Business Use Of Home Excess Real Estate Taxes

The petition must be filed before the second anniversary of the date of the sale of the property. State law requires that penalty and interest be charged on taxes paid after January 31.

Schedule E Business Use Percentage Calculation Schedulee

A A person including a taxing unit and the Title IV-D agency may file a petition in the court that ordered the seizure or sale setting forth a claim to the excess proceeds.

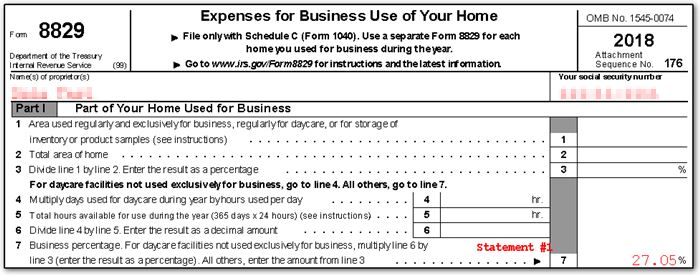

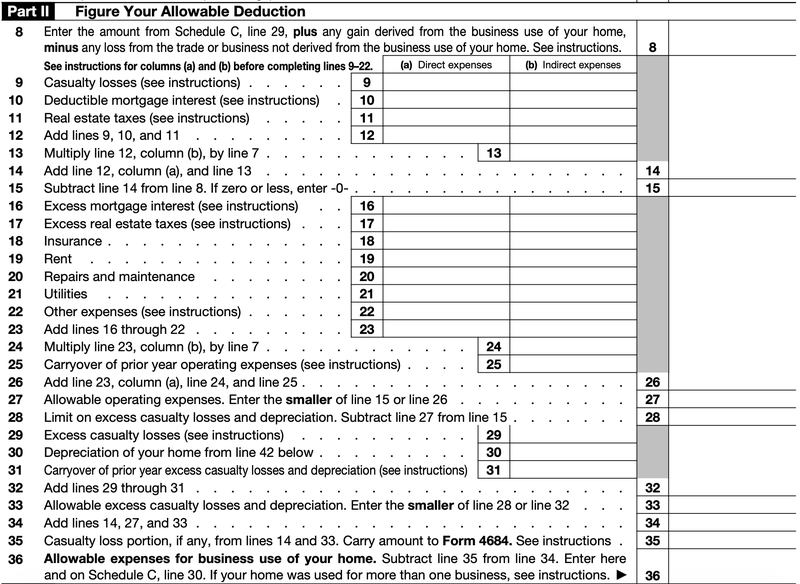

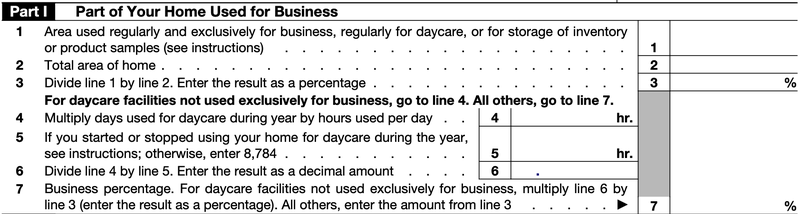

Business use of home excess real estate taxes. Revenue Procedure 2013-13 PDF allows qualifying taxpayers to use a prescribed rate of 5 per square foot of the portion of the home used for business up to a maximum of 300 square feet to compute the business use of home deduction. If the taxpayer is claiming the standard deduction all real estate taxes on Form 8829 must be allocated as excess real estate taxes. Your business percentage is 10.

Therefore it would appear at first that with the new rules in place these taxes. Line 11a is zero and line 17a is 1200. Texas Tax Code 3404 Claims for Excess Proceeds.

The difference here is that the business personal property can only be taxed IF it is tangible AND used to generate income while real property is taxed either way. Furthermore the real estate market was booming and conservative growth models showed that the business could be worth in excess of 100 million in 10 years creating another 10 million of estate taxes. If the combined state and local income taxes real estate taxes and personal property taxes do not exceed the Schedule A limit then real estate taxes are reported for business use of home the same as they were in prior years.

Names of proprietors Your social security number. Go to wwwirsgovForm8829 for instructions and the latest information. This program is designed to help you access property tax information and pay your property taxes online.

Expenses for Business Use of Your Home File only with Schedule C Form 1040. Your office is 10 1 10 of the total area of your home. Looking at form 8829 expenses for business use of your home.

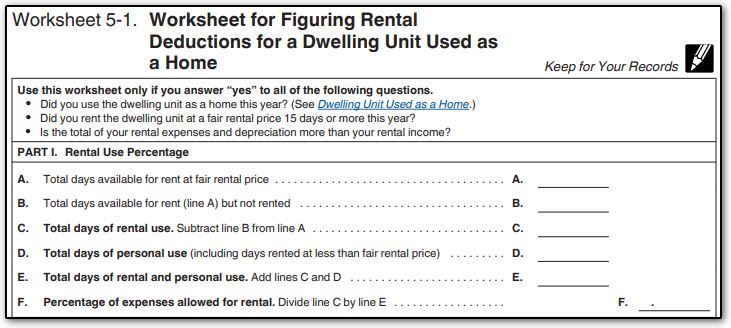

Individuals who own vacant land generally do not receive any income from the land and also are not entitled to any business deductions related to it. Use lines 17 of Form 8829 or lines 13 on the Worksheet To Figure the Deduction for Business Use of Your Homenear the end of this publication to figure your business percentage. The property sold in August of 2008 for 18000000 then the property owner meets the one-third test.

If the appraised value of the property as reflected on the tax roll is 25000000 yet the property owner has evidence indicating the correct appraised value should be 18000000 eg. On screen 29 I removed the real estate tax from indirect column and entered the 1200 on the excess real estate taxes line under Direct Expenses. Use a separate Form 8829 for each home you used for business during the year.

The excess property taxes referenced on Form 8829 would be property taxes in excess. Leave the business to his children at his death. Do we need to make a manual entry of the personal portion of.

As a result of the Tax Cuts and Jobs Act of 2017 there is now a 10000 limit on the amount of state and local income taxes real estate taxes and general sales taxes that can be taken as itemized deductions. The Grayson County Sheriffs Office conducts a public auction of the properties that have gone through the legal procedure to be seized. Tax delinquent properties are sold in a Tax Foreclosure sale each month in each Texas county.

Here is an example of how to apply the one-third test. And of course these real property taxes are deductible under IRC 164a2 which gives a deduction for state and local property taxes While it is true that 212 expenses are miscellaneous itemized deductions the tax in this case is not being deducted under 212. Business personal property is taxed at the same rate as real property.

If the property is sold for more than the amount of taxes owed the various taxing agency the excess amount remains in the county unless the previous owner petitions for their money. This percentage will be used throughout the rest of the form to figure out your allowable deduction so take the time to get it right. Taxes are due and payable on October 1 and are delinquent if not paid on or before January 31.

Under this safe harbor method depreciation is treated as zero and the taxpayer claims the deduction directly on Schedule C Form 1040 or 1040-SR. Many times the previous homeowner business estate or financial. The real estate taxes paid on vacant land before the passing of the Tax Cuts and Jobs Act were an itemized deduction on Schedule A.

Real property may be seized and sold at Sheriff sales for delinquent taxes. About Form 8829 Expenses for Business Use of Your Home Use Form 8829 to figure the allowable expenses for business use of your home on Schedule C Form 1040 and any carryover to next year of amounts not deductible this year. At the time of foreclosure you owed somewhere in the neighborhood of 18000 of taxes and late fees to the countyA few months later the county brings this property to their annual tax sale where they sell your property along with dozens of other delinquent properties to the highest bidder all in an effort to recoup their lost tax revenue on each parcel of real estate.

What are excess property taxes. One example is vacant land held for investment. Convenience Fees are charged and collected by JPMorgan and are non-refundable.

The auctions start with a minimum bid that includes judgment year. For example if your home office is 400 square feet and the total size of your home including the home office is 2000 square feet the percentage of your home used in business is 20. Texas Property Tax Code does not allow for tax lien certificates.

The 1200 goes to the 8829 perfectly but the 8200 remainder does not flow to schedule A. Business personal property can actually be used to bring your taxes down even though they are taxable.

11781 Form 8829 Office In Home

How To Complete And File Irs Form 8829 The Blueprint

Depreciation Recapture On Rental Property And Calculator Avoid The Painful Irs With A 1031 Exchange Inside The 1031 Exchange

What Is Irs Form 8829 Expenses For Business Use Of Your Home Turbotax Tax Tips Videos

Flipping Houses Blog Posts Biggerpockets Flipping Houses Real Estate Marketing Real Estate Business

U S Tax Form 8829 Expenses For Business Use Of Your Home Freshbooks Blog

The 2020 Ultimate Guide To Irs Schedule E For Real Estate Investors

U S Tax Form 8829 Expenses For Business Use Of Your Home Freshbooks Blog

Understanding The Schedule E For Rental Properties

Getting Ready To Sell Your Home Here Are Some Tips To Help Things To Sell Life Changes Real Estate Companies

Increase In Rent Notice Ez Landlord Forms Being A Landlord Rent Rental Property Management

11 Simple Commercial Lease Agreement Template For Landowner And Tenants Lease Agreement Real Estate Lease Lease

How To Complete And File Irs Form 8829 The Blueprint

Infographic For New Landlords Real Estate Investing Rental Property Rental Property Investment Rental Property Management

The Truth About The Home Office Deduction In 2021 Mark J Kohler

How To Wholesale Real Estate Free Training Youtube Wholesale Real Estate Free Training Home Based Business

Tax Benefits Of Owning Rental Properties Being A Landlord Rental Property Income Property

U S Tax Form 8829 Expenses For Business Use Of Your Home Freshbooks Blog

7 Ways On How To Finance First Real Estate Investment Real Estate Investing Buying Investment Property Real Estate

Post a Comment for "Business Use Of Home Excess Real Estate Taxes"