What Is Hawaii Business Tax Id Number

Register a business online in the state of Hawaiʻi. A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding.

Hawaii Tax Id Ein Number Application Business Help Center

430 pm Monday Friday except state holidays to meet the needs of the public over the phone online and in-person.

What is hawaii business tax id number. Business Complaints Search OCP. Or if your corporation changes its taxation status to that of an S Corp it can keep the same ID. 3 rows Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format.

Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation. 18 Do I need to keep records. Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits.

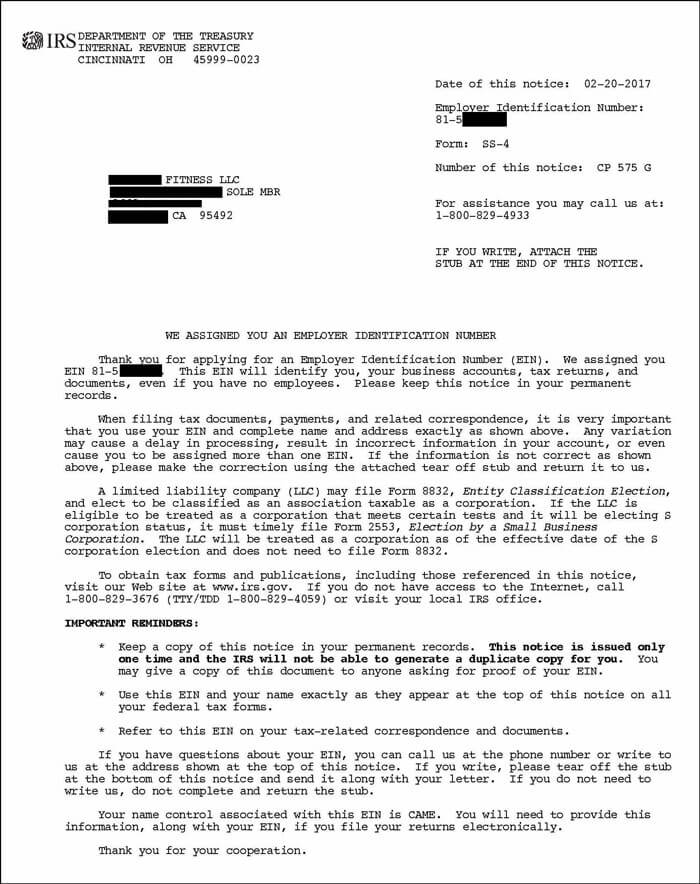

Your Hawaii LLCs EIN may be called different names. Federal Employer ID Number. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on.

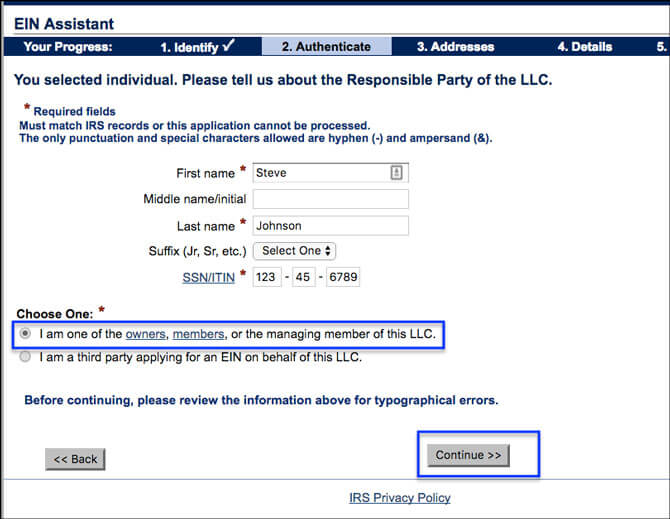

It is common for a bank to require your Hawaii Tax ID social security number or EIN and your organizing document. The Office of Consumer Protection search allows you to check if a business or individual has had complaints filed against them and view the outcome of those complaints. Either a Social Security number or an EIN or employer identification tax id number.

When Starting a Business all businesses including home based businesses internet businesses eBay online web sites professional practices contractors or any other business in Hawaii are required to identify their business with one of two numbers. And if your partnership begins operating a new business the. They all mean the same thing though.

You should not enroll in AutoFile using a Hawaii Tax ID that begin with abbreviations for other tax types such as CO FR GS PS RV TA or WH etc. The IDs were supposed to be mailed to you last year. You do not need another Hawaii Tax ID.

Each bank has its own requirements so its best to ask your banker directly. However not all changes to your business will mean a change in your Hawaii tax ID. Our old system assigned a Hawaii Tax ID starting with the letter W followed by 10 digits.

BusinessOccupationalBusiness Tax Receipt Number This is a Aiea general business tax number also called a Tax ID or home occupation permit that all businesess MUST obtain. Tax accounts that have been upgraded will be distinguished by a new Hawaii Tax ID starting with a two-letter account type identifier and 12 digits. Hawaii does not have a sales tax.

The state of Hawaii began a new process in 2017 that now requires a 12 digit business ID number. See a full list of all available functions on the site. See Hawaii Tax ID Number Changes for more information.

Business Complaints Search RICO. Instead we have the GET which is assessed on all business activities. Business Registration Division staff remain available during normal business hours 745 am.

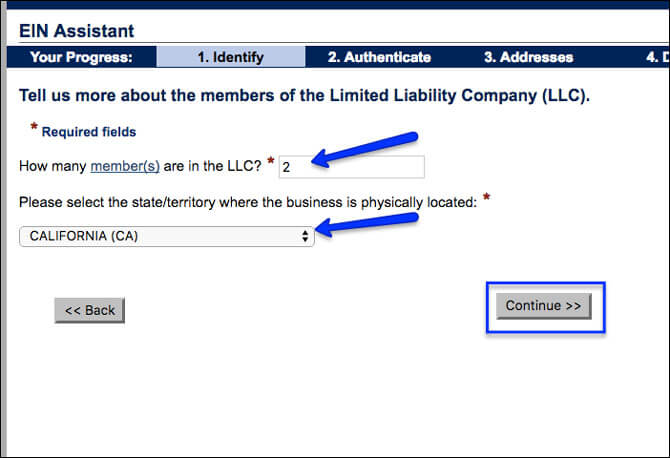

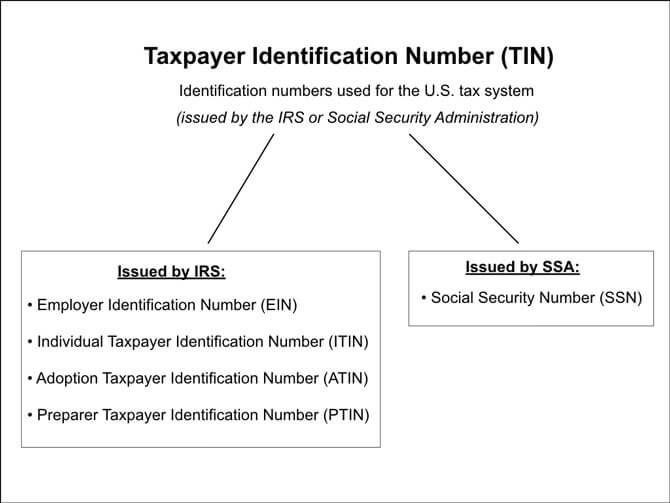

The EIN is just a type of Taxpayer Identification Number TIN that identifies your Hawaii LLC with the IRS. 17 Do I need a Hawaii Tax ID to open a business bank account. Register a business entity trade name trademark or submit other filings with the Department of Commerce Consumer Affairs Business Registration Division Get help with applying for a general excise tax GET license from the Department of Taxation and receive information on how to apply for a federal employer identification number EIN.

Every new business is required to have its own State IDHawaii tax ID number depending on the particular facts of your business. GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type. If your LLC changes its name or the location where it operates your original ID number is still valid.

If you did not get the mailer you can contact taxpayer services in the link below. There are several different ones. 11 rows Display your tax licenses at your place of business as indicated on the.

Then there is a Federal Tax ID Number a Business Tax Registration Number and a Social Security Number. A Hawaii tax id number can be one of two state tax ID numbers. Tax forms can be downloaded and printed from our website at taxhawaiigovformsYou can also file select tax returns online at Hawaii Tax OnlineHawaii Tax Online currently supports General Excise Transient Accommodations Withholding Use Only Sellers Collection Corporate income Franchise Rental Motor Vehicle County Surcharge and Public Service Company taxes.

Similar terms for an EIN include.

Ein Tax Id Number How To Apply For A Federal Ein

How To Start A Business In Washington Starting A Business Employer Identification Number Workers Compensation Insurance

How To Get A Tin Online Getting Tax Identification Number From The Bir How To Get Tax Online

How To Apply For An Ein For Your Llc Online Step By Step Llc University

The Worst States For Taxes Tax Deductions Travel Nursing Pay Tax Return

Tax Debt Help Red Hill Pa 18076 Irs Paymentplan Taxes Www Mmfinancial Org Tax Debt Debt Help Tax Debt Relief

How To Apply For An Ein For Your Llc Online Step By Step Llc University

Register For A Sales Tax Permit In The State Of Virginia Business Solutions Virginia Sales Tax

Ein Tax Id Number How To Apply For A Federal Ein

Tax Clearance Certificates Department Of Taxation

Apply Sales Tax Registration State Tax Tax What S The Number

Licensing Information Department Of Taxation

Tin Ssn Ein And Itin Taxpayer Id Numbers Llc University

Ein Tax Id Number How To Apply For A Federal Ein

How To Apply For An Ein For Your Llc Online Step By Step Llc University

Does A Sole Proprietor Need To Register In Hawaii Sole Proprietorship Sole Proprietor Employer Identification Number

How To Apply For An Ein For Your Llc Online Step By Step Llc University

Post a Comment for "What Is Hawaii Business Tax Id Number"