Small Business Gross Receipts Test 2020

For example if a taxpayer. Receipts are averaged over a business latest three complete fiscal years to determine the average annual receipts.

Sample Laboratory Report Templates Report Template Liberty High School High School Science

IR-2020-174 July 30 2020.

Small business gross receipts test 2020. The ability for that employer to retain eligibility for the employee retention credit will end on the last day of the 2020 calendar quarter in which the gross receipts between the 2020 and 2019 same calendar quarters exceeds 80. Small business taxpayers are defined as having average annual gross receipts for the three taxable year period ending before the current taxable year not exceeding 25 million adjusted for inflation gross receipts test. An example is the best way.

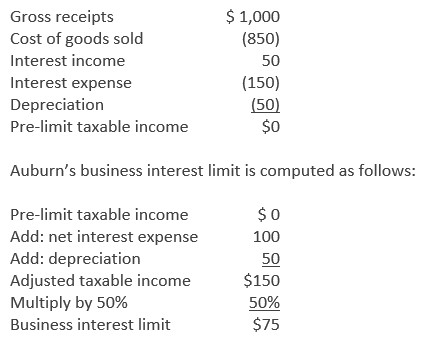

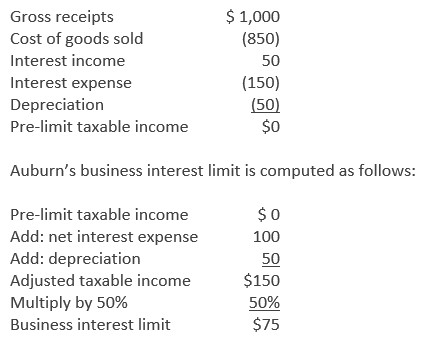

The Final Regulations provide rules for implementing the small business exception in section 163j3 for certain taxpayers meeting the 25 million gross receipts test of section 448c including rules for the application of section 448c to individuals in their own capacity and as owners of interests in. 8102020 Richard Shevak Travis Butler. For taxable years beginning in 2019 and 2020 the gross receipts amount has been adjusted to 26 million.

The TCJA broadened the small-business exception by increasing IRC Section 448cs gross-receipts-test. Gross receipts for a tax year of less than 12 months eg due to a change in accounting period or for an initial year are annualized by multiplying the gross receipts for the short period by 12. The Tax Cuts and Jobs Act TCJA amended Internal Revenue Code IRC sections 263A 448 460 and 471 giving small businesses with average annual gross receipts of 25 million or less small businesses or small taxpayers the option to simplify their tax accounting methods.

This webinar will cover the proposed regulations issued in July 2020 addressing the simplified tax accounting rules for taxpayers having gross revenues under 26 million indexed annually for inflation. Thus the 25 million gross receipts test is determined by averaging a taxpayers gross receipts for the three prior taxable years. For tax years beginning in 2019 and 2020 these simplified tax accounting rules apply for taxpayers having inflation-adjusted average annual gross receipts of 26 million or less known as the gross receipts test.

While these employers can claim the credit without suspended operations or reduced receipts they are limited to 50000 in credits per quarter. The increased amount for this gross receipts test will also affect the limitation on the business interest deduction under Sec. 448 - 1T f2iv and includes sales net of returns and allowances and all amounts received for services.

Proposed regulations REG-132766-18 issued Thursday update various tax accounting regulations to adopt the simplified tax accounting rules for small businesses enacted by the law known as the Tax Cuts and Jobs Act TCJA PL. Now for tax years beginning in 2019 or 2020 if a taxpayer meets the 26 million gross receipts test it will be exempt from the business interest limitation for that year because it qualifies as a small business. For tax years beginning in 2019 and 2020 these simplified tax accounting rules apply for taxpayers with inflation-adjusted average annual gross receipts of 26 million or less known as the gross receipts test.

This is the total income or gross income plus the cost of goods sold These numbers can normally be found on the business IRS tax return forms. RD Tax Credit FAQS For Large and Small Businesses. Or call 1-800-926-7926.

The panel will discuss adopting the simplified methods related to the use of the cash method the exception of applying the UNICAP. Began operating after February 15 2020 and Has average annual gross receipts of less than or equal to 1 million. Annual gross receipts test and other provisions A taxpayer is considered to meet the gross receipts test and be permitted to use the cash method of accounting if average annual gross receipts for the three-tax-year period ending immediately before the current tax year are 25 million adjusted for inflation to 26 million for 2020 and 2021 or less.

References the existing gross receipts test under section 448c2 and increases the dollar threshold from 5 million to 25 million. The term gross receipts is defined under Temp. Gross receipts for any taxable year of less than 12 months must be annualized by multiplying the gross receipts for the short period by 12 and dividing the result by the number of months in the short period.

The TCJA increased section 448 cs gross receipts test ceiling to 25 million which allows taxpayers to grow and continue to use the cash method of. WASHINGTON The Internal Revenue Service today issued proposed regulations PDF updating various tax accounting regulations to adopt the simplified tax accounting rules for small businesses under the Tax Cuts and Jobs Act TCJA. July 30 2020.

The 25 million gross receipts test is contained in Section 448. A recovery startup business generally is an employer that. If a taxpayer is not considered a tax shelter it is eligible to be considered a small taxpayer if it meets the gross receipts test of Sec 448c.

RD FAQs for Small Business Path to Payroll Tax Credit. IRC Section 448c permits small businesses to use the cash method of accounting the small-business exception if their annual average gross receipts fall at or below a certain amount for the three-year period ending immediately before the current tax year the gross-receipts test.

Excel Spreadsheet For Payroll If You Manage A Team Employee Or Busy Household You Can Excel Spreadsheets Templates Spreadsheet Template Bookkeeping Templates

Iowa State University Vegetable Production Budgets For A High Tunnel Example Budgeting Iowa State University Vegetable Farming

Final Business Interest Limitation Rules Present Opportunities 2020 Articles Resources Cla Cliftonlarsonallen

Targeted Eidl Grant How To Calculate Gross Receipts Youtube

Sba Update To Gross Receipts Test How To Calculate The 25 Reduction In Gross Receipts Ppp 2 Youtube

Income Employment Earnings Approval Application Ytd Gross Annual Monthly Verification Job Loan Payroll Template Letter Of Employment Payroll Checks

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

How Do Capital And Revenue Expenditures Differ

Targeted Eidl Grant How To Calculate Gross Receipts Youtube

Account Abilitys W 2c User Interface Corrected Wage And Tax Statement Data Is Entered Onto Windows That Res Business Tax Statement Template Tax Accountant

Instructions For Form 8990 05 2020 Internal Revenue Service

Get Our Example Of Real Estate Marketing Budget Template For Free Cash Flow Statement Statement Template Budget Template

Instructions For Form 8990 05 2020 Internal Revenue Service

Farm Books Accounting Software List Of Reports Payroll Checks Payroll Template Payroll

Instructions For Form 8990 05 2020 Internal Revenue Service

Qualifying As A Small Business Corporation For Amt Purposes

Explore Our Printable Used Car Sales Receipt Template Receipt Template Invoice Template Invoice Template Word

Qualifying As A Small Business Corporation For Amt Purposes

Post a Comment for "Small Business Gross Receipts Test 2020"