Business Expenses Credit Karma

You pay for it with your information. Credit Karma Money Save.

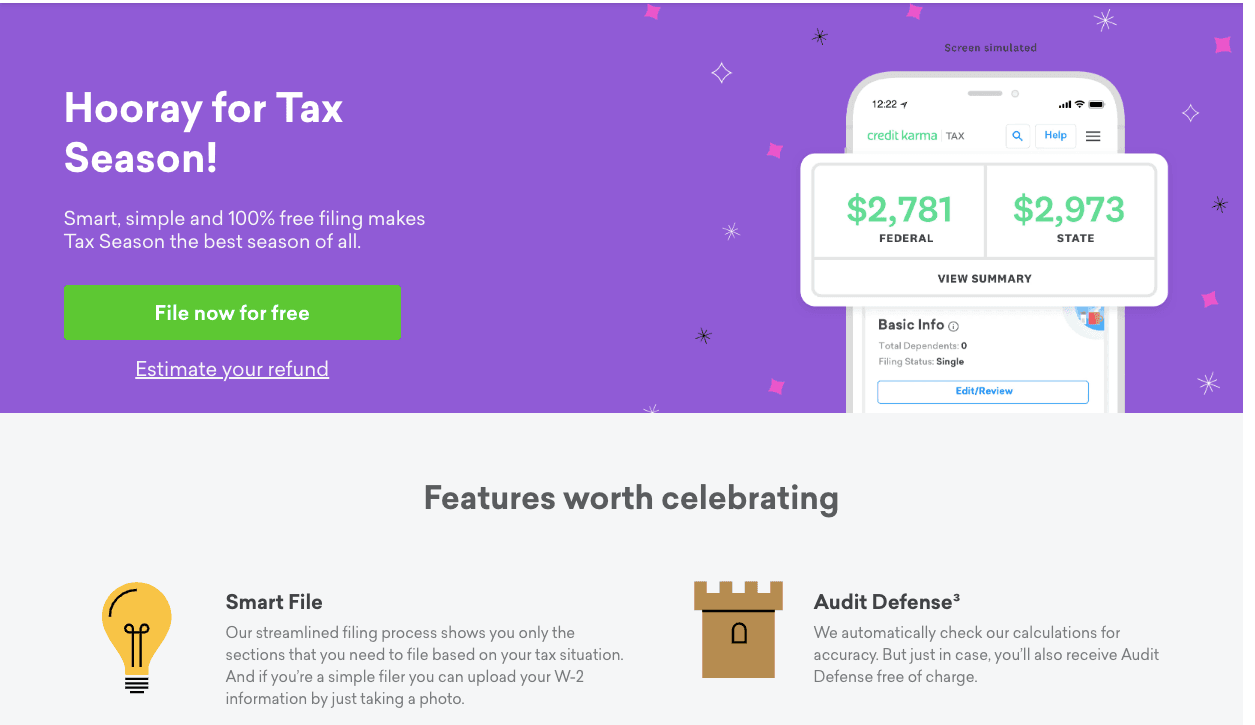

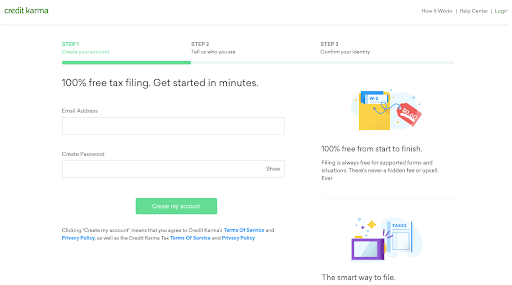

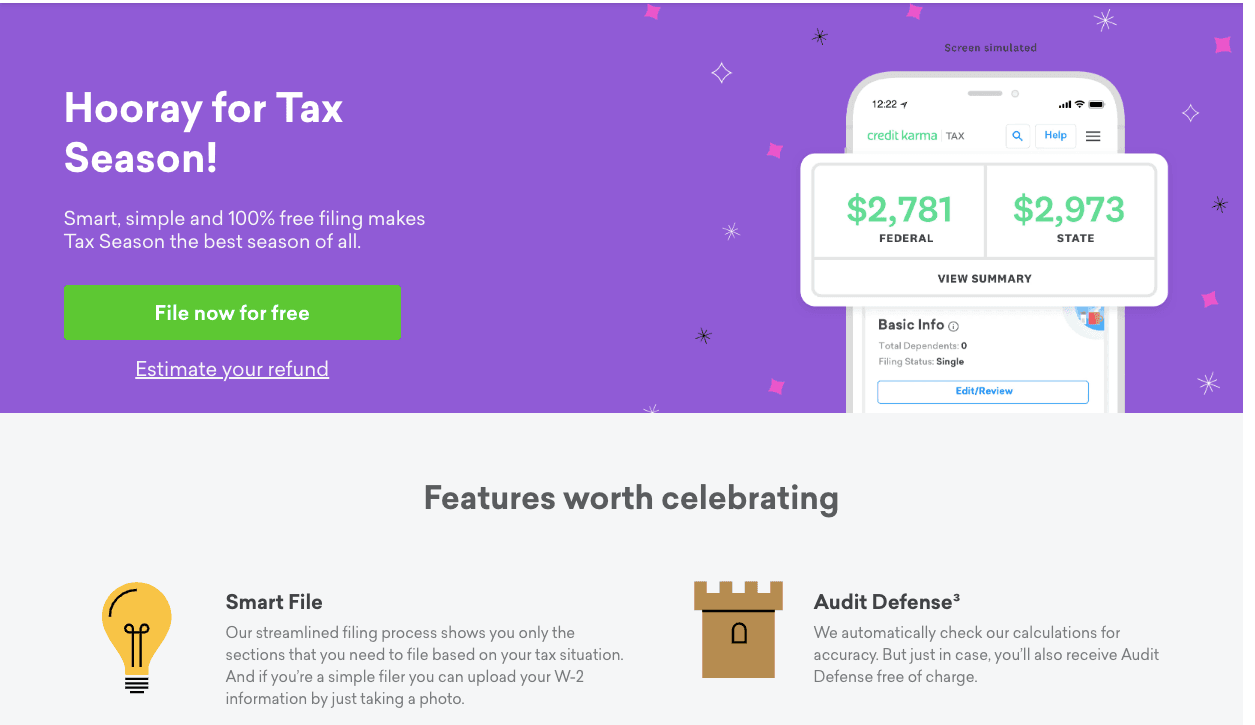

Credit Karma Tax Review 2021 Best Free Tax Prep Software

Credit Karma entered the space but underestimated the complexity of the product they were offering.

Business expenses credit karma. It appeals to those enticed by the word free and can. Credit Karma Tax 2020 remains a reasonable free option for filing federal and state taxes. Founded in 2007 and based in San Francisco it now has over 800 employees across its three offices.

Business expenses should always be on a separate business-only credit card for a variety of reasons and personal expenses should never be. CREDIT KARMA OFFERS INC. Upgrades etc and now 20 of that can go on schedule C as business expenses 2002002000.

The total amount repayable will be 676764. Credit Karma Money Spend. Licenses and Registration Fees.

Credit Karma is a personal finance company whose mission is to provide tools and education to help people make financial progress. Get a business credit card and a business bank account. 8829 Expenses for Business Use of Your Home.

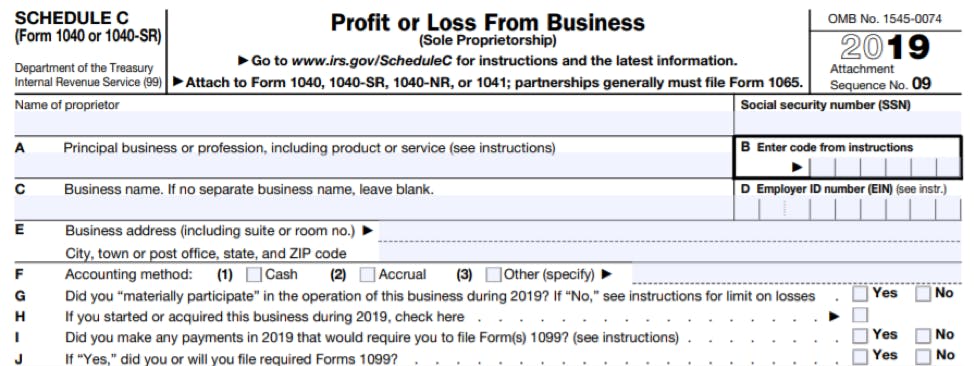

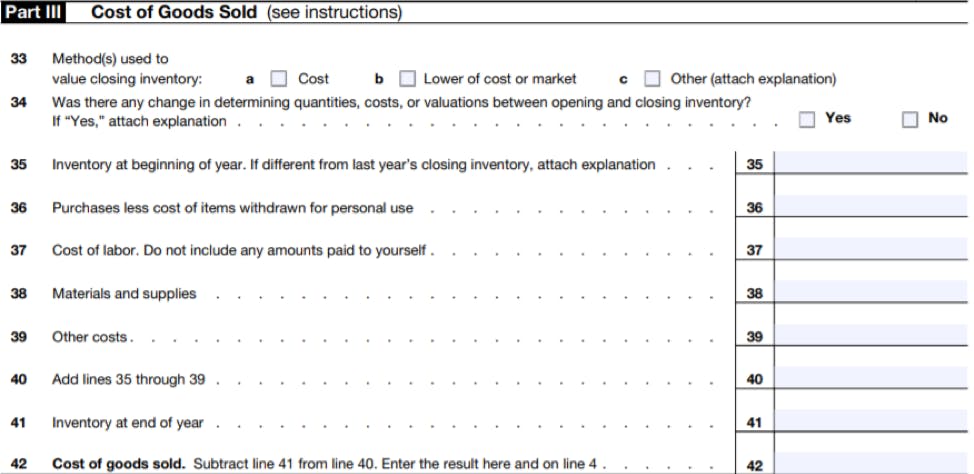

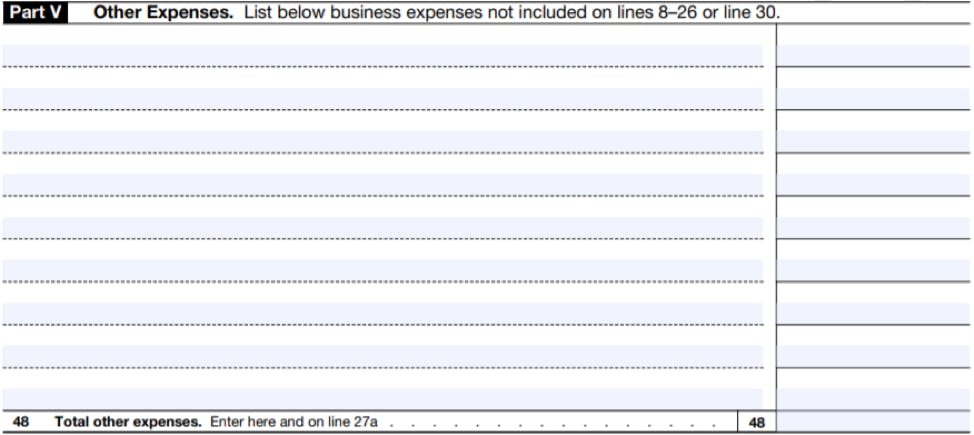

Credit Karma Tax accommodates filing Schedule C for self-employed business expenses and Schedule SE for the self-employment tax as well as Schedule E for partnerships multi-member LLCs and estates and trusts. You can file your taxes even as an independent contractor with gig apps like Doordash Uber Eats Grubhub Instacart and others without paying fees. 8839 Qualified Adoption Expenses.

Gather your business expenses. 8862 Information To Claim Certain Credits After Disallowance. NMLS ID 1628077 Licenses NMLS Consumer Access.

8853 Archer MSAs and Long-Term Care Insurance Contracts. You must only deduct the actual expenses related to the business use of the vehicle. Youre giving Credit Karma your financial information.

Some business credit reporting agencies will use this to track your business instead of the Social Security number they use to track personal credit. How to report 1099-MISC or 1099-K income using Credit Karma Tax. Credit Karma Tax 85 for all round quality and functionality.

That doesnt always mean its truly free. If you used your vehicle for 50 business and 50 personal use then you would deduct 50 of the actual vehicle expenses. These deductible expenses include the following.

8834 Qualified Electric Vehicle Credit. Check out their high and weak points and find out which software is a more sensible choice for your company. Your APR will be determined based on your credit at the time of application.

Miscellaneous Expenses While some of these deductions have no minimum requirement others are deductible only to the extent that they exceed 2 percent of your adjusted gross income AGI. The exception is anything I buy or upgrade in the house for business purposes only is 100 a business expense. Keep your business card strictly for business and your personal credit card for personal expenses to make your taxes easier down the line.

Start with the basics. Credit Karma Tax NA for user satisfaction rating. 3 You cant file more than one state return and you cant file a part-year state return or a nonresident state return either.

However if you are self-employed you can continue to deduct qualifying home office expenses by reporting the deduction on federal form 8829 Expenses for Business Use of Your Home which is filed along with your Schedule C Profit or Loss From Your Business on your form 1040. 8859 Carryforward of DC. 1100 Broadway STE 1800 Oakland CA 94607 Credit Karma Offers Inc.

Go to this section in Credit Karma Tax. Find the Tax option at the top of the page. Some dont fit into any of the other groups of itemized deductions so they fall under miscellaneous expenses.

Depreciation or lease payments. Credit Karma doesnt cost actual money. Gather your Form 1099s.

With over 85 million users its best known for offering all its services free-of-charge.

Video Demonstration And Instructions On How To Use The Credit Karma Login Credit Karma Karma Business Credit Cards

Common Mistakes On Credit Karma Free Tax Doordash Uber Eats Instacart

Credit Karma Tax Review My Experience Using Credit Karma Tax

Credit Karma Guide To Credit Cards Credit Karma

Common Mistakes On Credit Karma Free Tax Doordash Uber Eats Instacart

Credit Karma Guide To Business Credit Cards Credit Karma

Credit Karma Tax 2021 2020 Tax Year Review 2021 Pcmag Uk

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Credit Karma Tax Vs H R Block Which Is Better For Filing Taxes

Credit Karma Tax Review My Experience Using Credit Karma Tax

Common Mistakes On Credit Karma Free Tax Doordash Uber Eats Instacart

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Common Mistakes On Credit Karma Free Tax Doordash Uber Eats Instacart

Credit Karma Guide To Business Credit Scores Credit Karma

Credit Karma Tax Review An Absolutely Free Turbotax

Credit Karma Tax 2021 2020 Tax Year Review 2021 Pcmag Uk

Credit Karma Guide To Business Credit Scores Credit Karma

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

:max_bytes(150000):strip_icc()/credit.karma.logo.cropped-5bfc2e08c9e77c0026b570fb.png)

Post a Comment for "Business Expenses Credit Karma"