How To Get An Ein Number In Md

Apply for a FEIN. 3 Select the State in which you would like to search.

Maryland Business Entity Search Corporation Llc

Get Sales and Use Tax Information for consumers or get all the details in the business section.

How to get an ein number in md. 1 Choose a Search Type. Many functions are also available through the Maryland Unemployment Insurance for Claimants mobile app. Once you have submitted your application your EIN will be delivered to you via e-mail.

Employee Income Tax Witholding. If applying online isnt an option you can also complete an EIN application by mail or fax by sending Form SS-4 to the IRS fax number 855-641-6935. Businesses are often confronted with customers who wish to make purchases tax free either because they intend to resell the item and charge the sales tax or because they are making a purchase for an organization possessing a tax exempt card issued by the State Comptrollers Office.

Outside of obtaining your Federal Tax ID EIN in Maryland you will also likely need a Maryland State Tax ID. The person making the call must be authorized to receive the EIN and answer questions concerning the Form SS-4 PDF Application for Employer Identification Number. Eastern Time Monday through Friday to obtain their EIN.

To begin your application select the type of organization or entity you are attempting to obtain a Tax ID EIN Number in Maryland for. Sales and Use Tax. Open an LLC business bank account.

How do I apply for a Federal Tax ID EIN Number. If filing by phone note that it. You must have a federal employer identification number FEIN before you can register your business unless you are a sole proprietorship and applying for a sales and use tax license only and do not have a FEIN.

Select Your Entity Type. What if I cannot get through using telephone number. Are you starting a business in Maryland and need to apply for a Tax ID number.

Marylands use tax protects Maryland businesses from unfair competition. The third step in the necessary filings process is to file a Combined Central Registration with the Maryland Comptrollers Office. After completing the application you will receive your Tax ID EIN Number via e-mail.

You can apply for a Federal Tax ID EIN Number here online. Maryland Combined Registration Online Application. Local businesses would be at a competitive disadvantage if consumers were entitled to a 6 or 9 percent discount on items purchased from out of state businesses.

Your property account identification number is located above your name and address on your assessment notice. You may apply for an EIN online if your principal business is located in the United States or US. Online Verification of Maryland Tax Account Numbers.

Generally the State Tax ID is used for the follow. ACCT 01 02 123456 4 40500 0391 302000 C DOE JOHN 123 MAIN ST ANYTOWNIN MD 21200-0000. Look for the information in the following format.

Handle employee payroll if applicable Obtain business lines of credit or business loans. Sole owners dont need it unless they are employers but still can get an EIN and use it instead of a ss to separate from the busienss. Maryland State Tax ID.

This form from the Comptrollers Office will ask the filer to list both the FEIN number and this Departments internal entity filing number. 5 Click on the provider name for additional information. File taxes at the federal state and local level.

If you are opening a business or other entity that will have employees will operate as a Corporation or Partnership is. Sales Tax Exemption Permits. Using your assessment notice to search by account number.

The person applying online must have a valid Taxpayer Identification Number SSN ITIN EIN. Apply for a Maryland Tax ID EIN Number Online. Apply for a Maryland Tax ID EIN Number To obtain your Tax ID EIN in Maryland start by choosing the legal structure of the entity you wish to get a Tax ID EIN for.

You are limited to one EIN per responsible party per day. International applicants may call 267-941-1099 not a toll-free number 6 am. Sole Proprietor Individual.

How do I get an EIN. You can obtain get an EIN here online same day service. You may access many account features through the BEACON portal.

2 Enter your Criteria. Having an EIN for your Maryland LLC enables you to do the following. Obtaining a Maryland EIN is quick and easy with the help of GovDocFiling.

You can even get an EIN over the phone if the company was formed outside the US. This ID is needed to pay business taxes state income tax andor sales tax on items you sell.

Maryland Tax Id Ein Number Application Business Help Center

Https Secure 2 Dllr State Md Us Webtax Images Usermanual Pdf

Maryland Business Entity Search Corporation Llc

Payout Structure Racetrax Md Lottery Md Lottery Lottery Prizes

Stumped How To Form A Maryland Llc The Easy Way

Obtain A Federal Tax Id Number From The Irs Maryland Business Express Mbe

Pin By Lance Burton On Unlock Payroll Template Tax Refund Money Template

Vintage 1965 Maryland Md License Plate Tag Pair Set Bh 9274 3 31 1965 License Plate Maryland Vintage

Flag Of Maryland Coloring Page From Maryland Category Select From 26999 Printable Crafts Of Cartoons Flag Coloring Pages Maryland Flag Flower Coloring Pages

Https Secure 2 Dllr State Md Us Webtax Images Usermanual Pdf

Irs Id Number Ready For Apostille Irs Maryland Person

Obtain A Federal Tax Id Number From The Irs Maryland Business Express Mbe

How To Search Available Business Names In Maryland Startingyourbusiness Com

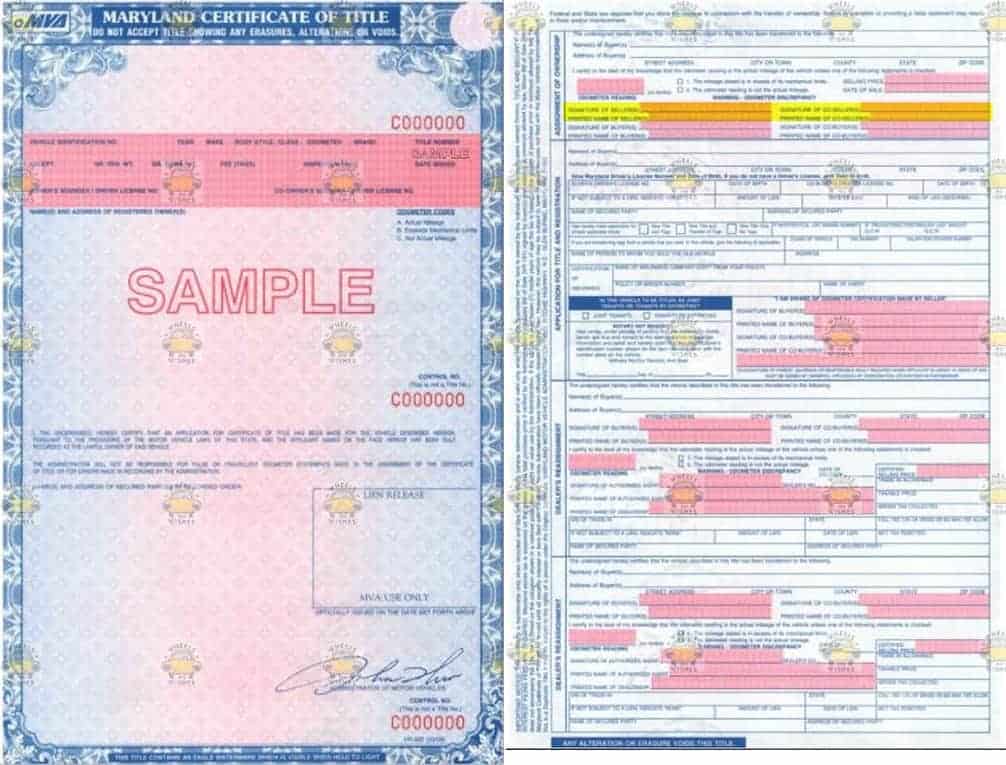

Maryland Vehicle Donation Title Questions

Obtain A Federal Tax Id Number From The Irs Maryland Business Express Mbe

Https Secure 2 Dllr State Md Us Webtax Images Usermanual Pdf

Https Secure 2 Dllr State Md Us Webtax Images Usermanual Pdf

Health Inspiration A 10 Minute Inner Thigh Workout To Try At Home The Exercises Which Have Helped M Inner Thigh Workout Thigh Workouts At Home Thigh Exercises

Obtain A Federal Tax Id Number From The Irs Maryland Business Express Mbe

Post a Comment for "How To Get An Ein Number In Md"