Does Venmo Business Charge A Fee

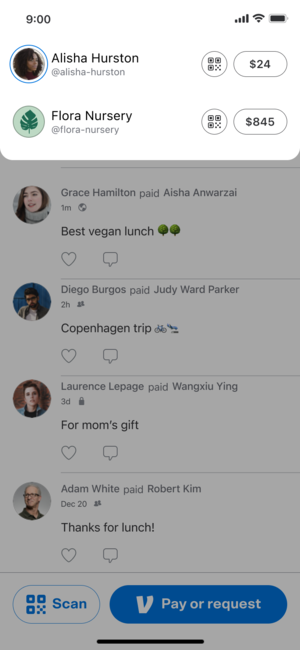

Venmo charges merchants an interchange fee for processing transactions. No fee for setting up a Venmo Business Profile.

Get 750 To Spend On Venmo Mastercard Gift Card Credit Card Fees Venmo

Venmo charges a standard fee of 19 plus 010 USD on every seller transaction and this fee is non-refundable.

Does venmo business charge a fee. Venmo makes their money from the fees they charge. When withdrawing from an ATM users must pay a 250 withdrawal fee or incur a 300 fee when making withdrawals at bank tellers. Everything comes with a price doesnt it.

The fees help allow Venmo to continue to provide this service and develop the service further. Receive money in your business profile from Venmo users. Venmo also makes money off peer-to-peer payments made with a credit card which costs users an extra 3.

Some credit card providers charge cash advance fees possibly including an additional dollar amount or percent rate in addition to other possible cash advance service fees including a higher APR if you use your credit card to make payments to friends on Venmo. People do this to save a little cash. Oftentimes new business owners only accept payments via Venmo Cash App PayPalme or checks in the mail.

All of these are ways to avoid the 28 - 3 processing fee. Between the instant payment aspect and the help with building a social presence Venmo offers many features for businesses. If youre asking Is it okay to use Venmo for business the answer is no.

Sending money over Venmo triggers a standard 3 fee but the company waives that expense when the transaction is funded with a Venmo balance a bank account or a. The following Venmo business fees and processing rates are all fully disclosed on the companys website. Venmo does charge a fee if you use a credit card to send money The most common fee you are likely to encounter with Venmo is when you make a purchase or send money to another person.

Venmo is an increasingly popular peer-to-peer mobile payment app owned by PayPal that allows users to easily transfer money through their phones. The seller transaction fee is a standard rate of 19010 of the payment. Youll pay the same rate to process transactions via Venmo as you do for PayPal transactions which is about 29 and 30 cents from each transaction.

Fees vary by country and deposit or withdrawal type charging users anywhere from 499 to 3049 for a single transaction. No monthly account fee. While most often associated with personal use its starting to gain popularity for business transactions.

19 010 per transaction for purchases made using the Venmo app and a QR code. Interchange and withdrawal fees. Although the app is being used by millions of people and more recently organizations its likely that few of those users are considering.

When a business sets up Venmo payments through PayPal standard. Adding money using cash a check feature faster check deposits payroll and government checks 100 minimum 5 fee Theres a 100 fee with a minimum fee of 500 when you choose to deposit payroll or government checks with pre-printed signature in. For merchants each purchase costs 29 030 for online transactions and 19 010 for in-person QR scans.

Venmos initial person-to-person sending limit is 29999. Theres a fee when you receive a payment sent to your business profile. There is no fee to the user for sending money from a Venmo balance bank account or debit card In 2016 Venmo began allowing some businesses to accept Venmo for payment.

Venmo gives back 3 on groceries 2 on bills and utilities and 1 on other products or services you pay for using the credit card³. That means that if the business profile is sent a 100 payment 2 of the payment would be charged as a seller transaction fee and the owner of the profile would receive 98. Venmo does charge a fee if you use a credit card to send money The most common fee you are likely to encounter with Venmo is when you make a.

Using the app to collect payments from others is free Venmo makes money by charging a 3 fee if users want to send money to another person using a credit card. Once a user is verified that increases to a weekly rolling limit of 499999. How much does it cost to take Venmo payments.

Venmo fees for businesses are pretty transparent. Venmo is owned by PayPal so it shouldnt be a surprise that Venmo can be used by customers to make payments through this platform. Venmo launched its check cashing service in January 2021.

Venmo is not able to refund this fee. As with all payment.

Poshmark Has New Forms Of Payment Virtual Card Payment Things To Sell

Help Grow Your Small Business With Venmo Business Profiles Are Officially Available For All Sellers The Venmo Blog

Does Venmo Charge A Fee Mobile Banking Banking Trends Banking

Difference Between Venmo Paradigm Shift Mobile Payments

Venmo For Business Is It Costing Your Small Business Money Business Money Small Business Accounting Small Business Tips

Venmo For Business Review Is It Good

/how-safe-venmo-and-why-it-free_FINAL-5c7d732a46e0fb00018bd86c.png)

What Is Venmo Are There Any Fees And Is It Safe

Venmo S Website Sending Money Using Venmo Comes With A Standard 3 Fee But The Company Waives That Fee When You Fund Instant Money Money Transfer Send Money

Venmo Debit Card Cool Material Debit Card Design Credit Card Design Credit Card Sleeve

Venmo 1099 Taxes For Freelancers And Small Business Owners

Can I Use Venmo And Cash App To Accept Payments In My Business Virtual Assistant Services Venmo Virtual Assistant Business

Venmo Helps Micro Businesses Accept Payments For Free For Now Finovate

Pin On Korean Tech Trends Tech Guide

Stop Using Venmo To Avoid Fees When Accepting Money In Your Business Business Pages Entrepreneur Resources Business

How Does Venmo Make Money Fourweekmba

Venmo For Business Is It Costing Your Small Business Money Business Money Small Business Tips Small Business

/Venmo-ItsBusinessModelandCompetition2-7a04c392fba04909b3d5dd560a9782e3.png)

Venmo Its Business Model And Competition

Post a Comment for "Does Venmo Business Charge A Fee"