First Year Business Rate Relief

The Government will make a Business Interruption payment to cover the first 12 months of interest payments and any lender-levied fees. Where an asset is subsequently sold there is a potential clawback of the super deduction to prevent abuse.

Credit Card Tips Creditcardtips Creditcard Small Business Loans Small Business Loans Financing For Businesses Nat Sba Loans Finance Loans Business Loans

Your business might qualify for rate relief if you start up in or relocate it to one of the UK enterprise zones.

First year business rate relief. Small business rate relief can be backdated for a maximum of six years from the date of your application as long as you have met the qualifying criteria throughout. Further temporary measures were announced to support pubs. There is no upper limit on the level of investment qualifying for this relief and it is only available to companies.

This has been increased to 5000 in the Budget to support pubs in response to coronavirus. Major supermarkets and other retailers which had been allowed to stay open as essential businesses said they would repay the rates relief. In some cases you are exempt from paying anything but many business owners are unaware of the.

The chancellor called it a 6bn tax cut for businesses. Small business rate relief. You may be able to claim Gift Hold-Over Relief if you give away your holiday home or sell it for less than its worth to help the buyer.

Business rates are handled differently in Scotland and Northern Ireland. Relief for gifts of business assets. What to pay and when Your local council will send you a business rates bill in February or March each year.

However as already noted by many. If youre a small business owner then you might be eligible for business rates relief through the governments Small Business Rates Relief scheme SBRR. The measure also temporarily amends the rules.

A 50 first year allowance will also be available for qualifying special rate assets including long life assets. The small business multiplier is 491p and the standard multiplier is 504p from 1 April 2019 to 31 March 2020. Rates relief is handled differently in Scotland Wales and Northern Ireland.

This is the case even if you do not get small business rate relief. This form of Tax relief designed for new business startups in mind allows the business owner s to carry back the losses in the first four years to offset against income three years previous Taxable income. 247 Business rates reliefs The government will continue to provide eligible retail hospitality and leisure properties in England with 100 business rates relief from 1 April 2021 to 30 June 2021.

This relief cuts the amount of business rates you have to pay lowering your overheads and freeing up cash for investing in growth. You have to contact your local council to see if youre eligible and apply for. The council will work out how to apply the relief.

If your business has a rateable value less than 15000 and only uses one property you may be able to cut the costs of your bill by applying for small business rate relief via your local council. But it could be as much as 55000 per year for a period of five 5 years. A first year allowance of 50 on most new plant and machinery investments that ordinarily qualify for 6 special rate writing down allowances.

The payments by the government to cover interest in the first year and all other loan fees are government grants under FRS 102 and so the accounting for these will be similar to the CJRS scheme described above. This relief reduces the amount of business rates you have to pay and in some cases can lead to your business being exempt from paying costs entirely. Changes in circumstances Certain changes in circumstances will need to be notified to the Business Rates team by the ratepayer.

This usually entitles them to a discount of 50 per cent on the full rate but at present the Government has doubled the relief rate to 100 per cent for small businesses with properties that have a. This will be followed by 66 business rates relief for the period from 1 July 2021 to 31 March 2022 capped at 2 million per business for properties that were required to be closed on 5 January 2021 or 105000 per business. There was also further support on Business Rates with 100 relief continuing to 30 June 2021 with rates then discounted by two thirds until March 2022.

An enterprise zone might be a good place to grow your business. Entrepreneurs Relief means youll pay tax at 10 on all gains on qualifying assets. The Government had already announced the introduction of a one year business rates discount of 1000 from 1 April 2020 for pubs in England with a rateable value below 100000.

Free 7 Business Application Forms In Pdf

Dealing With Debt Issues Milwaukeebankruptcyattorney Dealing Debt Milwaukeebankruptcyattorney Problems Debt Solutions Debt Problem Bankruptcy

Have You Set A Goal For Your Business This Year But Is Finance Posing A Challenge Prestloans Provides Financial Assistance To Al Business Loans Business Loan

Finally Relief For Small Business Owners Has Arrived In 2020 Business Loans Business Smart Money

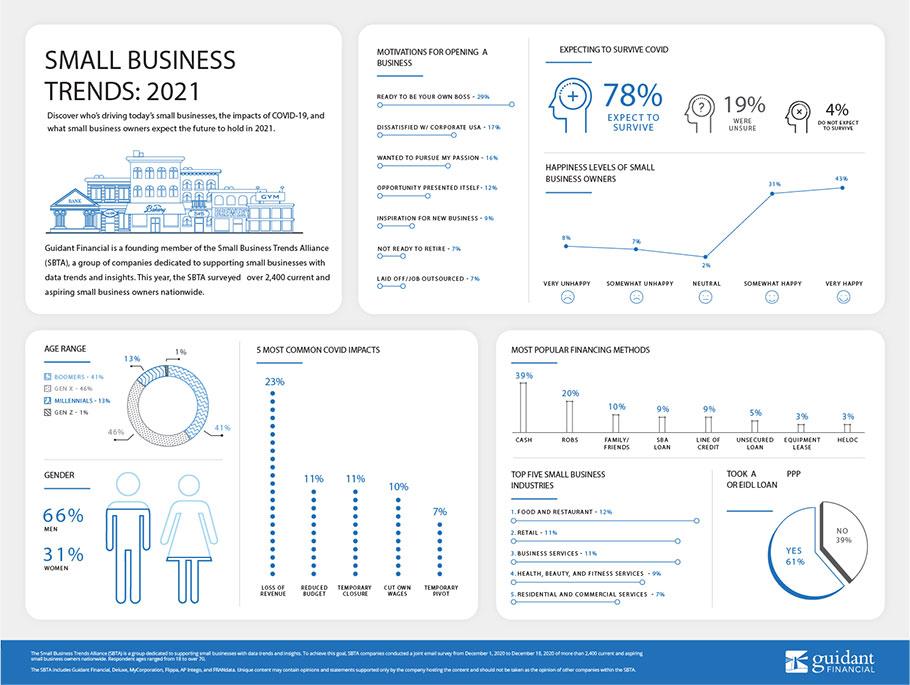

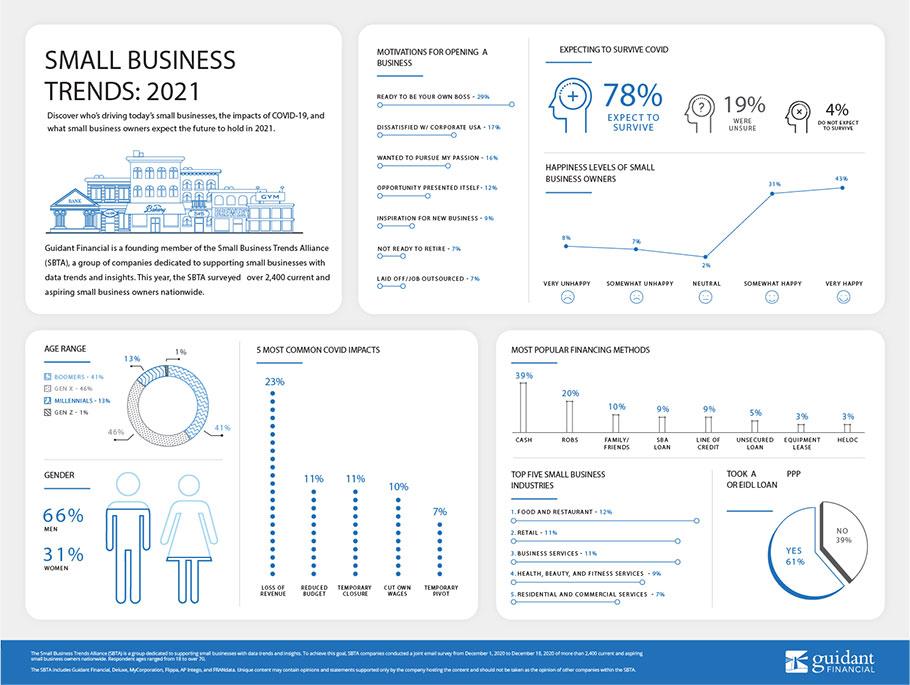

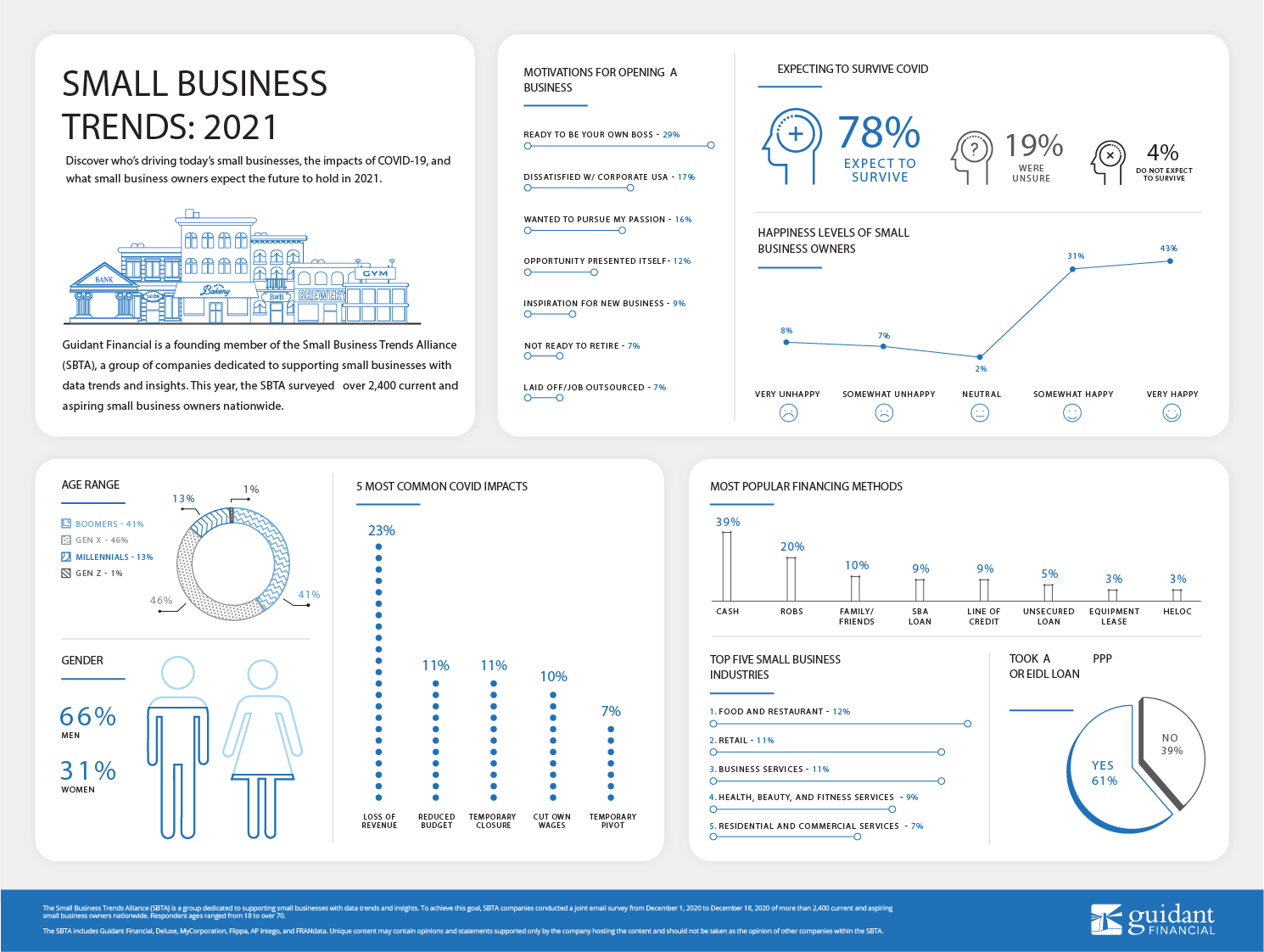

2021 Small Business Trends Statistics Guidant Financial

2021 Small Business Trends Statistics Guidant Financial

Tips For Choosing The Right Debt Consolidation Approach Debt Relief Credit Card Debt Forgiveness Debt Consolidation Loans

Retailers Fiscal Future Laws Regulations Content From Supermarket News The American Taxpayer Relief Act Flow Chart Fiscal Data Visualization Infographic

Discover How To Make Your Website Work For Your Business How To Improve Your Business Website And M Online Business Strategy Blogging Advice Business Website

The Small Business Accounting Checklist Infographic Small Business Finance Small Business Accounting Bookkeeping Business

Can You Afford To Be An S Corp Bookkeeping Business Business Tax How To Get Clients

Ventura County Mortgage Rates Take A Breather From Hike Mortgage Rates 30 Year Mortgage Mortgage Tips

Penalties For Late Filing Of Business Taxes Tax Relief Center Filing Taxes Business Tax Tax

On The Blog I Share The Exact Formula I Used To Pay Off 60k In Debt In 2 Years Debt Payoff Paying Off Credit Cards Debt

Coronavirus Relief Packages Details For Businesses Individuals Health Npr

Mountain West Financial Inc Welcome Financial Home Loans Underwriting

11 Simple Steps To Help You Pay Off Any Kind Of Debt Debt Relief Programs Debt Payoff Pay Off Mortgage Early

Post a Comment for "First Year Business Rate Relief"