Business Tax Deadline 2021 Extension

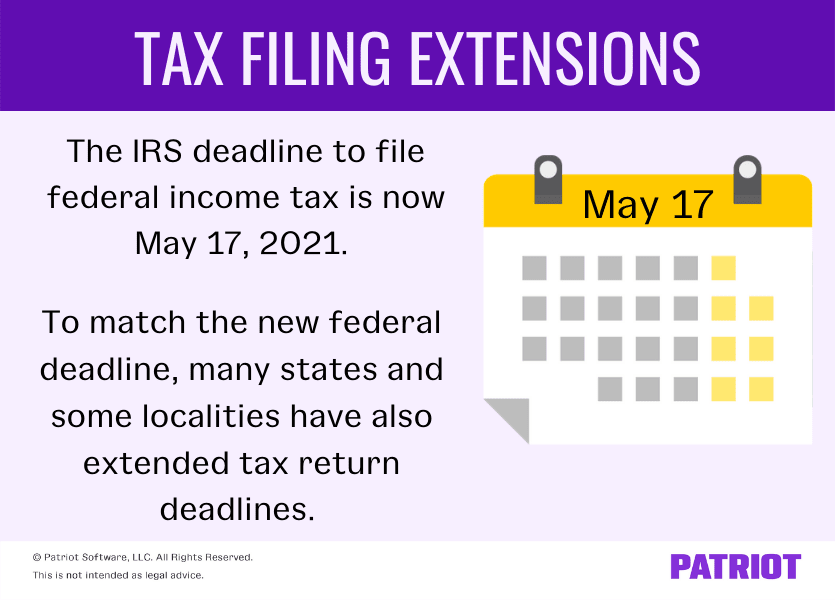

On March 17 2021 the IRS extended the April 15 2021 filing deadline for 2020 Personal Income tax returns to May 17 2021. What Is Extended for 2021 On March 17 2021 the IRS officially extended the federal income tax filing deadline from April 15 to May 17.

Tax Extension Deadline Is Today What To Know About Filing Late Irs Penalties Cnet

If a due date falls on a weekend or holiday the due date is the next business dayFor example.

Business tax deadline 2021 extension. Information about Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns including recent updates related forms and instructions on how to file. The New York City Department of Finance DOF recognizes that individual Unincorporated Business Tax taxpayers and their return preparers may need to take advantage of this extended due date. Return and Payment Due Dates.

The IRS pushed back the tax filing deadline by a month to May 17 instead of April 15 as the agency grapples with staffing issues and outdated systems at. The IRS announced an extension to May 17 2021 of the deadline for filing individual income tax returns including those who pay self-employment taxes. The applicable extension form must be submitted by June 15 2021.

If the business is a C corporation then the extension is due by the 15th day of the 4th month after the end of your tax year. The same rule holds true for partnerships. If your business uses a calendar year-end of December 31 2021 your return or your extension is due to the IRS on or before March 15 2021.

In all cases file IRS Form 1120. Tax Extension Due dates for Business Tax Returns in 2021 S-corporation tax extension due date is 17th September 2021 no change in the due date Corporation tax extension due date is 15th October 2021 allowed automatic extension. This form must be postmarked on or before May 17 2021 for the 2020 tax year only.

Different types of business entities file tax returns in different ways. We cant process extension requests filed electronically after May 17 2021. For example if your C corporation is a calendar year taxpayer with a December 31 year end you must file a 2020 tax return or extension request by April 15.

Individual Income Tax Return. The deadline for individual and business returns filing on extension has not changed and remains October 15 2021. That means taxpayers who owe money dont need to file a tax return until this date and if they owe money they dont need to make payments until then.

For sole proprietors in non-2020 years thats April 15. File the 2020 income or 2021 franchise tax return beyond the June 15 2021 date an extension request may be submitted on the applicable extension form based on the tax type. Deadlines for business returns employer withholding and first quarter payments of estimated tax did not change.

The postponement does not apply to C-Corps trusts and estates. To request an extension to file your federal taxes after May 17 2021 print and mail Form 4868 Application for Automatic Extension of Time To File US. This extension does not affect estimated quarterly taxes which are still due April 15 2021 for non-employee income.

The April 2021 sales tax return which is normally due on May 23rd is due May 24th 2021 since the 23rd falls on Sunday. The tax extension deadline is the original return due date. April 15 2021 if your corporation operates on a calendar year October 15 2021 if you decide to use the extended deadline If your corporation operates on a fiscal year your tax deadline is the 15th day of the fourth month following the end of your fiscal year.

So if your return due date was March 15 2021 an extension will give you until September 15 2021. The Texas Comptroller did match the IRSs extension in 2020 for federal tax returns due to the COVID-19 pandemic so guidance is expected to be forthcoming. Tax Deadline Extension.

The filing due date for 2020 individual returns has been extended to May 17 2021. IRS tax help is. Individuals outside the United States file Form 1040 for 2021.

For more information about deadlines to file a 2020 federal income tax return see IR-2021-122 IRS reminds taxpayers living and working abroad of June 15 deadline or visit the official IRS. If your business is set up as a partnership your tax return will be due on the 15th day of the third month after the end of your tax year. Form 7004 is used to request an automatic extension to file the certain returns.

If your business is not covered by the IRS tax filing extension related to the February 2021 winter storm you can still get a six-month extension of time to file your return. Businesses taxed as partnerships S.

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

2021 Annual Tax Calendar And The Last Day To File

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Tax Extension Deadline Is Today What To Know About Filing Late Irs Penalties Cnet

Tax Day 2021 Tax Filing Deadline H R Block

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Irs And Many States Announce Tax Filing Extension For 2020 Returns

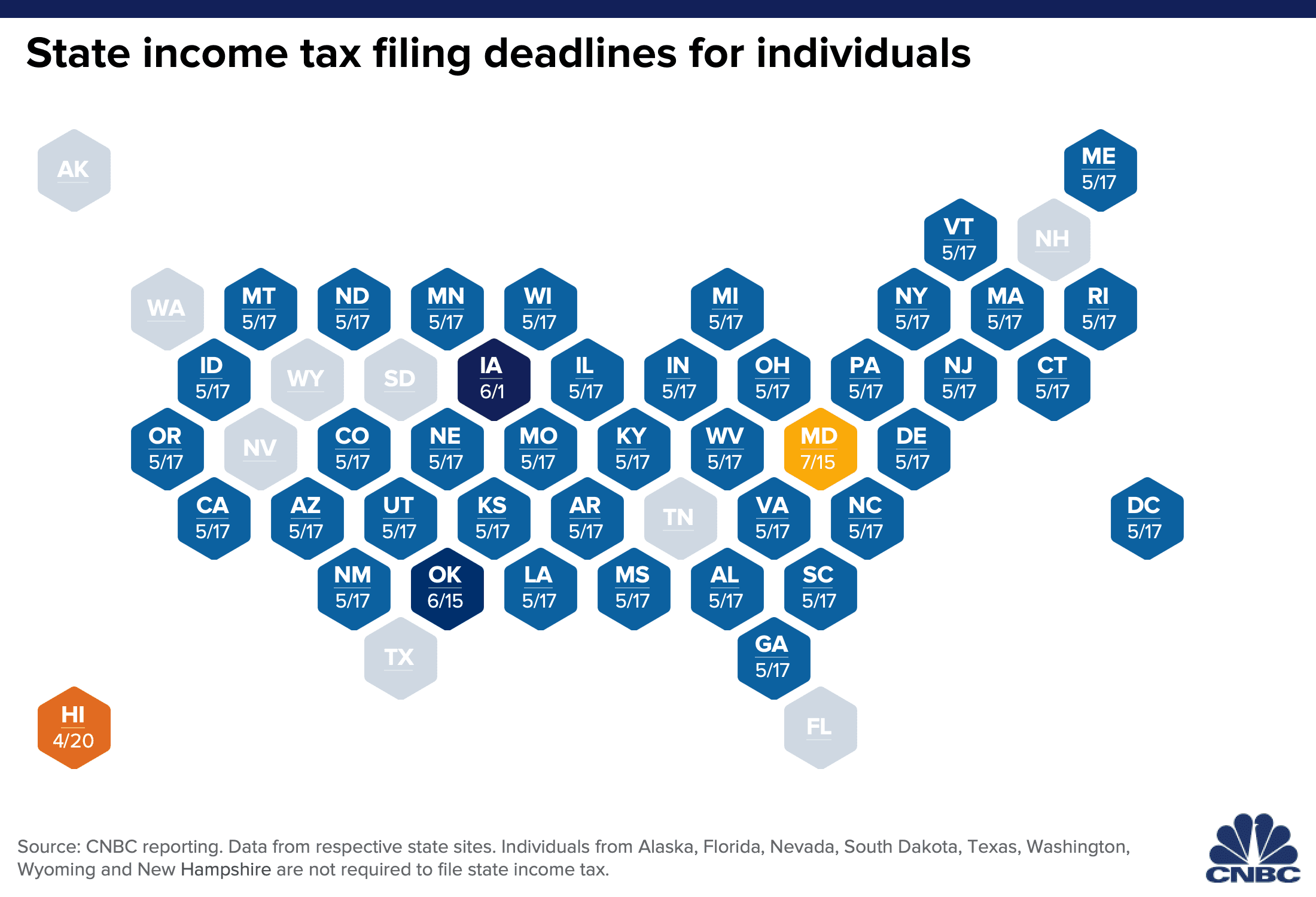

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

2020 Tax Deadline Extension What You Need To Know Taxact

How To File An Extension For Taxes Form 4868 H R Block

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Tax Day 2021 Tax Filing Deadline H R Block

Have You Filed Your 2020 Taxes Yet Deadline Is May 17

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Tax Deadline Monday 4 Reasons Why You Should File Your Income Tax Return Now Cnet

The 2021 Tax Filing Deadline Is Extended For Texas Oklahoma And Louisiana Residents Taxact Blog

Irs Extends Tax Deadlines For Texas Residents And Businesses Mc Gazette

Irs Makes It Official Tax Deadline Delayed To May 17 2021 Cpa Practice Advisor

Post a Comment for "Business Tax Deadline 2021 Extension"