Do You Have To Pay Back Sba Disaster Loans For Small Business

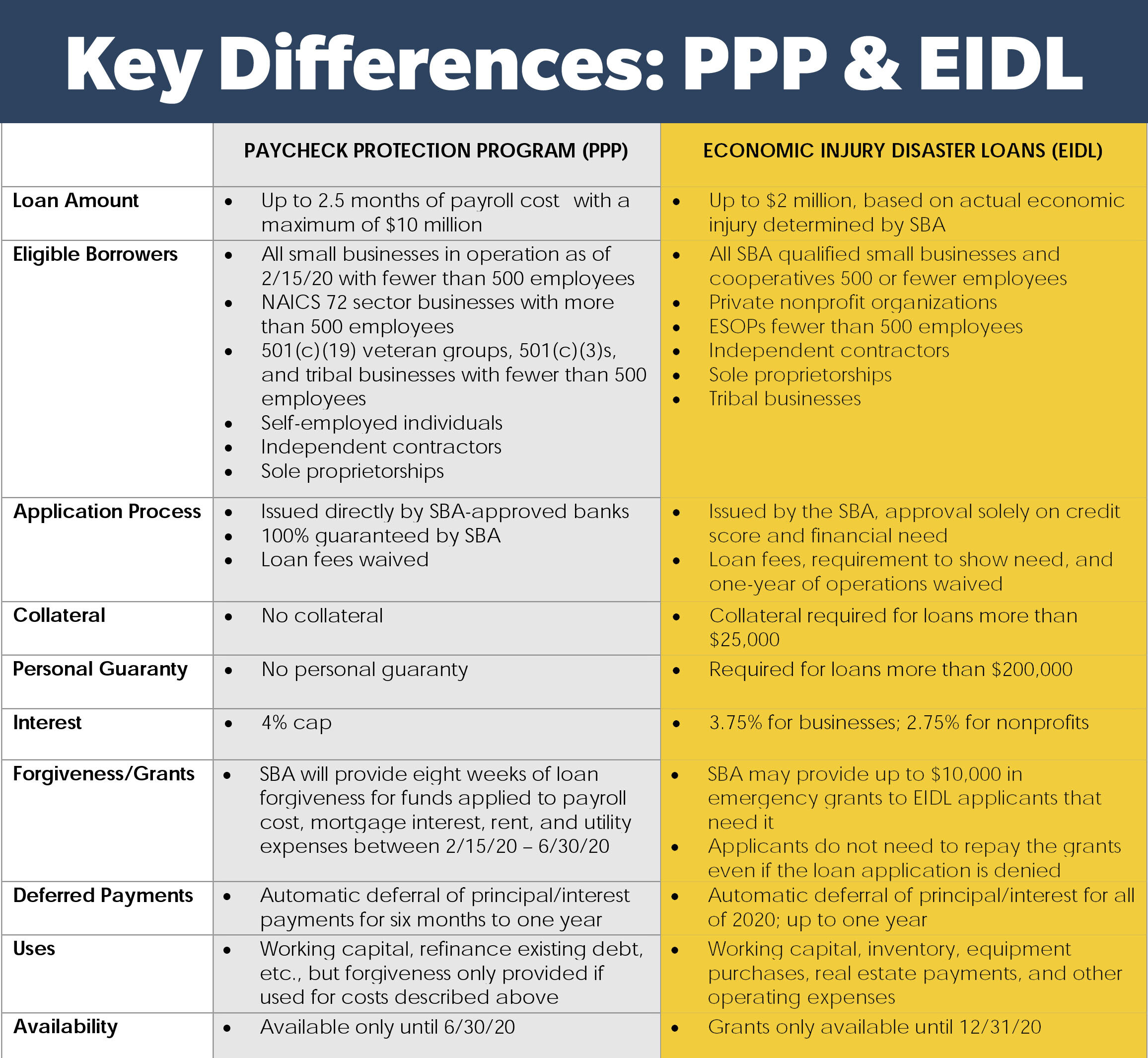

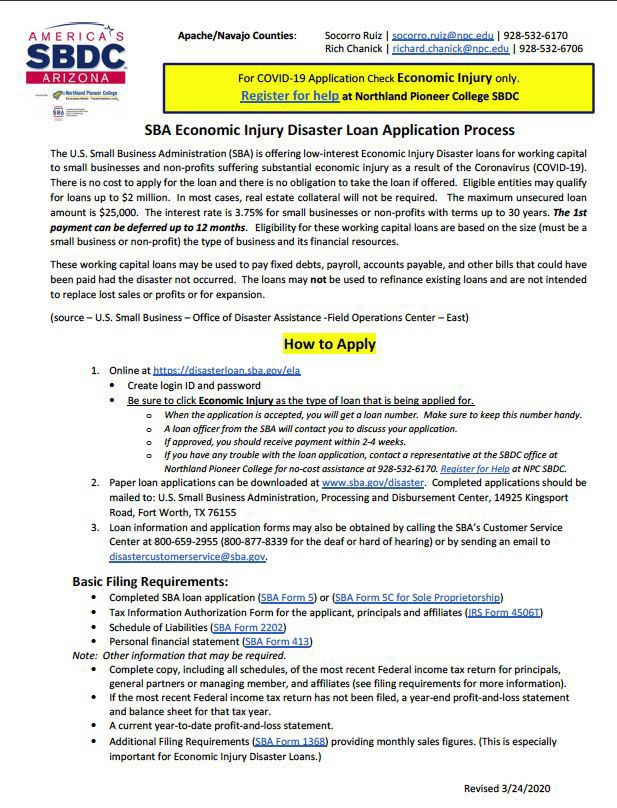

The law says borrowers dont have to repay the loans if the money is. 12 hours agoWorking capital loans up to2 million are available at 3percent for small businesses and 275 percent for private nonprofit organizationswith terms up to 30 years.

Are You Qualified For The 2021 Sba Targeted Eidl Advance

SBA disaster loans have a 1 year deferment and a 30 year loan term.

Do you have to pay back sba disaster loans for small business. 1 out of 6 SBA. You can receive up to 2 million to cover expenses you wouldve been able to pay if the disaster hadnt occurred. Heres everything you need to know about the grant.

The Supplemental Targeted Advance provides the smallest and hardest hit eligible businesses with a supplemental payment of 5000 that does not have to be repaid. The best place to start would be by reading the SBA Loan Agreement you signed. Its an expansion of the SBAs existing disaster loan program.

Visit the portal on the SBA website for more. Your loan will begin accruing interest immediately but you have no penalties for prepayment. With the second round of stimulus the grant is back but with stricter eligibility.

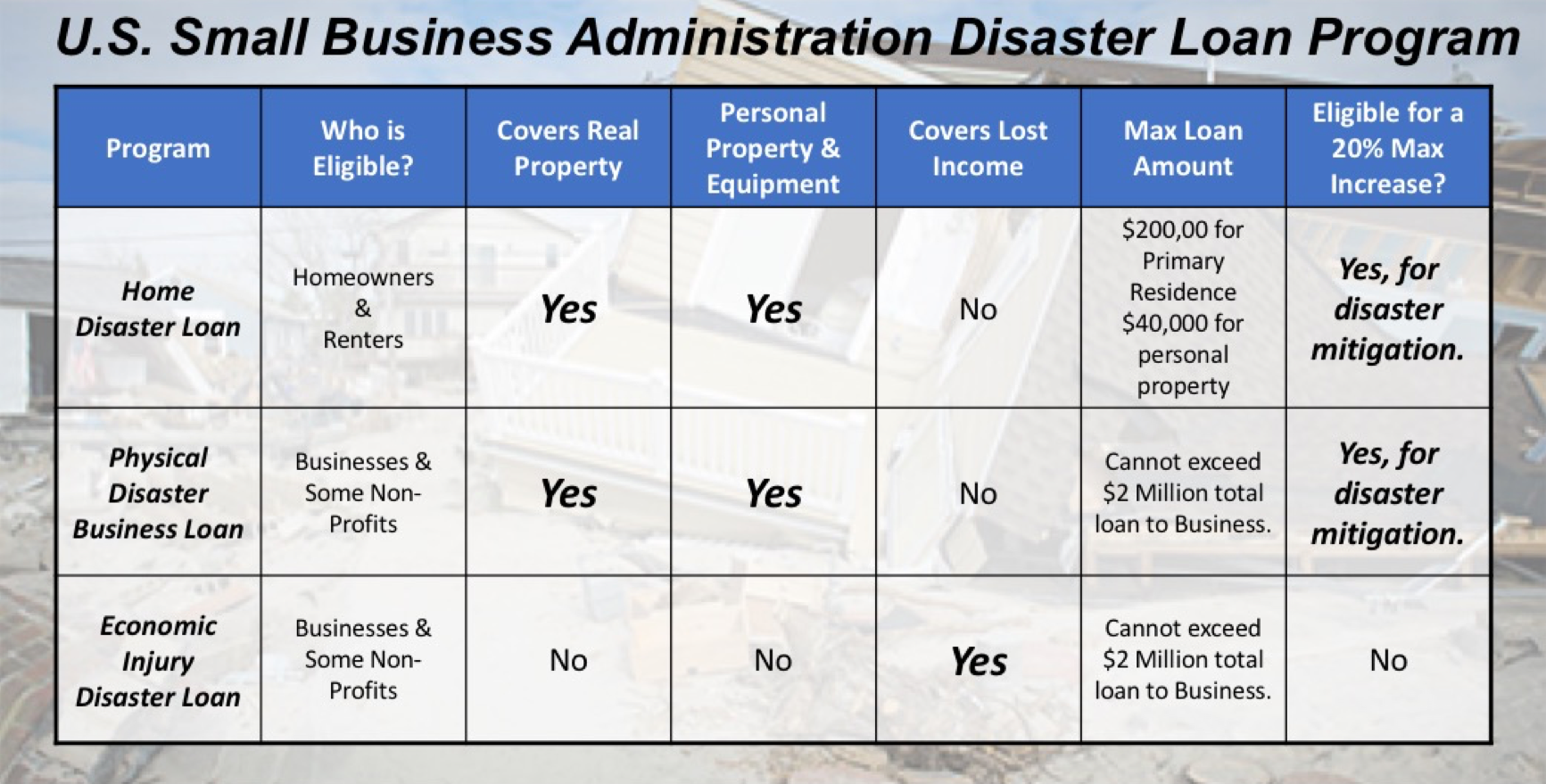

These loans are specifically relevant in situations where your business didnt suffer any physical damage but was harmed nonetheless. You cant make payments and are now facing an SBA loan default which would likely spell doom for your business. Whether youre suffering from lost revenue or any other crisis theres a solution to get you back on your feet.

Its hard to say if youll be required to pay off the SBA loan if your close your business. If you have an existing SBA disaster loan and prefer to continue making regular payments to your SBA Servicing Center justcontact your center. This will likely be addressed on a case-by-case basis for businesses affected by coronavirus.

Typically there will be a section in the agreement where you will find Covenants that may address this matter. The program provides loans of as much as 10 million to small businesses affected by the outbreak. This loan allows borrowers to borrow up to 2 million dollars at an interest rate.

There are also Paycheck Protection Program loans offering 25x monthly payroll expenses capped at 10 million that can be completely forgiven as long as employers use the money to keep their workers on the payroll for at least eight weeks. 8312017 203 PM 2 Page. Where do I apply.

Theres no obligation to accept the loan if offered no cost to apply and no closing fees. By Heather Bant on February 7 2021. This situation isnt uncommon.

The 10-digit SBA loan number and payment. Even if you have previously received the original EIDL Advance in the full amount of 10000 you may be eligible for the Supplemental Targeted Advance if you meet eligibility criteria. Borrowers use this form to pay your SBA serviced loan payments including Economic Injury Disaster loans EIDL and other non-COVID Disaster loans.

An SBA 7a loan. Getting an SBA disaster relief grant or loan is a great opportunity for small businesses but its not the only option. Previously as part of the SBAs Economic Injury Disaster Loan EIDL program small businesses could apply for an EIDL grant of up to 10000 that did not need to be repaid.

An SBA 7a loan is the Small Business Administrations SBA most popular loan and its not hard to see why. 1000 per employee in advance - no need to pay back up to 10000 375 percent interest rate for small businesses and 275 percent for nonprofit organizations Terms up to 30 years Eligibility for these working capital loans are based on the size must be a small business and type of business and its financial resources. The time frame can stretch as long as 30 years and businesses are allowed to defer repayment for up to a year.

The soonest payment date is the next business day. Running a small business is tough especially when working capital is low and expenses are high. Under the program the SBA can loan any qualifying small business thats been affected by COVID-19 up to 2 million at a 375 interest rate.

The loans are intended to pay fixed debts payroll accounts payable and other expenses that could have been paid had the disaster. Economic Injury and Disaster Loan EIDL and Loan Advance. Thats why if you are trying to pay it off you need the latest payoff amount during.

Its 1000 per employee up to 10000. The good news is you dont have to pay it back even if youre denied a loan. As with any loan the lender needs to consider your ability to pay back the loan in full.

If youre a business loan customer just dont request a deferment from your lender. If you are trying to pay the loan off enter the payoff amount you got from SBA CAFS you can also make a partial payment.

Sba Economic Injury Disaster Loans Are Still Available Br Startup Junkie

Here S Information About Applying For Disaster Loans From The Federal Sba Vaildaily Com

Covid 19 Relief Loans For Small Businesses Masstlc

Sba Loan Application Is Lengthy But Worth Getting Started Right Away Bus Motorcoach News

How To Apply For A Federal Disaster Loan If You Are A Small Business

Application For Disaster Loans Exposed Business Owners Personal Data Newsday

Quick Guide Sba Disaster Loan Application Specific To Coronavirus Covid 19 Youtube

How To Apply For An Sba Disaster Loan

How To Get An Sba Disaster Loan Eidl Bench Accounting

Sba Economic Injury Disaster Loan Application Process Latest News Wmicentral Com

The Small Business Administration Disaster Loan Program The Allen Firm Pc

Sba Economic Injury Disaster Loan Faq Small Business Development Center

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

Disaster Assistance Loans Available To Small Businesses Hit By Covid 19

Sba Disaster Loans For Coronavirus Hit Delays Website Crashes Washington Business Journal

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Offers Small Business Covid 19 Emergency Disaster Loans Azbio

Sba Defers Existing Disaster Loans Until End Of 2020 Nawrb

Step By Step Guide To The Sba S Economic Injury Disaster Loans For Coronavirus Related Economic Disruptions Ihcc Business

Post a Comment for "Do You Have To Pay Back Sba Disaster Loans For Small Business"