Capital First Business Loan Statement

The useful life of the assets being financed. Our lenders are committed to helping clients succeed.

A Small Business Guide To Common Sources Of Capital

The Finance Buddha Team will contact you soon.

Capital first business loan statement. The loan amount plus the fixed borrowing cost is called the total owed. Personal or business property assets used to secure a loan Cosigner. Among the products offered are.

Capital First Q2 net trebles to Rs 105 cr on strong core income 26102018 Capital First Standalone September 2018 Net Sales at Rs 110721 crore up 3118 Q-o-Q. Shopify Capital merchant cash advances are available in Canada and all remaining US states. Personal or business property you own Capital.

Using a loan as means to start a business Default. Click on Quick Pay EMI. Failing to pay back a loan that offers loans loan guaranties and.

First Legacy Capital business loans to help you grow your business. Appalachian Growth Capital will offer loans to small businesses at 2 percent interest. A Shopify Capital loan is a lump sum called the loan amount that you receive from Shopify Capital in return for a fixed borrowing cost.

Type in your phone number and an OTP would be generated. Business Instalment loan BIL is an unsecured loan which is provided to a self-employed individual and entity. The term on a Minority Business Direct Loan cannot.

The loan amount is deposited into your business bank account and then a percentage of your daily sales is repaid to Shopify Capital. IDFC FIRST Banks Business Instalment Loan. Business banking is all about relationships.

With IDFC FIRST Bank Business Loan we help you take your business to new heights. To apply for a personal loan from Capital First just fill in the form above. Business making profit for the last 1 year.

Login to the Capital First Ltd. GLOSSARY OF BUSINESS TERMS Assets. Hiring and training employees come with added overhead to your bottom line.

Whether you are buying a piece of equipment or need capital. A person who also signs for the loan and is responsible for payments if you default Debt Financing. Different phases of your business the initial phase or growth phase requires you to have the requisite financial wherewithal to maintain the growth momentum.

Get Your First Business Loan in 4 Steps. Kurt Keaner Fran Litterski and Scott Griffin are 2011 Capital graduates. The term on the Minority Business Direct Loan will be based upon.

Use the capital raised from a quick business loan to hire top-notch employees. Apply for Working Capital Loan. Eligibility to apply for Capital First Business loan depends on below factors.

A business loan can provide the capital for expansion of business or for meeting short or long term financial needs. Hiring more skilled employees to keep up with demand. Total business experience should be 60 months.

Enter your Loan Account Number and your contact details email id and mobile number. Created and performed by Columbus-based band Kid Runner which was born out of Capitals Conservatory of Music. First Capital Business Finance only requires business owners to submit the most recent six months of business bank statements.

Current business experience requirement is of 48 months. Voice over and engineering talent by Capital. Determining how much you need how long you need to repay it and your best option for funding is a process that takes a bit of research.

Obtaining business loans for the first time is a big step for any business and its a step that shouldnt be taken lightly. Customer Portal and get access to your Account Details check your Account Statement and Outstanding Loans and Pay EMI online. Exceed 15 years for real estate financing or 10 years for machinery financing Exceed the term of the bank loan.

Jenna Jaworski a junior majoring in music technology with a digital media minor from Norwalk Ohio. Fill in the OTP and you shall be directed to the application page fill in the details and complete the form and submit. The maximum loan amount is 500000 and businesses will have the ability to defer payment for up to six months.

The term of the bank loan in the project. As the demand for your products and services grow scaling your team with more skilled workers is crucial. This is a term loan with competitive rates to address all your business requirements.

The loan account information provided herein is only indicative in nature and no representation is given as to the accuracy of the whole or any part of this information due to reasons including payment realisation system updation in general and assume no liability for any errors omissions or inaccuracies on the statement herein provided. It uses this to evaluate your businesss cash flow and to determine how much your business is eligible to borrow. Equipment Leasing Accounts Receivables Factoring SBA Loans and Business Lines of Credit.

Choose the payment option BilldeskPaytmMpesa and enter the CAPTCHA code and click on Proceed Next. You should be between the ages of 23 to 65 years. It can be availed for any business upgrade or equipment purchase which is repaid in equal instalments at fixed monthly intervals.

Whether it is to expand to new markets buy new equipment upgrade existing facilities or meet the requirements of your working capital IDFC FIRST Bank provides you with unsecured business lending solutions that cater to your diverse needs.

![]()

Ucc Filing The Ins And Outs Of What A Ucc Is And Where To Look For One

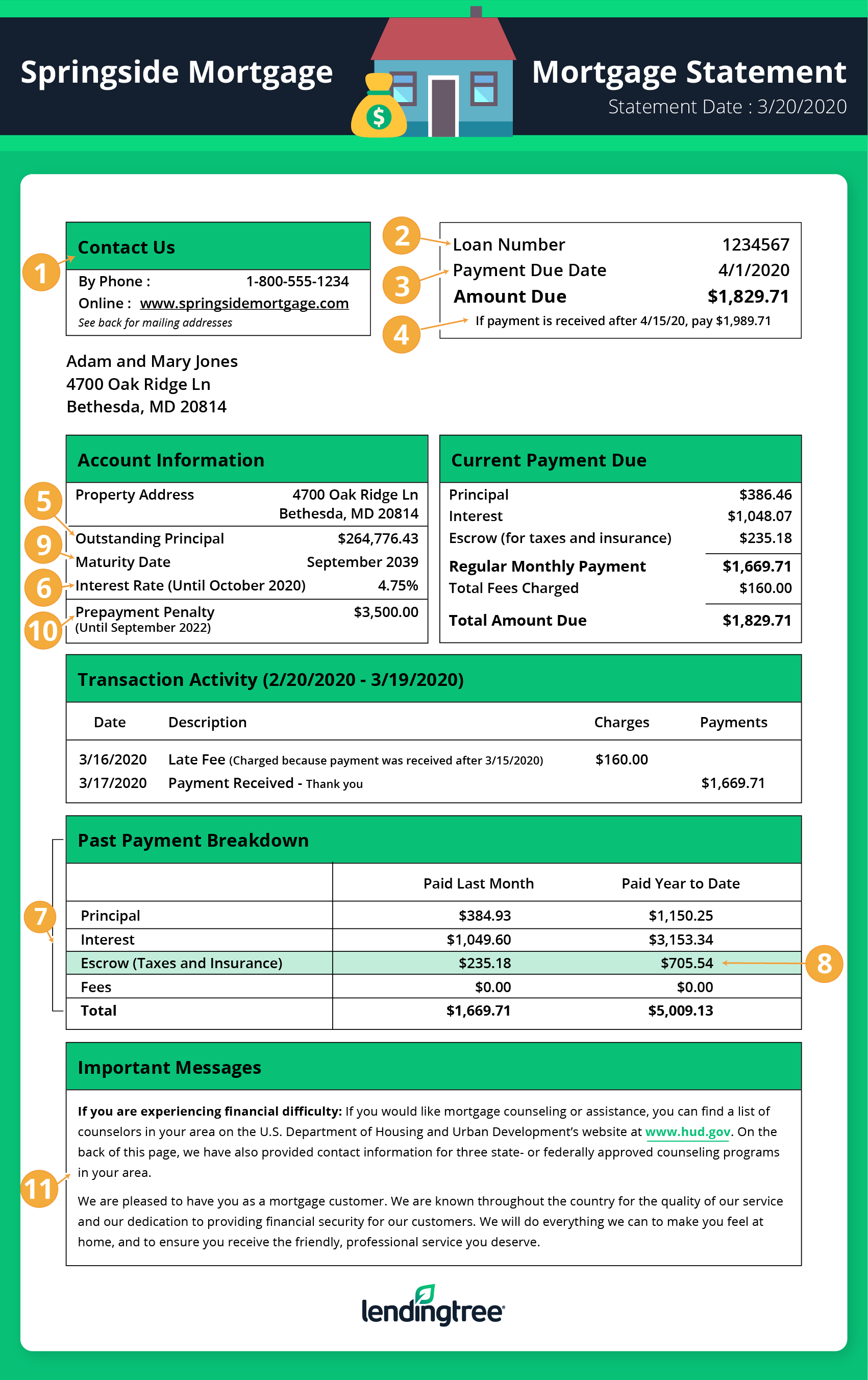

How To Read A Monthly Mortgage Statement Lendingtree

![]()

Ucc Filing The Ins And Outs Of What A Ucc Is And Where To Look For One

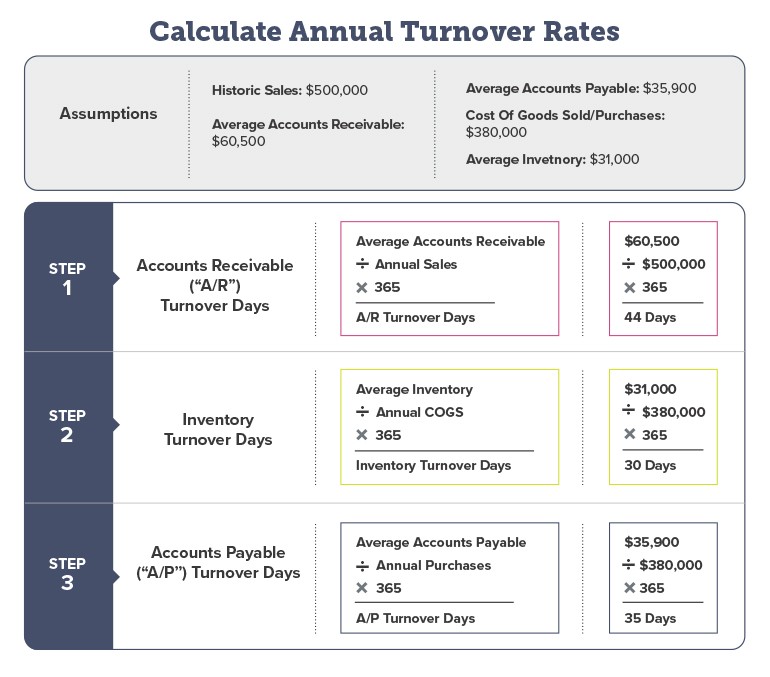

Cash Flow Statement Definition Example And Complete Guide Fourweekmba

How To Write A Convincing Business Loan Request Letter

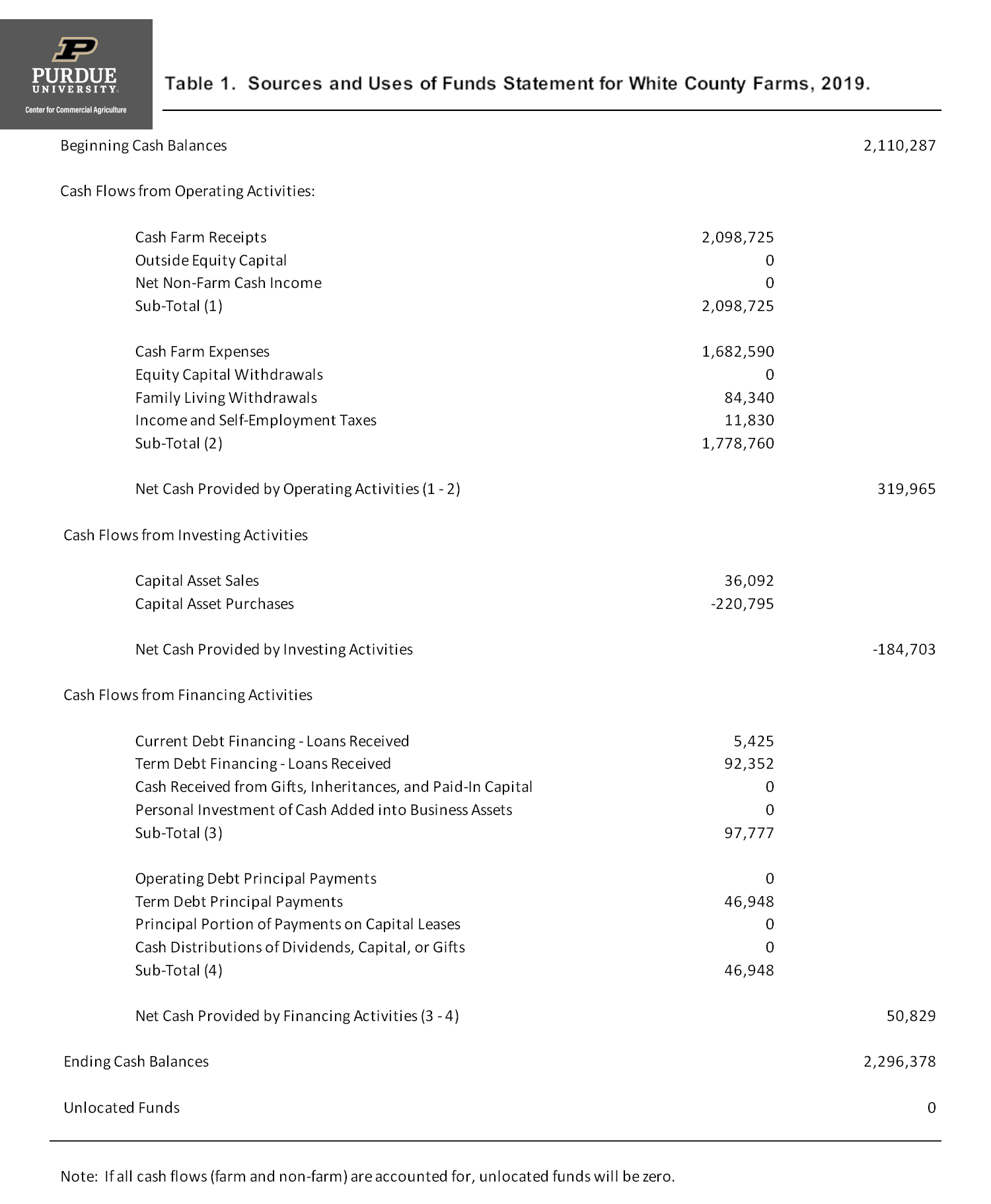

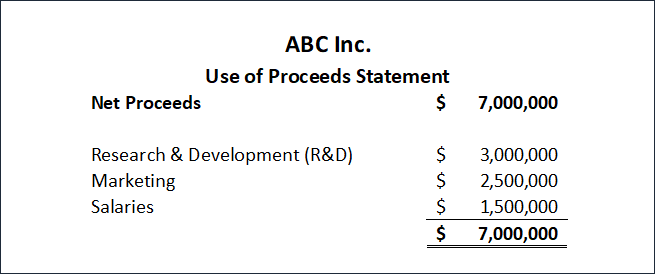

Sources And Uses Of Funds Statement Center For Commercial Agriculture

Use Of Proceeds Statement Overview How To Create Format

Sources And Uses Of Funds Statement Aka Cash Flow Statement

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

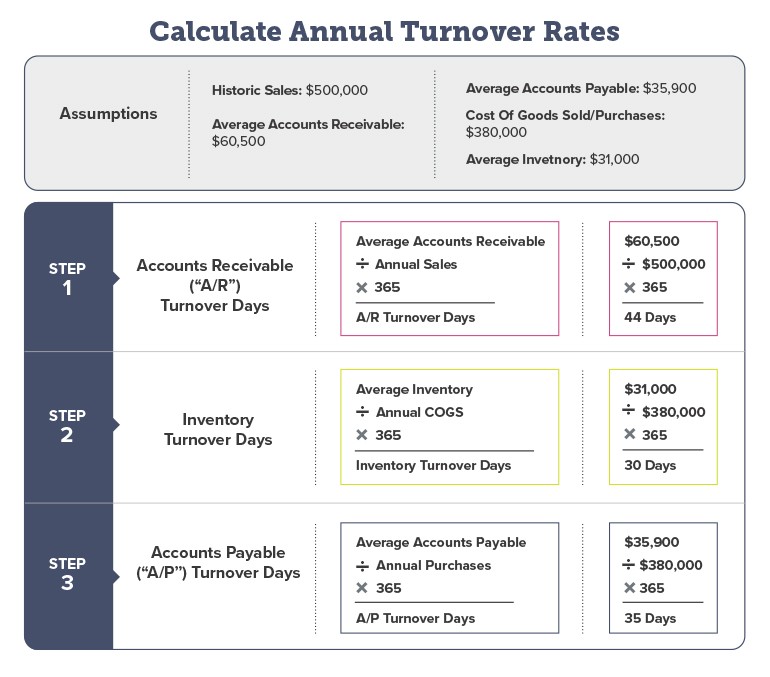

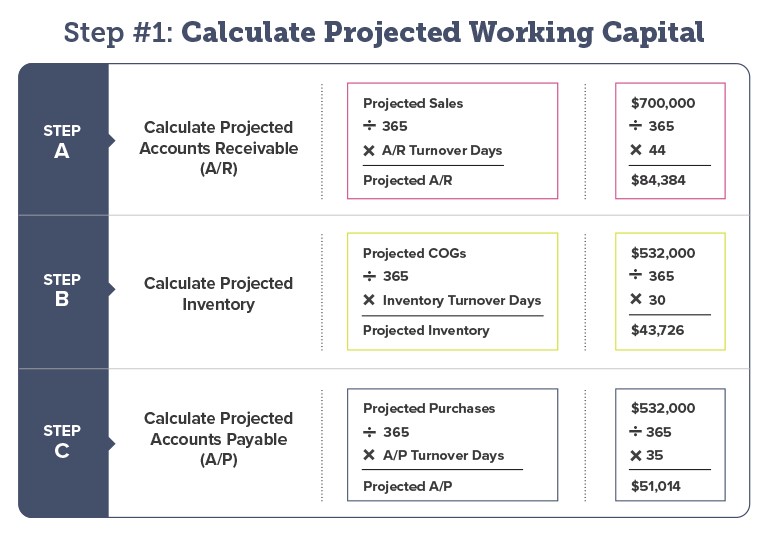

How Much Working Capital Is Needed To Grow Your Business Pursuit

Usa Capital One Bank Statement Template Word And Pdf Format Doc And Pdf Statement Template Bank Statement First Bank

Hybridge Sba Loan National Business Capital Business Capital Business Sba Loans

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is Examples

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

Equity Definition Formula Calculation Examples

How Much Working Capital Is Needed To Grow Your Business Pursuit

How To Write A Convincing Business Loan Request Letter

How To Write A Convincing Business Loan Request Letter

Post a Comment for "Capital First Business Loan Statement"