Business Hazard Insurance Sba Loan

The Small Business Administration SBA offers an economic injury disaster loan EIDL to provide relief to small businesses that experienced a. Hazard insurance coverage refers to insurance coverage that covers the construction of your property or enterprise.

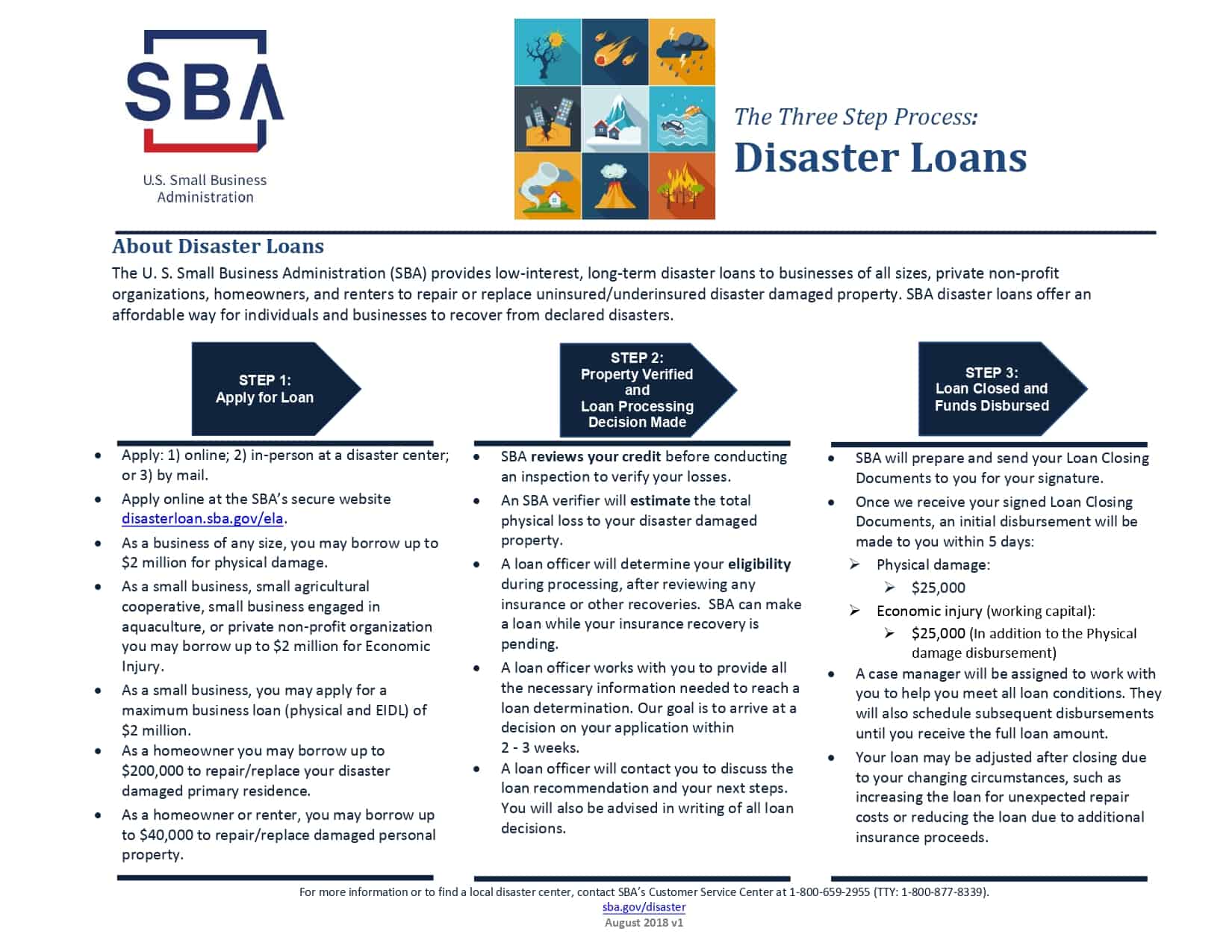

Sba Loan Information Romeoville Area Chamber Of Commerce

I sign on behalf of -company name- for the SBA EIDL Loan 000000000 for loan amount with your signature at the bottom.

Business hazard insurance sba loan. Borrowers must maintain this insurance for the full term of. The Small Business Administration is a lender. SBA Required Hazard Insurance on All Assets Borrowers are required to maintain hazard insurance covering all assets up to 80 of the value of the assets and provide proof of such insurance to the SBA.

The Loan Closing documents that were signed had additional documents that are required. By law borrowers whose damaged or collateral property is located in a special flood hazard area must purchase and maintain flood insurance. Rates As Low As 50month - Instant Evidence of Insurance.

The Resolution will need the following The document should state there was a meeting of the board or owners. Authorized an SBA Loan in the amount of XX. Just like any other lender the SBA is trying to protect their loans collateral from unforeseen circumstances.

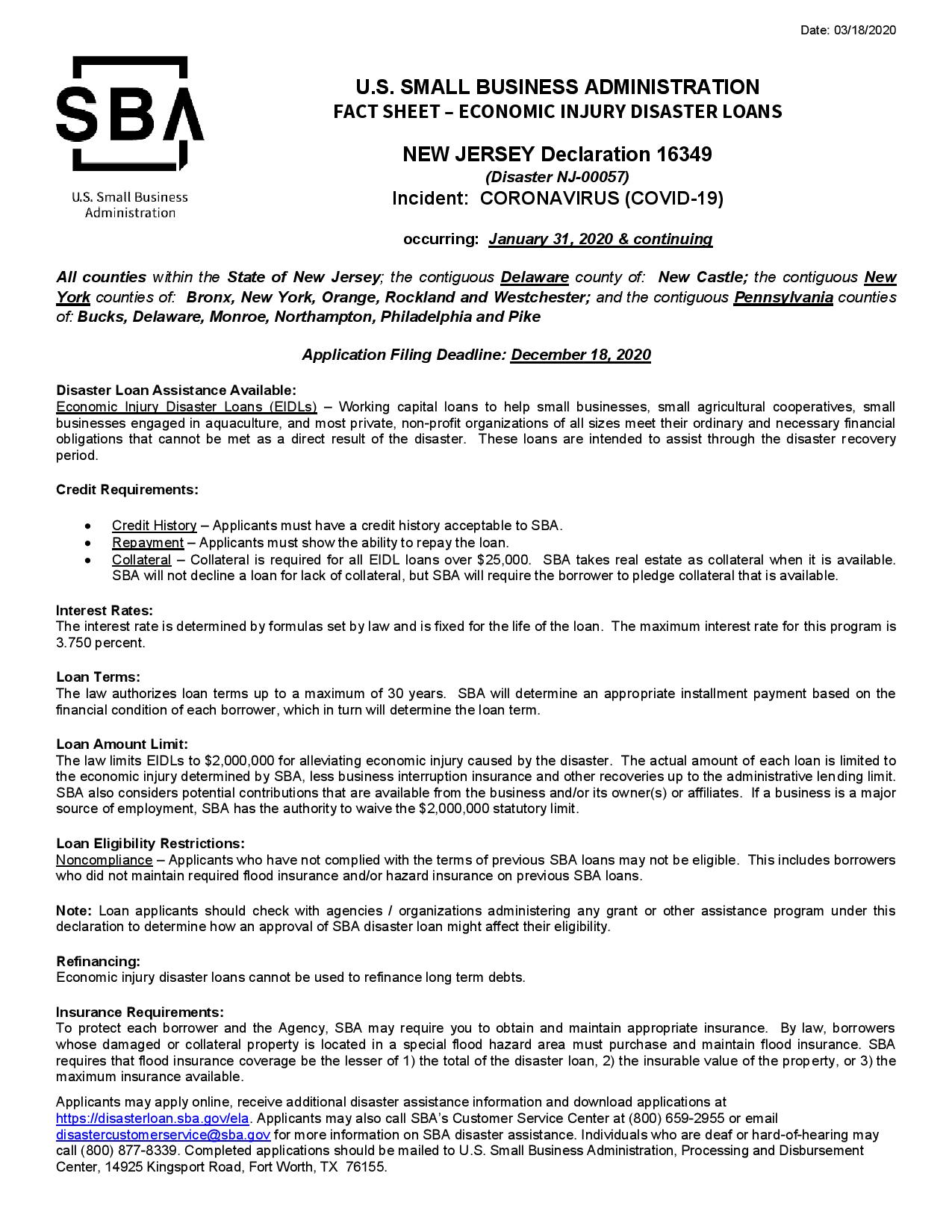

Its essential that various require-ments for the insurance policy be vetted and communicated to all the lines of business that originate commercial real estate loans. We have been getting many requests for evidence of Hazard Insurance for SBA loans. Economic injury disaster loans cannot be used to refinance long term debts.

SBA notices should not be cause for concern CALL 424 888-7635 now to get a FREE quote purchase your insurance print your certificate rest easy the same day. Currently the SBA is requiring that your hazard insurance is at least 80 of your loan amount. The SBA simply requires that Business Personal Property coverage be included in the policy.

Read more about that legislation and apply for a new PPP loan here. The documents are Borrowing Resolution and Proof of Hazard Insurance. Hazard Insurance Requirements To properly protect real property collateral securing commercial loan transactions a bank must define its hazardproperty insurance re-quirements.

SBA Loan Insurance A Small Business Administration Loan will require you to purchase Hazard Insurance equal to or up to 80 of your loan amount. Hazard Insurance for an SBA Loan The ongoing COVID-19 pandemic has affected millions of small businesses in the US. In addition to hazard insurance most lenders also require proof of general liability insurance workers compensation insurance and various other types of coverage depending.

SBA Required Hazard Insurance. - Adjustable to fit your needs - Lowest Rates Nationwide. Insurance Requirements - Breaking Down The Basics.

COMPANY LEGAL NAME LLC name When the meeting was held. The SBA uses the FICO Small Business Scoring Service or SBSS in many cases to evaluate the credit history of your business. However we recommend you insure 100 of your business property value with hazard insurance because if you had a total-loss situation you would want to make sure you could replace all of your business property.

Lenders typically require hazard insurance coverage at minimal earlier than they may approve you for a mortgage. Different forms of harm to your own home shall be lined by different phrases inside your householders insurance coverage coverage. SBSS scores get pulled for SBA 7a loan.

As for the hazard insurance if you work from home and have homeowners insurance that could work just fine. Millions of small business owners who received a loan through the Economic Injury Disaster Loan EIDL program were relieved to get approved for. The Small Business Administration SBA requires lenders to obtain hazard insurance on any real or personal property collateral securing a loan.

If you took out an SBA disaster loan last spring you may have recently been asked to verify insurance. Flood Insurance If your business is located in a special flood hazard area you may have additional requirements based on the Standard Flood Hazard Determination Hazard Insurance If loan proceeds will finance existing or new improvements on a leasehold interest in land the lease must include Lenders SBA or Assignees right to hazard insurance proceeds resulting from damage to. Our experienced office is ready to provide you the right coverage at the best price.

On December 22 2020 Congress passed the stimulus bill which includes new EIDL grants new Paycheck Protection Program loans and other small business relief. To protect each borrower and the Agency SBA may require you to obtain and maintain appropriate insurance. Essentially what they are looking for is proof of equipment coverage.

See how two owner-ops dealt with it here on Overdrive.

History Of Small Business In America Historical Events Business Infographic Small Business

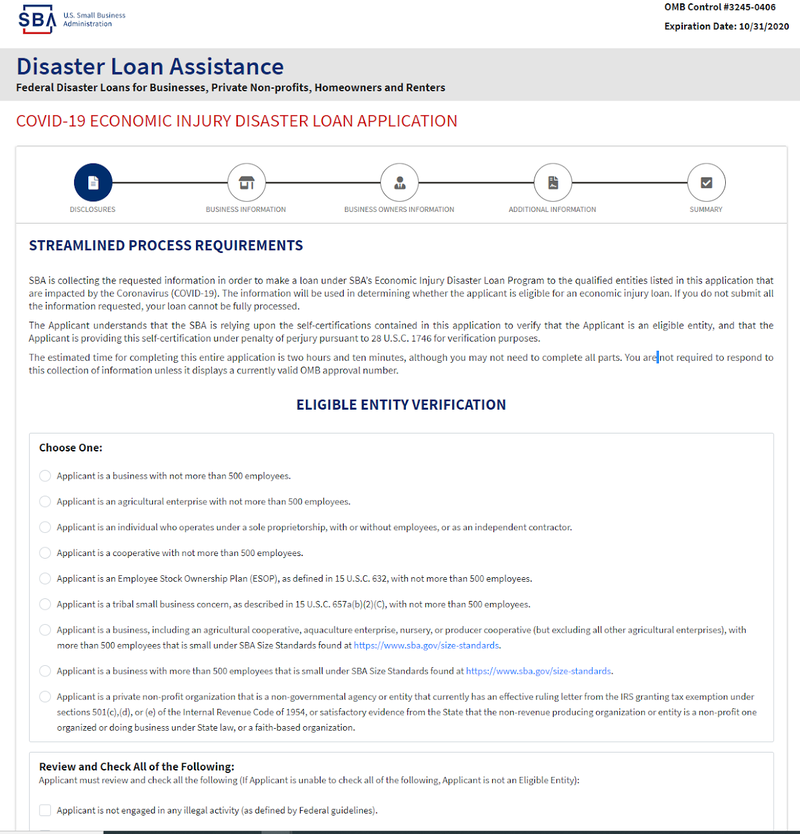

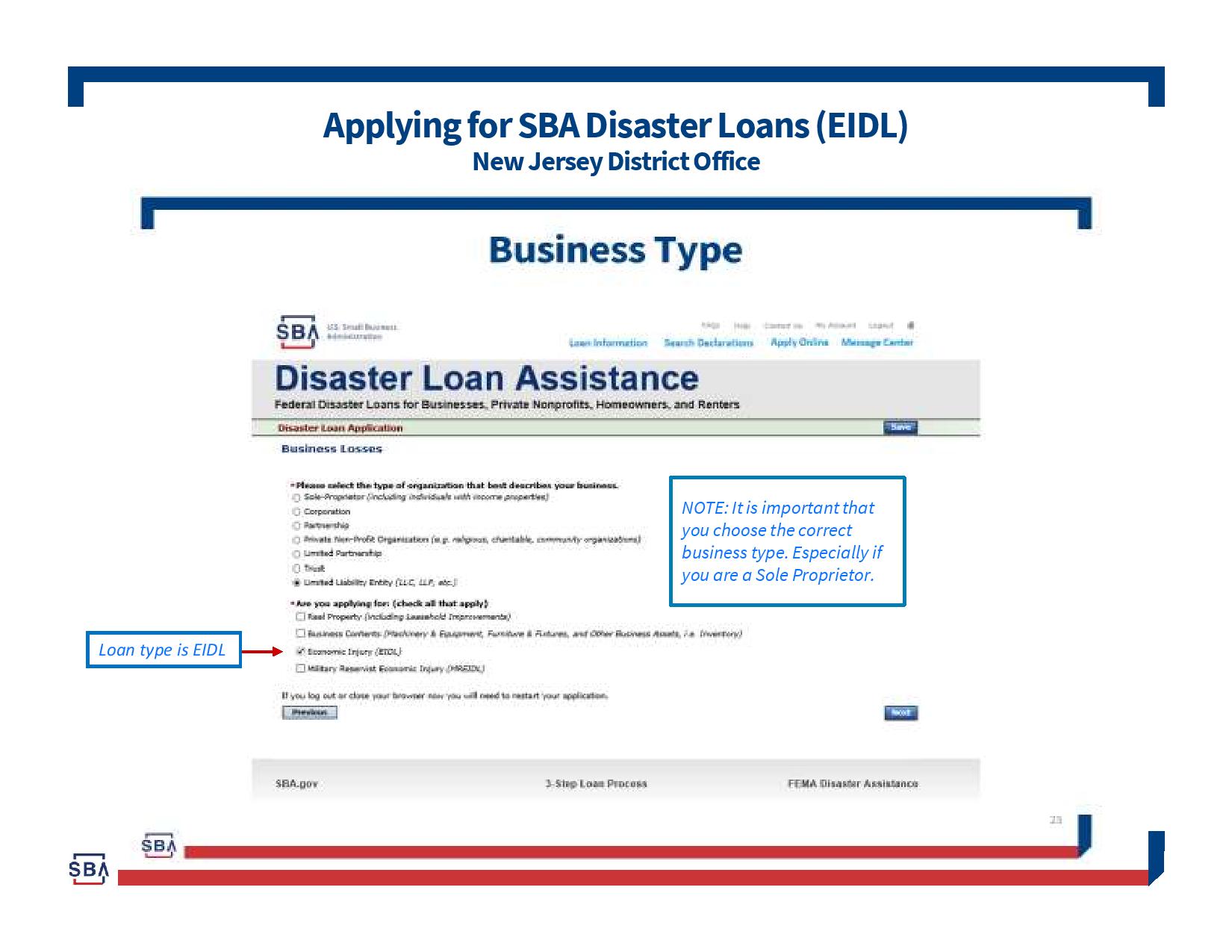

Applying For Sba Eidl Disaster Assistance

Sba Extends Eidl Loan Application Deadline Through End Of 2021 Narfa

Padd To Offer Covid 19 Business Relief Working Capital Loan Program Purchase Area Development District

Insurance Requirements For Sba Loans The Bunker Vault

How Much Does Business Insurance Cost Business Insurance Small Business Insurance Insurance

110 What Can I Use The Eidl Loan For Youtube Loan I Can Hazard Insurance

Eidl Loans Require Hazard Insurance Here S How To Get It Surfky Com

U S Small Business Administration Fact Sheet Disaster Loans Texas Texarkana Today

Life Insurance For Sba Loans Why It S Required In 2021

Sba S Business Hazard Insurance Requirements For The Eidl Youtube

Insurance Requirements And Consideration For Sba Loans

5 Eidl Loan Terms And Requirements You Should Know The Blueprint

Sba Economic Disaster Injury Loans Now Available For Small Businesses In Nj Affected By The Coronavirus Covid 19 Essex County Small Business Development Affirmative Action

Eidl Loans Require Hazard Insurance Here S How To Get It Surfky Com

A Guide To Sba 7 A Loans For Small Businesses Bench Accounting

Sba Economic Disaster Injury Loans Now Available For Small Businesses In Nj Affected By The Coronavirus Covid 19 Essex County Small Business Development Affirmative Action

Post a Comment for "Business Hazard Insurance Sba Loan"