Where Can I Find My Business State Tax Id Number

Generally businesses need an EIN. You can also call the IRS to look up your federal tax ID number.

Forming Business In Broward What You Ll Need To Do Llc Or Fictitious Name Sunbiz Org Ein If You Ll Be Selling Tangible Go Irs Gov Business Tax Broward

You may apply for a Minnesota Tax ID number with the Minnesota Department of Revenue online at Business Registration by phone at 651-282-5225 or 800-657-3605 or by filing a paper form Application for Business Registration ABR.

Where can i find my business state tax id number. Preform a lookup by Name Tax ID Number or File Number. Select the GET STATE CRS NUMBER link to obtain a New Mexico Combined Reporting System CRS number. Federal Employer Identification Number FEIN if applicable issued by the Internal Revenue Service IRS Click here to find out if you need a FEIN.

Using this system allows us to process your business registration application more accurately and efficiently. If you are doing business with a company you may need to have its state tax ID number. Businesses need a Doing Business As DBA certificate from the state of Texas.

You will leave the IRS website and enter the state website. You can find a tax ID number online on specific forms and documents or by contacting the appropriate department within the company. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

If you have not created your business entity you can use the Register my Business page to help you. Step 2 Choose Your Entity. The company requires another state tax ID number if it relocates to another state.

If you are from one of these states and you also want to get a federal Employer Identification Number EIN you may obtain both your state and. Is used for all payroll tax programs. AutoFile enrollment also requires only the first 13 digits.

Anyone seeking to register a business for the indicated tax types can use the Online Business Registration system to establish state tax ID numbers. Most states use the federal nine-digit EIN number for tax purposes so that is often the number you need. The trademark registration of a business name is not always necessary but doing so can prevent future allegations of trademark infringement or market confusion.

If you need to locate another companys EIN you can start by asking the company. You may apply for an EIN in various ways and now you may apply online. Sometimes referred to as FEIN.

However the Business Registry. 1 It is listed in smaller print on the back of your Florida sales tax permit. It will guide you through questions and ask for your name social security number address and your Doing Business As DBA name.

How to Apply for an EIN. Unemployment Tax Collected by the Texas Workforce Commission. If my business doesnt have a federal identification number yet can I still apply for the sales and use tax permit.

Application for Employer Identification Number Form SS-4 PDF. If a business applies for a sales tax permit before obtaining a federal employers identification number the Comptrollers office will issue a permit under a temporary number. Registering a business name and applying for a tax identification number also known as an Employer Identification Number EIN are important first steps to establishing a new business.

Besides an EIN business owners should have a business tax registration tax ID business license and sales state tax ID sellers permit. State and Federal Online Business Registration. For most applicants the account ID number will be issued instantly.

The full Business Partner Number will be 14 digits but the state requires only the first 13 digits to login to the e-file website. 2 All owners of New Mexico businesses registered as a Partnership Limited Liability Company or CORPORATION must obtain a New Mexico CRS Tax ID number. Is not the same as your Business Registry Number obtained through the Secretary of States Business Registry.

After deciding your query option you will be sent to the listings page See Below. Internal Revenue ServiceStarting a Business. 2 The state can also do a lookup of this number of you give them a call at 850-488-6800.

When preforming your lookup by name be sure to include as many keywords as you can in order to to have the best results. There are also free and paid databases that can. Your nine-digit federal tax ID becomes available immediately upon verification.

Dallas Texas businesses that have even one employee will also need a state tax ID number. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately. On the other hand the IRS is the agency that issues EINs to businesses and the.

Businesses obtain state tax ID numbers from the department of revenue of the state where it is located. If you need a business registration number from one of the states listed on this page all you need to do is click on one of the links below. Apply for an EIN with the IRS assistance tool.

1 Select the FEDERAL ID NUMBER HOME link to obtain a Federal Employer Identification Number EIN tax identification number. Withholding unemployment tax Workers Benefit Fund Assessment and transit taxes TriMet and Lane Transit. Basic federal tax information for new businesses including information about EINs business taxes and general small business resources.

Tax Forms Directory Comprehensive Irs Tax Forms Guide Irs Taxes Irs Tax Forms Business Tax Deductions

Where Do I Find My Employer Id Number Ein Turbotax Support Video Youtube

The Guide To A Painless Tax Season Nurse Ceo Tax Season Tax Prep Business Tax

Business Registration Application For Income Tax Withholding Sales And Use Tax And Machinery Equipment And Manufacturing Income Tax Registration Tax Forms

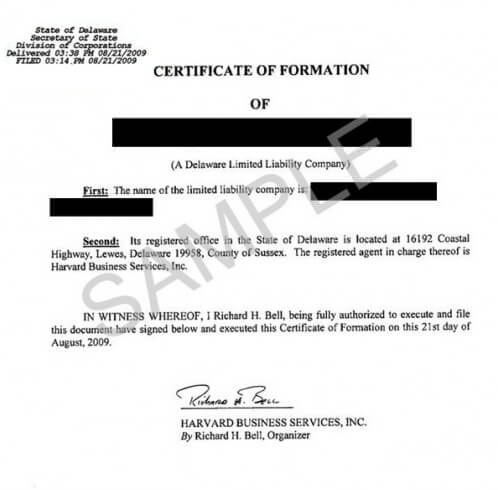

How Do I Obtain A Federal Tax Id When Forming An Llc Legalzoom Com

Individual Tax Preparation Checklist Tax Preparation Tax Preparation Services Tax Checklist

Pin On Difference Betweem Single And Multi Member Llc

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

Delaware State File Number What It Is How It S Used Harvard Business Services

4 Form Deductions 4 Benefits Of 4 Form Deductions That May Change Your Perspective 1099 Form Deductions Handy Printabl Tax Prep Checklist Business Tax Tax Prep

Your State Tax Id And Federal Tax Id Numbers Also Known As An Employer Identification Business Finance Writing A Business Plan Small Business Administration

7 Things To Expect When Registering Your New Small Business Start Up Modern Thumbprint In 2020 Small Business Start Up Successful Business Tips Starting Small Business

Letter Ein Confirmation Confirmation Letter Employer Identification Number Doctors Note Template

Tax Return Fake Tax Return Income Tax Return Income Statement

Fake Bank Statement 2 2 Unconventional Knowledge About Fake Bank Statement 2 That You Can T Confirmation Letter Doctors Note Template Letter Of Employment

Pin By Lance Burton On Unlock Payroll Template Tax Refund Money Template

Is My Tax Id The Same As My Social

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms W2 Forms Income Tax

Post a Comment for "Where Can I Find My Business State Tax Id Number"