Business Tax Id Hawaii

Hawaii Tax IDs that were issued prior to the modernization project begin with the letter W and are followed by 10. The Department of Taxation is moving to a new integrated tax.

Https Files Hawaii Gov Tax Forms 2019 Geins Pdf

Hawaii does not have a sales tax.

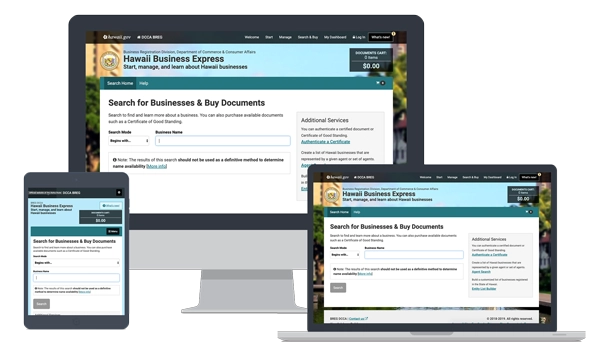

Business tax id hawaii. GovDocFiling offers business owners an intuitive user-friendly way to secure an EIN. Register a business entity trade name trademark or submit other filings with the Department of Commerce Consumer Affairs Business Registration Division. Business Complaints Search OCP.

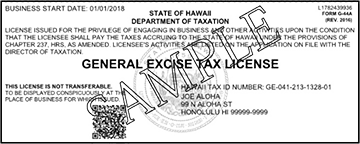

The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on. Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by. 2020-27 Revenue Ruling in its entirety for Hawaii income tax purposes.

As the search functions for licensee and business status is. Get a Federal Employee Identification Number. A Hawaii tax id number can be one of two state tax ID numbers.

Business Complaints Search RICO. All sales tax related account. Complete Form BB-1 State of Hawaii Basic Business Application and pay a one-time 20 registration fee.

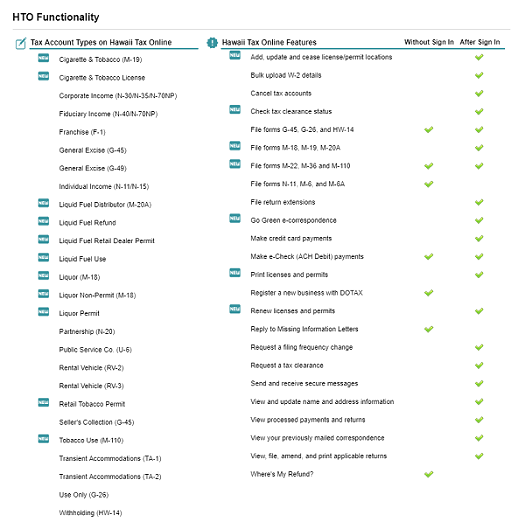

Its safe to say that any business that has employees andor pays any kind of taxes will need a federal tax ID. In Hawaii all business registrations are filed with the State of Hawaii Department of Commerce and Consumer Affairs Business Registration Division. Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make.

Then there is a Federal Tax ID Number a Business Tax Registration. A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding. The Office of Consumer Protection search allows you to check if a business or individual has had complaints filed against them and view the outcome of those complaints.

11 rows Anyone who receives income from conducting business activities in the. 4e changes to a previously filed Form BB-1 or Form TA-40. Our business registration forms are simple to fill out and only require enough information to fulfill Hawaiis statutory filing requirements.

3 rows Hawaii Tax ID Number Changes. Tax Information Release 2021-03 Details and Timing of Paycheck Protection Program Loan Forgiveness The purpose of this Tax Information Release is to adopt Revenue Ruling No. This website will allow consumers to check out businesses individuals or licensed professionals that you intend to hire or do business with.

There are several different ones. For more information visit the Department of Taxations website at taxhawaiigov 13 How do I apply for a HI Tax ID and tax licenses. The following discussion examples and procedures are provided for additional clarity.

Make changes to a previously filed Form BB-1 or Form TA-40. Your tax ID number is used to identify your business to several federal agencies responsible for the regulation of business. File for Hawaii EIN Whether you are launching a new business venture applying for financing hiring skilled workers or competing for federal contracts your company might need a Federal Tax ID number.

Register for various tax licenses and permits with the Department of Taxation DOTAX and to obtain a corresponding Hawaii Tax Identification Number Hawaii Tax ID. Register for various tax licenses and permits with the Department of Taxation DOTAX and to obtain a corresponding Hawaii Tax Identification Number Hawaii Tax ID. The Hawaii State Tax ID.

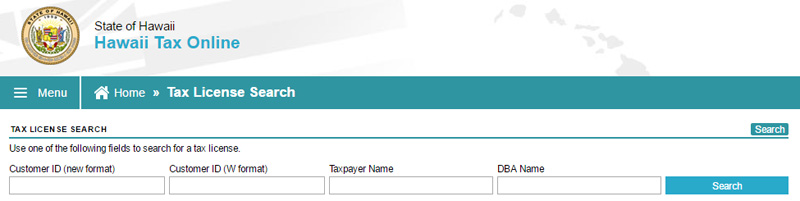

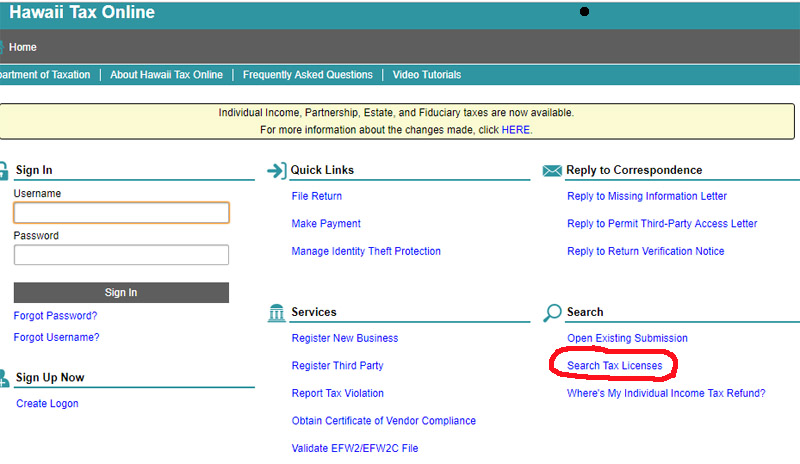

Register a business online in the state of Hawaiʻi. Use the Search Tax Licenses feature on Hawaii Tax Online to search for names Hawaii Tax ID numbers and status of business taxpayers issued a tax permit license or account. Additional fees may apply depending on.

Any business offering products or services in Hawaii that are taxed in any way must get a federal tax ID number. Every new business is required to have its own State IDHawaii tax ID number depending on the particular facts of your business. Federal Tax Information for Businesses.

Get help with applying for a general excise tax GET license from the Department of Taxation and receive information on how to apply for a federal employer identification number. Add a licensepermitregistration not applied for on your previously filed Form BB-1. It offers a number of online resources for consumers including licensee status and licensing complaints tax and business registration and other educational materials.

The Business Action Center has offices in Honolulu Maui and Hawaiʻi counties. Instead we have the GET which is assessed on all business activities. By visiting an office you can.

Add a licensepermitregistration not applied for on your previously filed Form BB-1.

Https Files Hawaii Gov Tax Forms 2017 G45ins Pdf

California Business Licenses Search Directory Induced Info

How To Prepare And Efile Your 2020 2021 Hawaii State Income Tax Return

What S New To Hawaii Tax Online Department Of Taxation

Amazon Com Mclovin Hawaii Drivers License Superbad Novelty Movie Prop Reproduction

Ge License Hawaii Online Application Blog Lif Co Id

Licensing Information Department Of Taxation

View Print 1098 T Tax Form And Information All Campuses Myuh Services

How To Register For A Sales Tax Permit In Hawaii Taxjar Blog

Hawaii What Is My Letter Id Taxjar Support

How To Get A Resale Certificate In Hawaii Startingyourbusiness Com

Http Files Hawaii Gov Tax Legal Tir Tir10 05 Pdf

A Fairly Thorough Explanation Of Hawaii General Excise Tax Get For Beginners 2019 Youtube

Hawaii Ge Tax The 10 Most Frequently Asked Questions

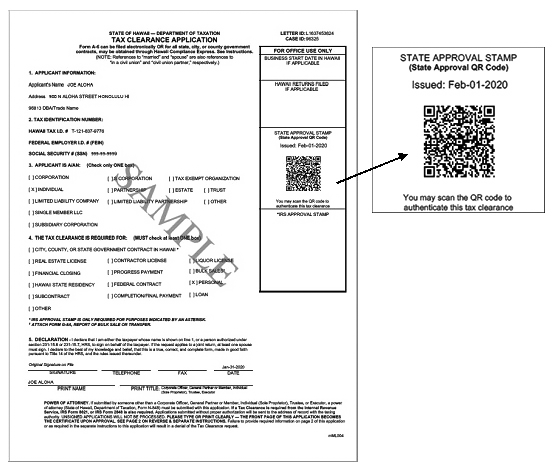

Tax Clearance Certificates Department Of Taxation

Https Dotax Ehawaii Gov Efile Html Geins Pdf

Post a Comment for "Business Tax Id Hawaii"