Cibc Business Wire Transfer Fees

Inside there is information about business banking accounts and fees. 005 of the cheque amount plus transaction fee if applicable.

International Wire Transfer On The Phone Or Online Redflagdeals Com Forums

Service charge when you use a cheque thats not MICR encoded for your US.

Cibc business wire transfer fees. Outgoing international fee. 10 or less depending on how you make your transfer for example in a branch or over the phone. Free To receive money.

Business Banking Product Fees pdf 154 MB Corporate Banking Product Fees pdf 153 MB Credit Card Fees pdf 114 MB Personal Banking Product Fees pdf 165 MB Night Wallet O-t-C Large Cash Deposit Fee Changes pdf 7295 KB. When sending a wire transfer with CIBC the cost of wiring money increases as the amount being sent increases. Send money with no transfer fee1 to over 120 countries.

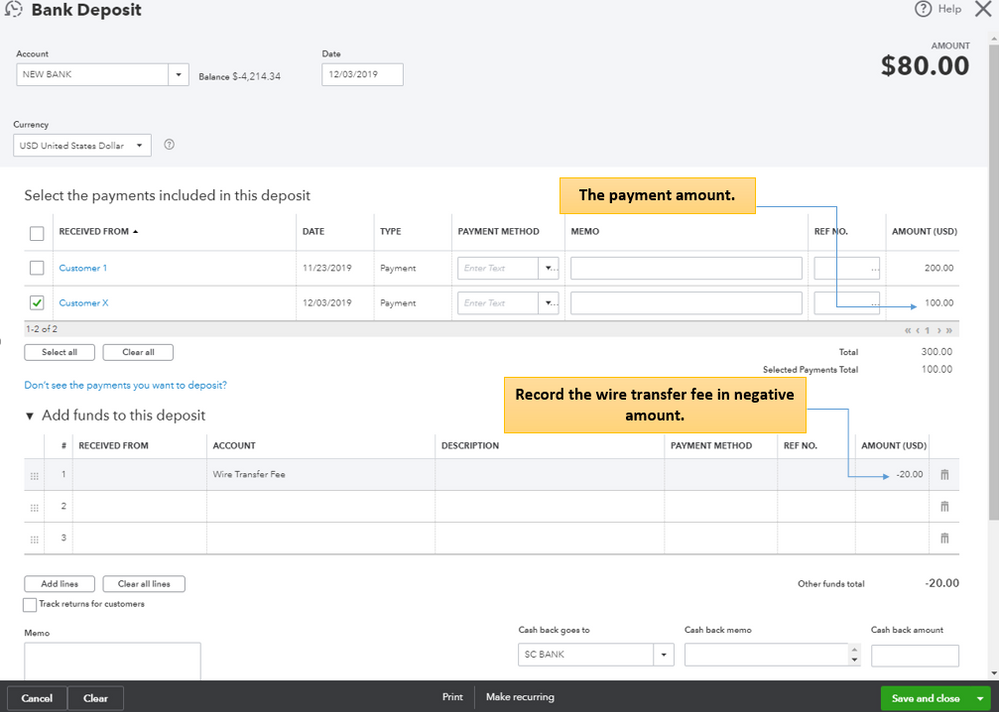

The first thing youll notice is they state. But if youre sending an amount greater than 50000 there is an 80 service fee. Transfer as little as 100 and up to 30000 at a time.

A Global Money Transfer and a Foreign Exchange transaction counts towards your allowable transaction limit bank account transaction fees may apply. CIBC Wire Payments service offers your business a fast dependable way of managing payments in any major currency to beneficiaries around the globe. Learn more about CIBC SmartBanking for Business.

For example when sending between 10000 and 50000 there is a 50 service fee. Its easy and secure and the money will arrive in as little as one business day1. 15 of 1 of the item amount minimum of 3000 each and maximum of 15000 each 15 of 1 of the item amount minimum of 3000 each and maximum of 15000 each Note.

CIBC Global Money Transfers GMT. 25 to 35 for requesting tracing services for a previous wire transfer. Other financial institutions may levy additional charges on outgoing items.

However if you look at their terms and conditions you will note two important things. Pay no monthly fee when you have a minimum daily balance of 350005. Send a Wire Transfer.

Any amount greater than 50000 80 service fee. As companies expand their supply chains globally international transmission of guaranteed funds is an increasingly important factor in maintaining good business relationships. To send or receive a wire transfer at your RBC Royal Bank account you will need the information outlined below.

500 plus transaction fee if applicable. Use CIBC Online or Mobile Banking to send money at competitive exchange rates. Between 1000001 and 50000 50 service fee.

Additional out-of-pocket expenses may apply. Interac e-Transfer fees. Full commissions and fees apply for each partial fill except when transacted within the same business day.

Orders placed with your CIBC Advisor or by telephone with an Investment Representative. A minimum commission of 59 applies to Canadian and US. Receive a Wire Transfer.

Global Money Transfer is advertised by CIBC as having a 0 transfer fee. Service charge when you dont use a cheque thats been MICR encoded for your Canadian dollar account. RBC Royal Bank RoutingABA number if funds coming from US.

Table of Contents How to Open a CIBC Business Account 1 CIBC Business Operating Accounts 2. Any amount 10000 or less 30 service fee. A CIBC advisor can give you advice on which financial solutions make sense for your business.

We hope you find this guide helpful. Most transfers will be received by the recipient within one business. No fee no fuss.

RBC Royal Bank institution number. Access easy-to-use payment capabilities that will keep you cash-flow positive and ready to move money to employees suppliers or across the world. 150 Per transaction to send money 1.

350 To stop a transaction. The cost for wiring money transfers with CIBC Bank is reliant on the amount you are sending. If you need assistance contact your system administrator or call the CIBC Business Contact Centre at 1 800 500-6316 Monday to Friday 700 am to 800 pm Eastern Time.

Please contact a CIBC advisor if you have any questions. Connect your CIBC business account to SmartBanking at no additional cost 1. A superior value account with 100 transactions including Interac e-Transfer transactions and a monthly fee waiver.

The cost of wiring money increases as the amount being sent increases. No upfront transfer fees. 30 to 80 for sending money to a non-Canadian bank account.

Not all banks charge this fee. You will need to provide the sending bank with. Some of the features of CIBCs Global Money Transfer service include.

CIBC Advanced Business Operating AccountTM. 2 rows CIBC Global Money Transfer total costs and limits table. Some CIBC accounts include unlimited Interac e-Transfer transactions 1.

Https Www Morganstanley Com Spc Amazon Docs Howtowireproceeds En 20v2 Pdf

Wire Bank Transfer All Products Are Discounted Cheaper Than Retail Price Free Delivery Returns Off 71

Wire Transfer Vs Online Transfer Key Differentiators Remitr Blog

Wire Bank Transfer All Products Are Discounted Cheaper Than Retail Price Free Delivery Returns Off 71

Shopify On Twitter Bank Statement Money Affirmations Key To Happiness

Wire Bank Transfer All Products Are Discounted Cheaper Than Retail Price Free Delivery Returns Off 71

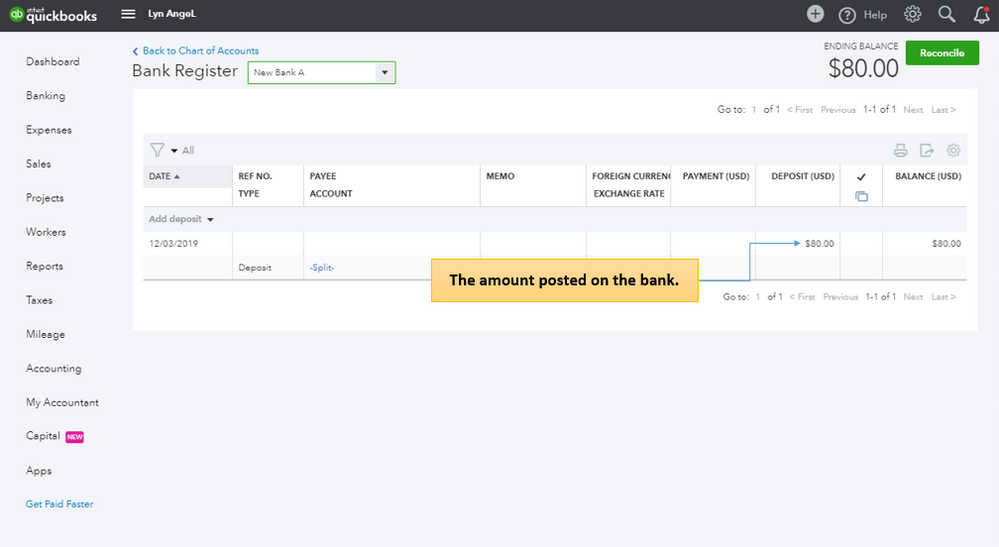

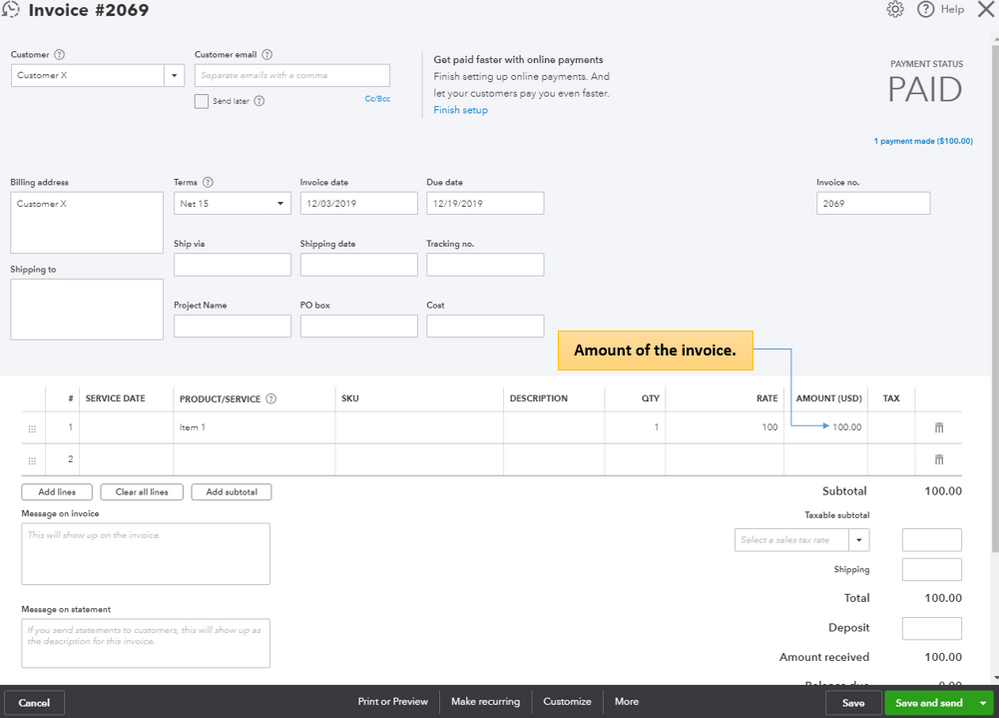

How To Send Cad To Transferwise In Canada Without Using A Wire Liveca Llp

How To Avoid Common Bank Fees And Charges Bank Fees Banking Mobile Banking

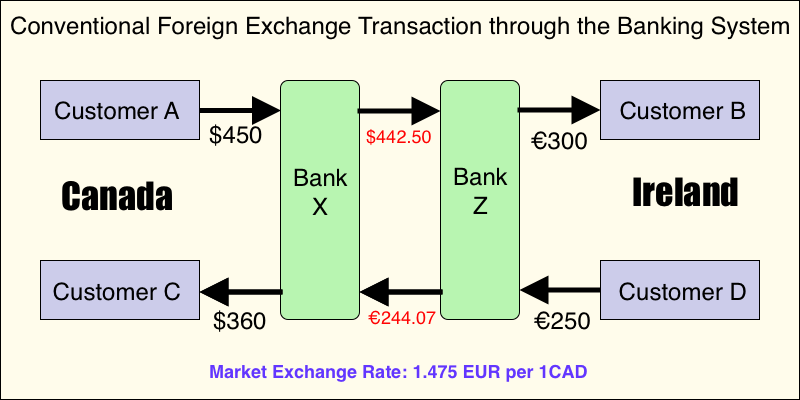

How To Make International Funds Transfers Cheaper

How To Transfer Money From Citibank To Another Account Citibank Youtube

How To Transfer Money Between Canadian Accounts On Easyweb

Cibc Foreign Currency Exchange International Wire Transfer Atm Fees Explained

Wire Bank Transfer All Products Are Discounted Cheaper Than Retail Price Free Delivery Returns Off 71

Wire Bank Transfer All Products Are Discounted Cheaper Than Retail Price Free Delivery Returns Off 71

Post a Comment for "Cibc Business Wire Transfer Fees"