Ohio Business Gateway Sales And Use Tax

Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as. Register for a vendors license.

Https Www Mecseminars Com Sites Default Files Presentation Files Tues 20keynote 20 203 20ohio 20sales 20and 20use 20tax 20updated Pdf

Unauthorized access use misuse or modification of this computer system or of the data contained herein or in transit to and from this system is strictly prohibited may be in violation of state and federal law and may be subject to administrative action civil and.

Ohio business gateway sales and use tax. March 31 2020. Based on your feedback last summer this was the most requested feature to be implemented in future upgrades to the Gateway. If sales tax is due but not collected by the seller a use tax equal to the amount of sales tax is due from the purchaser.

When calculating the sales tax for this purchase Steve applies the 575 state tax rate for Ohio plus 15 for Montgomery county. Electronic sales tax filing through the Ohio Business Gateway OBG is now much easier. Web Content Viewer Username.

Learn how to get started. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. Commercial Activity Tax Sales and Use Tax Severance Tax and Horseracing Tax Casino IFTA Kilo Watt Hour Kilo Watt SAP Motor Fuel Natural Gas PAT FIT E911 Tire Fee Replacement Cigarette Tax Other Tobacco Products Tax and Master Settlement Agreement compliance areas will be unavailable for.

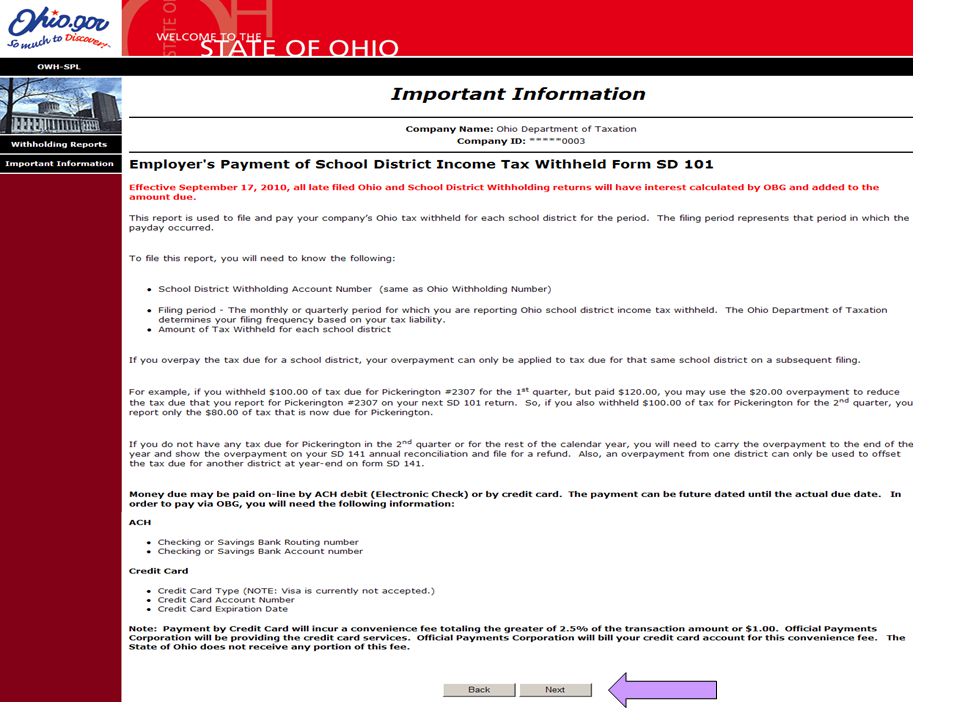

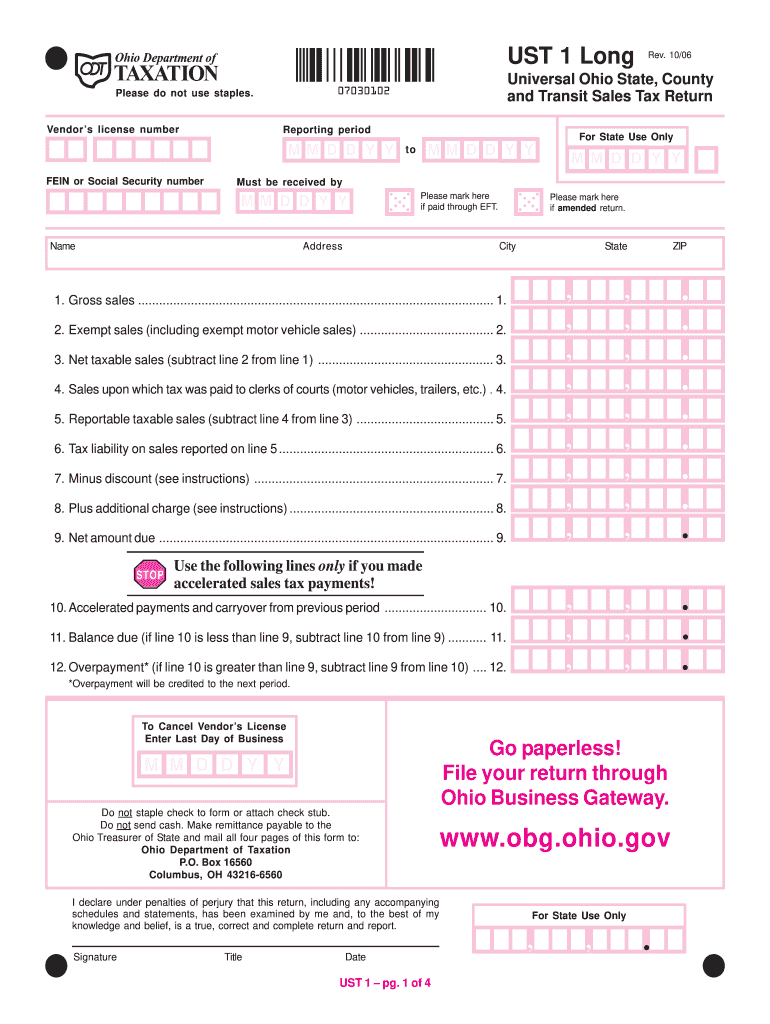

The first option the UST-1 County File Upload allows taxpayers and practitioners to upload a file to the OBG containing multi-county sales and tax liability data for one UST-1 return saving as many as 184 manual entries for businesses with sales in all Ohio. This is also known as payment by electronic check Credit card The Department offers credit card payment options in cooperation with ACI Payments. Learn about upcoming changes to the Gateway.

Once you have entered your filing and payment information into the Gateway system it will. Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as. Ohios one-stop online shop for business tax filing is designed to streamline the relationship between commerce and government.

For instance a consumer in Cuyahoga County pays 8 tax but a consumer in Lorain County pays 65. At a total sales tax rate of 725 the total cost is 37538 2538 sales tax. The Ohio Business Gateway allows all sales and use tax returns to be filed and paid electronically.

Two file upload options allow businesses with sales in multiple counties to file a single universal sales tax return or UST-1. Business taxes Employer Withholding School District Withholding and Sales Use Taxes can now be filed and paid by credit card on the Ohio Business Gateway. For more information about the sales and use tax.

The Ohio Business Gateway allows all sales and use tax returns to be filed and paid electronically. Counties and regional transit authorities may levy additional sales and use taxes. Register for file and pay Commercial Activity Tax.

Ohio has a sales tax rate of 575 but each county and regional tax authorities may levy additional rates. Register for a vendors license File and pay sales tax and use tax. This system contains State of Ohio and United States government information and is restricted to authorized users ONLY.

The Ohio Business Gateway is excited to announce our latest feature. TeleFile is available for vendors who have a regular county vendors license license number which begins with 01 88 and are filing for a single county. Save time and money by filing taxes and other transactions with the State of Ohio online.

There are no restrictions. It provides tools that make it easier for any business owner to file and pay sales tax commercial activity tax employer withholding unemployment compensation contributions workers compensation premiums and municipal income taxes. Sales and use taxpayers have several options for remitting the tax collected from customers.

File and pay sales tax and use tax. Save time and money by filing taxes and other transactions with the State of Ohio online. This system contains State of Ohio and United States government information and is restricted to authorized users ONLY.

TeleFile is available for vendors who have a regular county vendors license license number which begins with 01 88 and are filing for a single county. Commercial Activity Tax Sales and Use Tax Severance Tax and Horseracing Tax Casino IFTA Kilo Watt Hour Kilo Watt SAP Motor Fuel Natural Gas PAT FIT E911 Tire Fee Replacement Cigarette Tax Other Tobacco Products Tax and Master Settlement Agreement compliance areas will be unavailable for 1 hour starting at 530 pm on Saturday March 13 2021 for scheduled maintenance. The state sales and use tax rate is 575 percent.

March 31 2020. In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer. File Unemployment Compensation Tax.

Unauthorized access use misuse or modification of this computer system or of the data contained herein or in transit to and from this system is strictly prohibited may be in violation of state and federal law and may be subject to administrative action civil and. Starting June 30th 2019 you can save edit or delete your ACH or Credit Card information once with your account and it is readily available every time. Tell you the total dollar amount of your payment including the service fee.

ACH Debit is available through the Ohio Business Gateway. Learn about our services and transactions. Password Show and hide.

Ohio What Is My Login And Passcode Taxjar Support

Ohio Department Of Taxation Home Facebook

Start An Llc In Ohio Free Guide Helpful Resources

Ohio Llc Steps To Form An Llc In Ohio

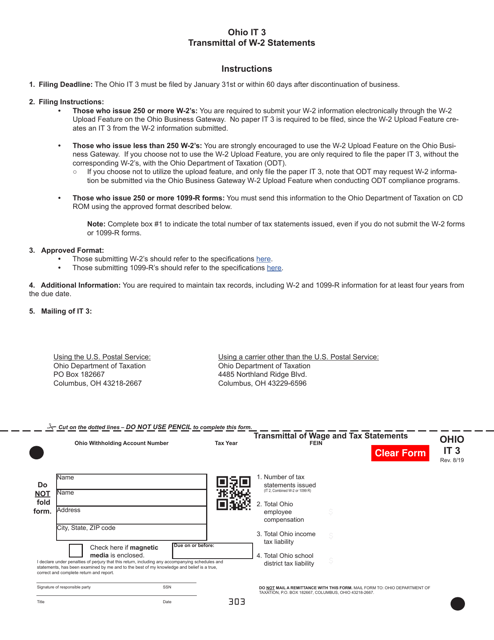

Form It3 Download Fillable Pdf Or Fill Online Transmittal Of Wage And Tax Statements Ohio Templateroller

Oh I Received A Sales Tax Delinquency Penalty For Over 3 000 For A Business That I Closed 18 Months Ago I Don T Understand Why This Happened And Could Really Use Some Help

Ohio Department Of Taxation S Casino Training Ppt Download

Ohio What Is My Login And Passcode Taxjar Support

Ohio Department Of Taxation Posts Facebook

How To File Sales Tax Department Of Taxation

Oh I Received A Sales Tax Delinquency Penalty For Over 3 000 For A Business That I Closed 18 Months Ago I Don T Understand Why This Happened And Could Really Use Some Help

2006 2021 Form Oh Odt Ust 1 Long Fill Online Printable Fillable Blank Pdffiller

Http Www Ohiolions Org Images Docs Procedures Info 20 20sales 20tax Pdf

Https Equineaffaire Com Wp Content Uploads 2020 01 Ohio Sales Permit Pdf

Starting A Business In Ohio Financeviewer

Useful Important Links Sbdc Small Business Development Center Akron Ohio Sbdc Small Business Development Center Akron Ohio

How To File Sales Tax Department Of Taxation

Post a Comment for "Ohio Business Gateway Sales And Use Tax"