Bank Of America Business Advantage Wire Transfer Fee

However its important to note that you can also transfer money with your Bank of America account by using Zelle a money transfer app thats integrated into the BOA online banking system. When sending in foreign currency there is no Bank of America wire transfer fee a.

Bank Of America Vs Wells Fargo Which Is Best For You Gobankingrates

ACH transfer vs.

Bank of america business advantage wire transfer fee. Available with Small Business Remote Deposit Online Call. Incoming domestic wire transfer fees are 15 per transaction. For international wire transfers fees can range from 15 and 25 for.

Outgoing domestic wire transfer fees are 30 per transaction. Exchange rate markup potential third party charges. Although fees may differ based on your type of account receiving a domestic wire transfer costs 15 and sending an international transfer costs 45.

These are outlined in detail below. Incoming domestic wire transfer fees are 15 per transaction. There are no fees for your first.

When you use Online. You should consider factors such as exchange rates currency availability and fees. Tax payments each 300.

Wire transfer orders Domestic 2500 per transfer International 3500 per transfer Positive Pay 6000 per account per month Transmissionbatch fee 1000 Per item fee 005 RemitONE Electronic Tax Payment 300 each Fax or mail confirmation 100 each Quarterly report 2400 per quarter Electronic Services. The BOA domestic wire transfer fee is. Bank of America wire transfer fees.

After you sign in to Online Banking look for the leaf icon or simply go to the Profile Settings and click. 20 rows ACH Transfer Fee. Additional checking savings and CD accounts over 5 each additional account per month 500.

0 for inbound transfers 3 for. You qualify and enroll in the Preferred Rewards for Business program There is a monthly account management fee of 15. While Bank of America has over 16900 fee-free ATMs.

The 12 fee applies to transfers exceeding 1 and theres a limit of one transfer fee per day. 30 for each transaction. Bank of America - transfer sent in GBP.

Wire transfer ACH transfers are cheaper than wire transfers which typically cost about 25 to send and 15 to receive. Outgoing international wire transfer in USD 45 Bank of America Additional Fees Charges Overdraft Fee - 35 per overdraft across all accounts except Advantage SafeBalance. Exchange rate markup.

Bank of America - transfer sent in USD. For domestic wire transfers fees can range between 15 and 20 for the receiver and 25 and 35 for the sender. Apart from the wire transfer fees if the transfer involves currency conversion banks make money on currency conversion as well by giving retail conversion rates to you which is usually 1-2 lower than the market rate.

Insufficient Funds Fee - Unlike overdraft the NSF fee is charged when a payment is returned due to insufficient balance. Wire transfer fees with Bank of America depend on a number of factors such as whether it is incoming outgoing is it a domestic or foreign transfer and what currency the wire needs to be sent in. Exchange rate markup.

USD45 exchange rate markup potential third party charges. Stop Payments each 2300. 18882834075 for pricing Go Paperless.

You can save paper and avoid messy filing by requesting that we stop mailing your paper statement. Contact this number for pricing. Than in the financial center.

Is locked in up front and the recipient will generally receive the funds in one to two business days. Not included Add for 15month or upgrade to Business Advantage Included Incoming wire transfer fee. Typical wire transfer fees at Bank of America are.

With this Bank of America business account youll have access to 500 free transactions every month which is more than 2x as many as the Advantage Fundamentals account. The account number for the recipient that they wish to deposit the funds. Incoming wire transfers will cost you 15 per domestic transfer and 16 per international transfer.

If you end up surpassing this cap each transaction you make in a month will carry a fee of 045. External transfers initiatedsingle item ACH each applies to BOB Advantage services only 300.

Bank Of America Bank Wire Address Seven Things You Should Know Before Embarking On Bank Of A Business Letter Template Letter Example Lettering

Bank Of America Foreign Currency Exchange International Wire Transfer Atm Fees Explained

Bank Of America Checking Accounts Bankrate

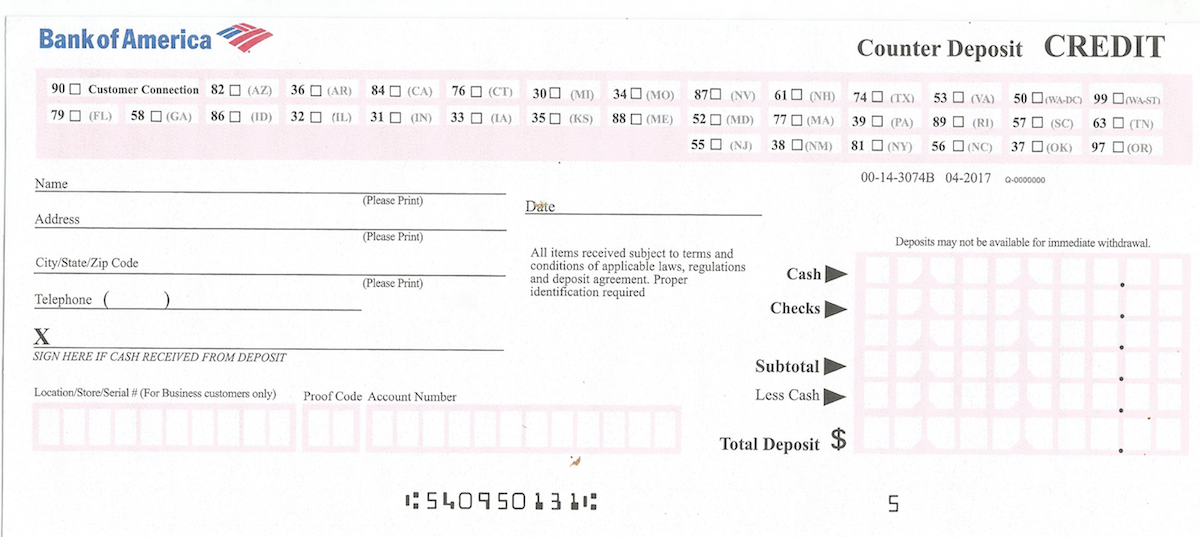

Bank Of America Deposit Slip Free Printable Template Checkdeposit Io

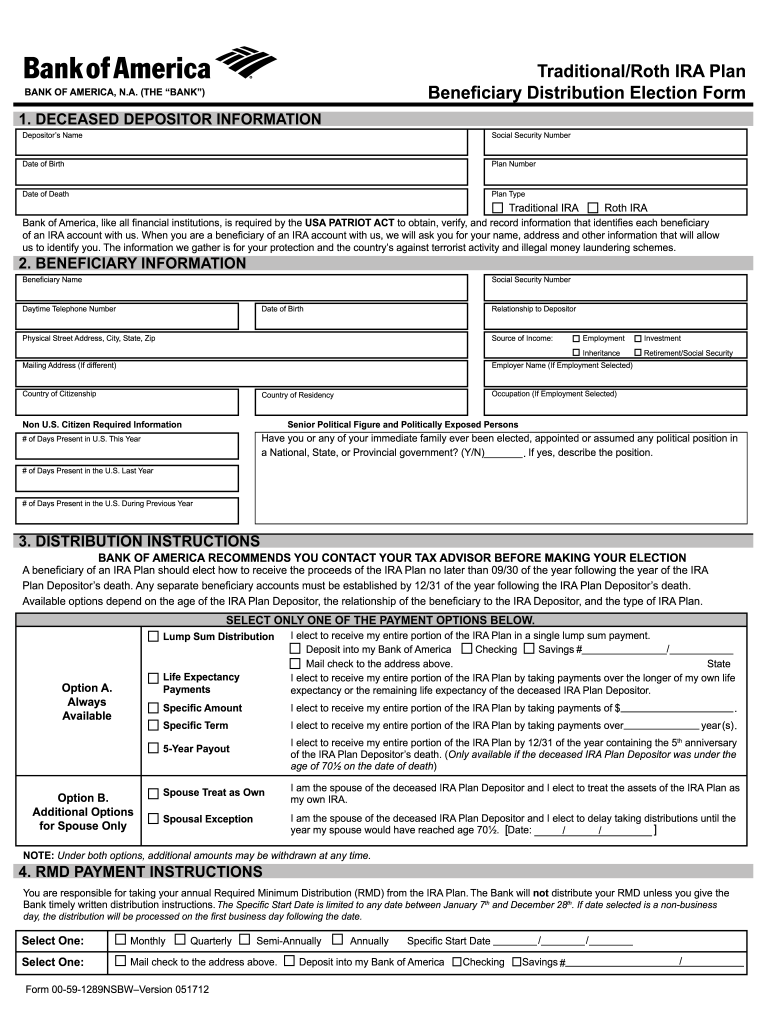

Https Www Bankofamerica Com Content Documents Deposits Service Pdf Docrepo Pch 00 53 5420nsb Pdf

Bank Of America Savings Review June 2021 Finder Com

Bank Of America Advantage Plus Review 2021 Finder Com

Zelle For Your Business From Bank Of America

Wells Fargo Bank Statement Template Free Download Statement Template Bank Statement Bank Account Balance

Bank Of America Business Checking Review Is It Worth It Pros Cons More

Wire Transfer Bank Of America Veem

Bank Of America Cash Rewards Credit Card Review Forbes Advisor

Bank Statement Wells Fargo Template Fake Custom Printable Income Monthly Verification Direct D Statement Template Bank Statement Credit Card Statement

Bank Of America Introduces Business Advantage Relationship Rewards Business Wire

Bank Of America Pod Form Fill Online Printable Fillable Blank Pdffiller

Business Advantage Relationship Banking

If Someone Has To Transfer Money From A Bank Of America Account To A Chase Account How Much Would The Bank Charge For The Transfer Quora

Waive Your Bank Of America Overdraft Fee A Easy Guide

Bank Of America Business Checking Review Is It Worth It Pros Cons More

Post a Comment for "Bank Of America Business Advantage Wire Transfer Fee"