Small Business Administration Loans California

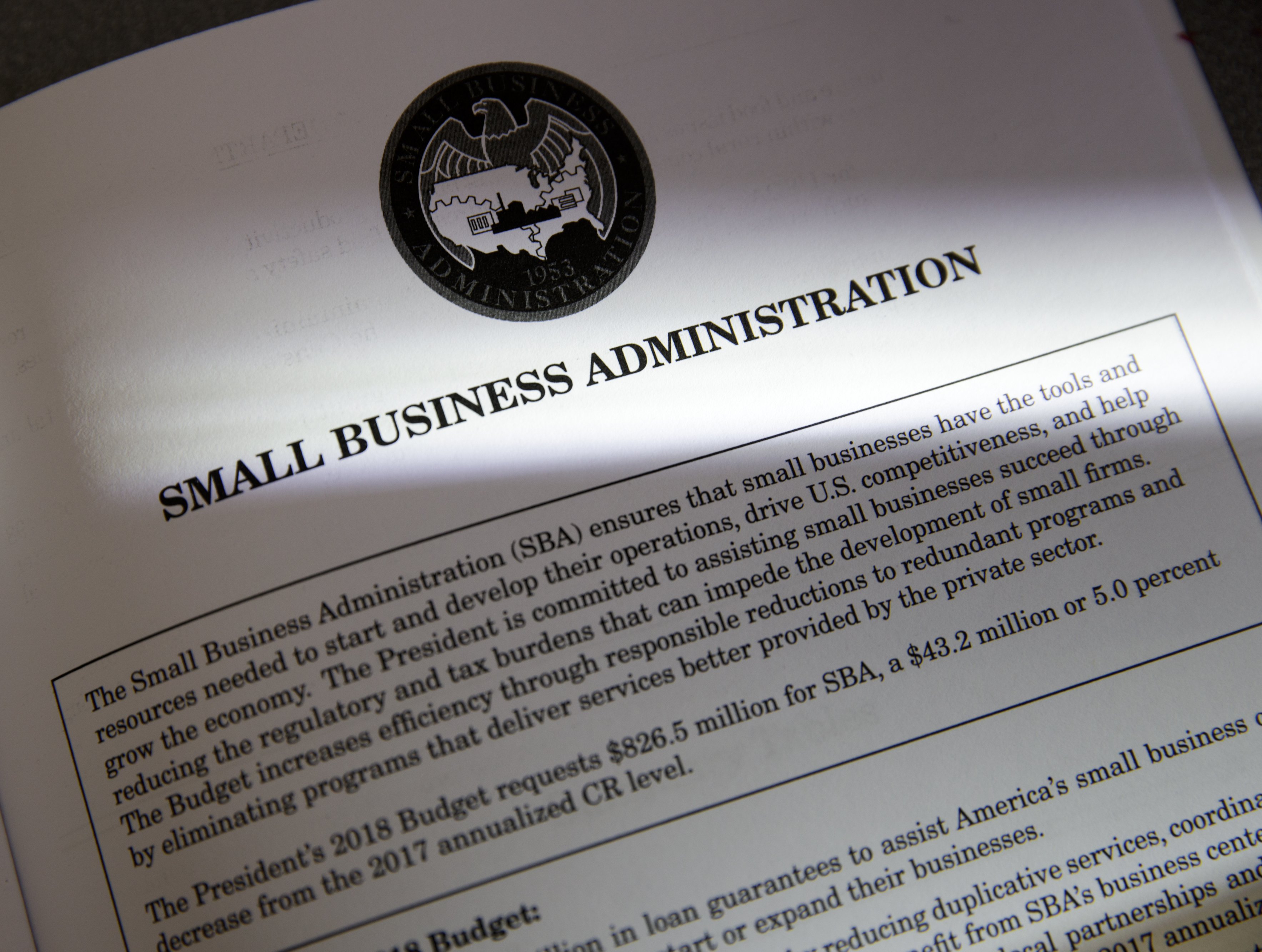

The SBA works with lenders to provide loans to small businesses. And its not just us.

A Master List Of States And Counties Eligible For Sba Coronavirus Relief Loans Workest

The agency doesnt lend money directly to small business owners.

Small business administration loans california. Read more about Year to Date Lender Totals October - April. Access to Capital Provided 125 Million in Small Business Loans. Washington DC 20416.

California Sacramento California Sacramento Read more about Sacramento District Year --to- Date Loans. SBA acted under its own authority as provided by the Coronavirus Preparedness and Response. Beginning in February 2021 that relief was extended for certain businesses.

Usually SBA loans term is 25 years. Check with WBCs and local assistance resources for guidance and our Lender Match tool for finding capital. When you see new opportunities to grow your business think about SBA financing through California Bank Trust an excellent solution for expanding your business renovating or building.

Small Business Administration is offering low-interest federal disaster loans for working capital to California small businesses suffering substantial economic injury as a result of the Coronavirus COVID-19 SBA Administrator Jovita Carranza announced today. The State of California is allocating 50 million to the Small Business Finance Center at Californias IBank to mitigate barriers to capital for those small businesses 1-750 employees that may not qualify for federal funds including businesses in low-wealth and immigrant communities. The SBA reduces risk for lenders and makes it easier for them to access capital.

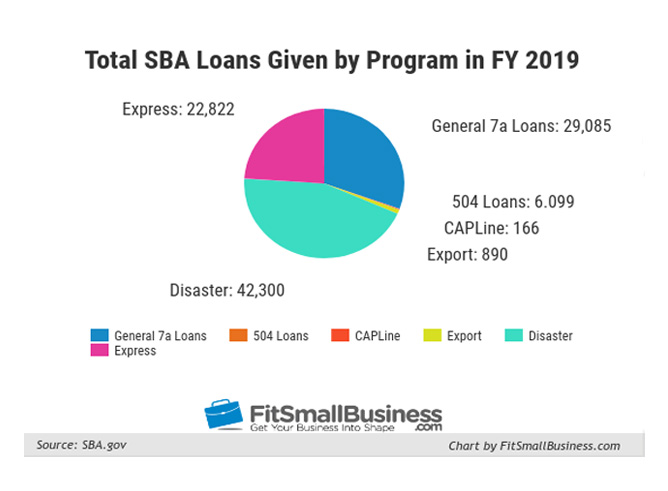

Small Business Administration SBA Loans. SBA loans require much more paperwork and documents and have more strict guidelines. SBA 7a and SBA 504.

Pacific Community Ventures can help. For non-COVID-19 related questions about how we can help your small business and other general information email SBAs Answer Desk. Instead it sets guidelines for loans made by its partnering lenders community development organizations and micro-lending institutions.

A total of 6217 Small Business Relief Payment Plans have been established for a total of 1059 million in tax through August 30. The California Infrastructure Economic. Were a mission-driven lender that provides fair and affordable loans up to 200000 to California small businesses.

EMAIL Contact SBAs Answer Desk at 1-800-827-5722 or answerdesksbagov Monday-Friday 9am to 6pm ET or speak with an American Sign Language ASL interpreter via videophone at 1-855-440-4960. Garfield of SBAs Disaster Field Operations Center-West. Many of the major SBA-approved lending.

That makes it easier for small businesses to get loans. As an SBA Preferred Lender we can help you find government-guaranteed SBA loan options that fit your business needs while allowing you to seize opportunities. These products usually offer variable rates.

SBAs Debt Relief Program pays the principal interest and fees for six months for 7 a 504 and Microloans disbursed before September 27 2020. With decades of relevant experience and strategic relationships in the industry CCS can serve commercial financing and business consulting needs across the United States. Our loans help small business owners like you thrive be successful and create jobs in our communities.

Financial analysis shows that California is one of the best places for small business owners to grow their businesses. For details see the Small Business Debt Relief Program section page 9 of the Small Business Owners Guide to COVID-19 Relief Legislation PDF Download. Women-owned small businesses can also take advantage of SBA loan programsOur partners offer advice and counseling to help choose the right path for your company.

14 rows Small Business Relief Payment Plans for Sales and Use Tax State California currently. 409 3rd St SW. The 8a Business Development program helps small disadvantaged businesses compete in the marketplace.

Whatever your situation may be SBA-backed loans are extremely useful for any small business in California and SBAExpressLoans Inc. We facilitate financing for acquisitions construction refinance and working capital through SBA USDA Conventional Loans and Private Funds across the United States. Small nonfarm businesses in Ventura Kern Los Angeles and Santa Barbara counties are now eligible to apply for lowinterest federal disaster loans from the US.

CDTFA has received 82 million in payments towards the small business relief payment plans. Small Business Administration announced Director Tanya N. Small Business Administration is offering low-interest federal disaster loans for working capital to California small businesses suffering substantial economic injury as a result of the Coronavirus COVID-19 SBA Administrator Jovita Carranza announced today.

Is standing by to provide you with all the help you need to get the financing your small business needs.

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Paycheck Protection Program Funds Exhausted Before Deadline Here S What You Can Do Silive Com

Emergency Funding For Small Business How To Qualify Funding Circle

Sba Paycheck Protection Ppp Loans For Construction How To Apply

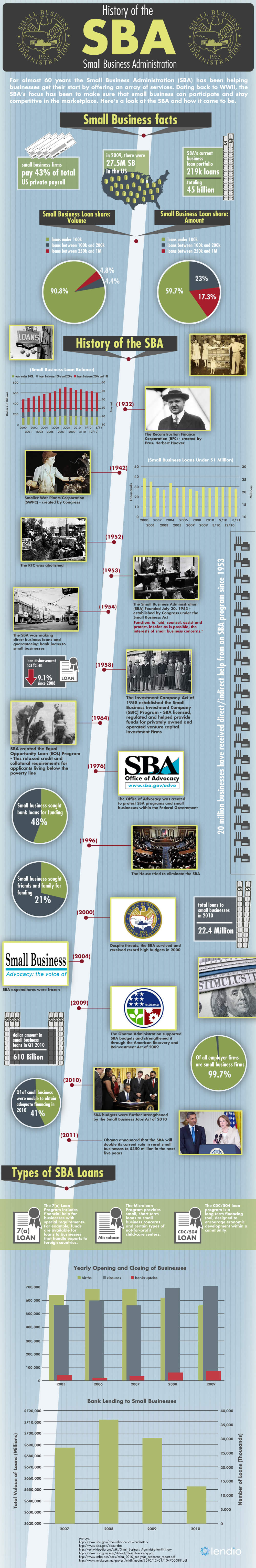

History Of The Small Business Administration Infographic

Sba Paycheck Protection Program Has Run Out Of Money But Outstanding Loan Applications Will Be Processed Newsday

9 Startup Business Loans For Bad Credit 2021 Badcredit Org

Learn About Sba Certified Development Company 504 Loans For Financing Small Businesses And Developing Community Economies Sba Loans Small Business Loans Loan

Sba Paycheck Protection Ppp Loans For Construction How To Apply

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

Sba Loans For Business The Pros Cons Nav

Fill Free Fillable Forms U S Small Business Administration

Sba Loans Types Rates Requirements

Opinion Relaxed Loan Terms From The Small Business Administration Offer A Ray Of Hope For Small Businesses Marketwatch

Beware Of Emerging Scams Cares Act Financial Scams And Fraud Targeting Small Businesses Snell Wilmer Jdsupra

Sba Rolls Out 100m Grant Program To Help Small Businesses Recover From Covid Fallout Masslive Com

Sba Loans What You Need To Know For Your Business Lendio

California Small Business Loans Sba Express Loans

Orange County Small Business Development Center Ocsbdc

Post a Comment for "Small Business Administration Loans California"