Schedule K-1 Form 1065. You cant deduct unreimbursed expenses if you werent required to pay them under the partnership agreement. To enter unreimbursed partner expenses do the following.

If you are a member of a partnership who is paid as a legal partner and receives a K-1. Click Business Income to expand the category and then click Partnership income Form 1065 Schedule K-1 Click Add Partnership Schedule K-1 to create a new copy of the form or Review to review a form already created. Enter unreimbursed partnership expenses UPE in the individual return.

The vast majority of W-2 workers cant deduct unreimbursed employee expenses in 2020. However there is an exception if the credit card was in the name of the business. Enter positive or negative amounts to adjust the.

My understanding is that if a partner uses their personal vehicle and they do not get reimbursed for mileage they can take a deduction as unreimbursed. Of course if the expenses in question are for meals or entertainment only 50 percent of the costs can be deducted on Schedule E. If the net amount from all partnerships listed on Schedule NJ -BUS-1 is a loss you should.

Also deductible UPE will reduce your self-employment income. See the Instructions for Schedule K-1 Form 1041 for a Beneficiary Filing. Can S corp deduct unreimbursed expenses.

However you may be able to deduct certain unreimbursed employee business expenses if you fall into one of the following categories of employment listed under Unreimbursed Employee Expenses next or are an eligible educator as defined under Educator Expenses later. Im using proseries and I am completing a 1065 and partnership uses 2 vehicles. The partner should also include the deductible amount as an expense for self-employment tax purposes on his or her Schedule SE.

You only can deduct unreimbursed expenses on Schedule E that are trade or business expenses under section 162. Since its using the cash basis of accounting like any other expense the S-corp or for that matter any other cash-basis taxpayer incurs its deductible when paid not incurred. If the partner is a SMLLC it is disregarded as an entity the owner of the SMLLC IS the entity for federal tax purposes.

The deduction can be described as unreimbursed partnership business expenses. Note however that unreimbursed expenses attributable to the trade or business of being an employee including those of maintaining a home office are no longer deductible as a miscellaneous itemized deduction due to the suspension of such deductions by Sec. Enter unreimbursed partnership expenses not deductible as an itemized deduction on Schedule A directly on the Schedule K-1 form in the Additional Information sectionThe total amount of unreimbursed partnership expenses will flow to Schedule E page 2.

Dont report unreimbursed partnership expenses separately if the expenses are from a passive activity and you are required to file Form 8582. If the Unreimbursed business expenses do not flow to the Schedule E Page 2. Since the Tax Cuts and Job Act of 2017 TCJA was passed a little-known deduction for unreimbursed partners expenses UPE has taken on more significance.

UPE Unreimbursed Partnership Expenses on Schedule E Schedule E form instructions page E-8 state the following. On the K1P screen select the 1065 K1 12-20 tab and enter the amount on line 20 Unreimb. You can deduct unreimbursed ordinary and necessary partnership expenses you paid on behalf of the partnership on Schedule E if you were required to pay these expenses.

The Tax Cut and Jobs Act TCJA eliminated unreimbursed employee expense deductions for all but a handful of. There is a separate. Amounts entered on line 20 add to those expenses entered on Form 8829 if applicable and then flow to line 28 of the Schedule Epg2 in view mode coded as UPE.

Ppp Guide For Partnerships K 1 1065 Homeunemployed Com

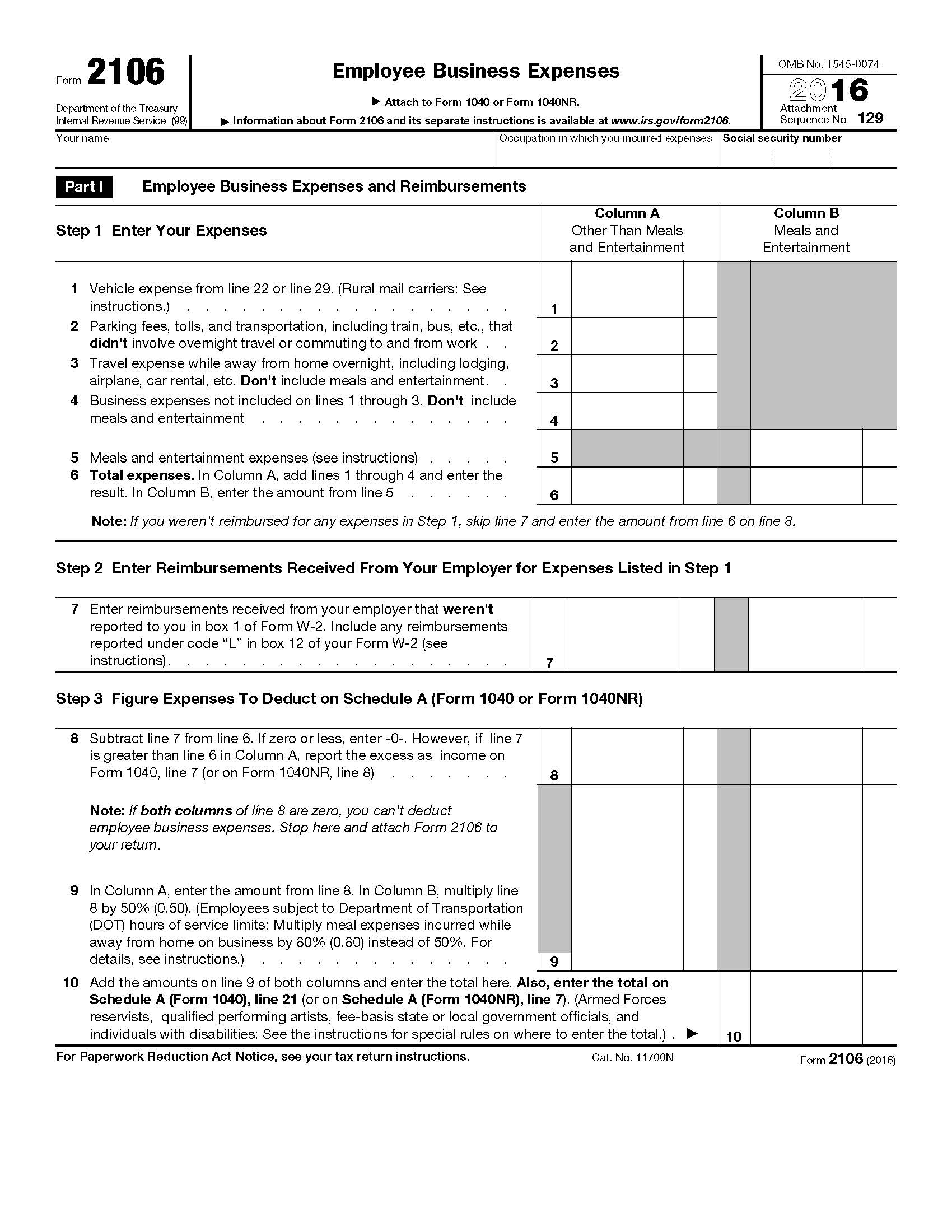

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

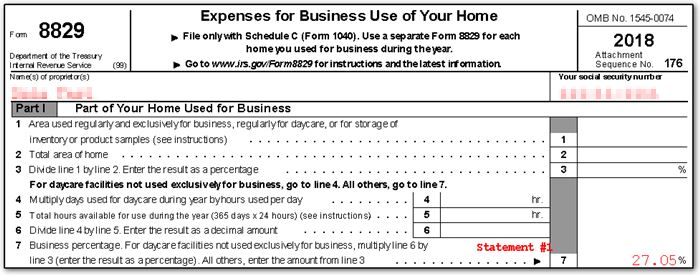

Form 8829 Office In Home 8829 K1

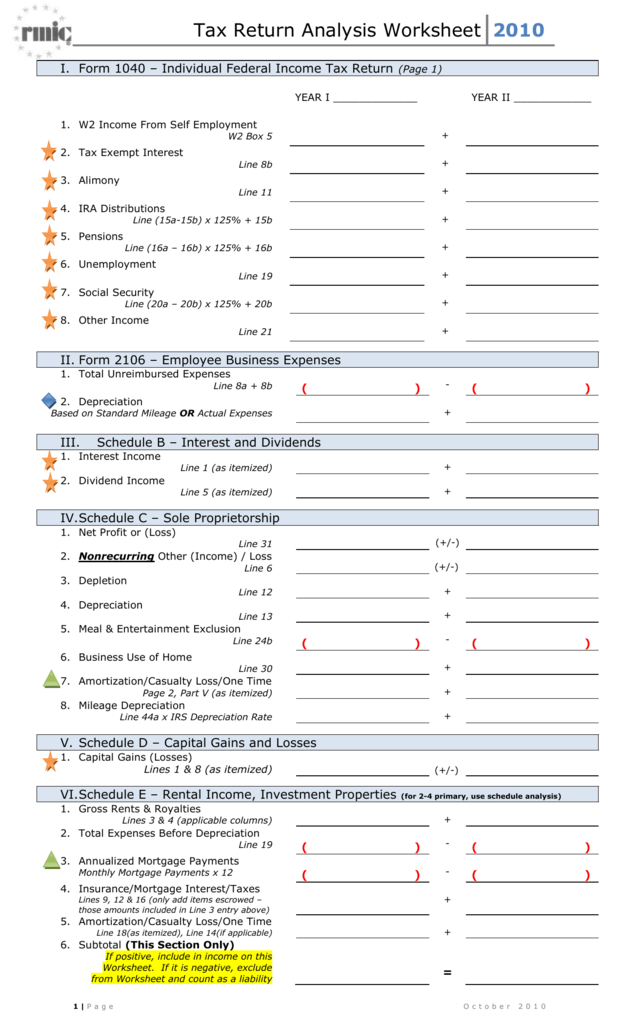

No Itemizing Needed To Claim These 23 Tax Deductions Don T Mess With Taxes

Https Www Irs Gov Pub Irs Utl 2017ntf Dealingpartnershipk1 Pdf

Https Www Irs Gov Pub Irs Utl 2017ntf Dealingpartnershipk1 Pdf

Https Singlefamily Fanniemae Com Media Document Pdf Glance Selling Guide Updates Related Tax Cuts And Jobs Act

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Https Singlefamily Fanniemae Com Media Document Pdf Glance Selling Guide Updates Related Tax Cuts And Jobs Act

Partner Home Office Deductions Under Covid 19

Https Www 3iscorp Com School Wp Content Uploads Pdf Courses Self Study California Module 3 Study Text Pdf

Re On 2020 Home Business Software Tt Does Not

Https Www Irs Gov Pub Irs Utl 2017ntf Dealingpartnershipk1 Pdf

Re K 1 Expenses From Llc Partnership And Their Re

Often Overlooked Tax Break Unreimbursed Business Expenses Accounting Services Audit Tax And Consulting Aronson Llc

Chapter 5 Schedule K 1 Issues University Of Illinois Tax School

Instructions For Form 8995 A 2020 Internal Revenue Service

Post a Comment for "Unreimbursed Business Expenses K-1"