What Is Distribution Income On K1

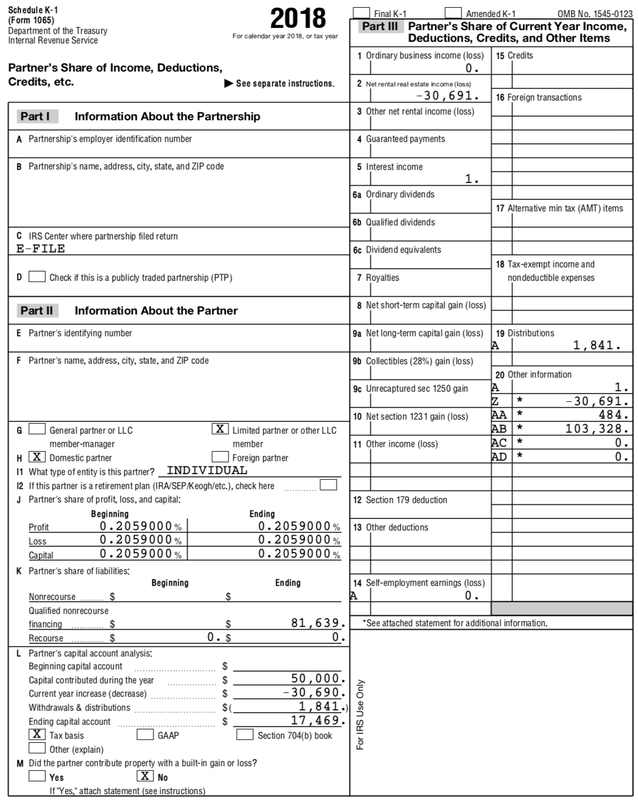

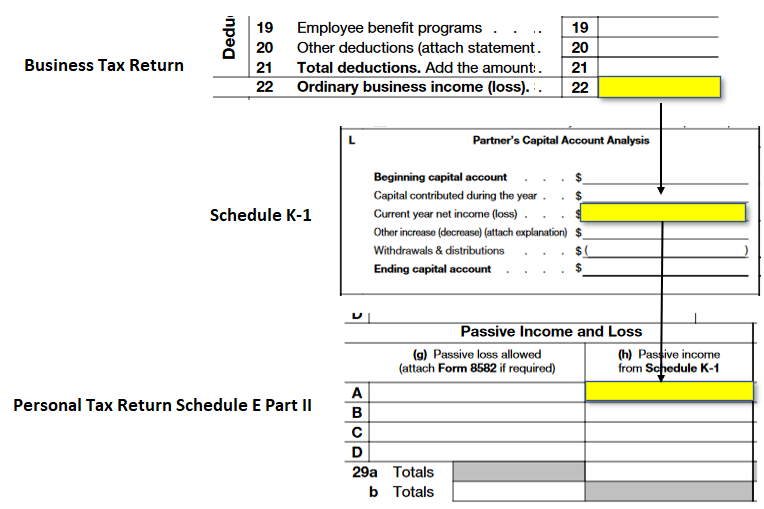

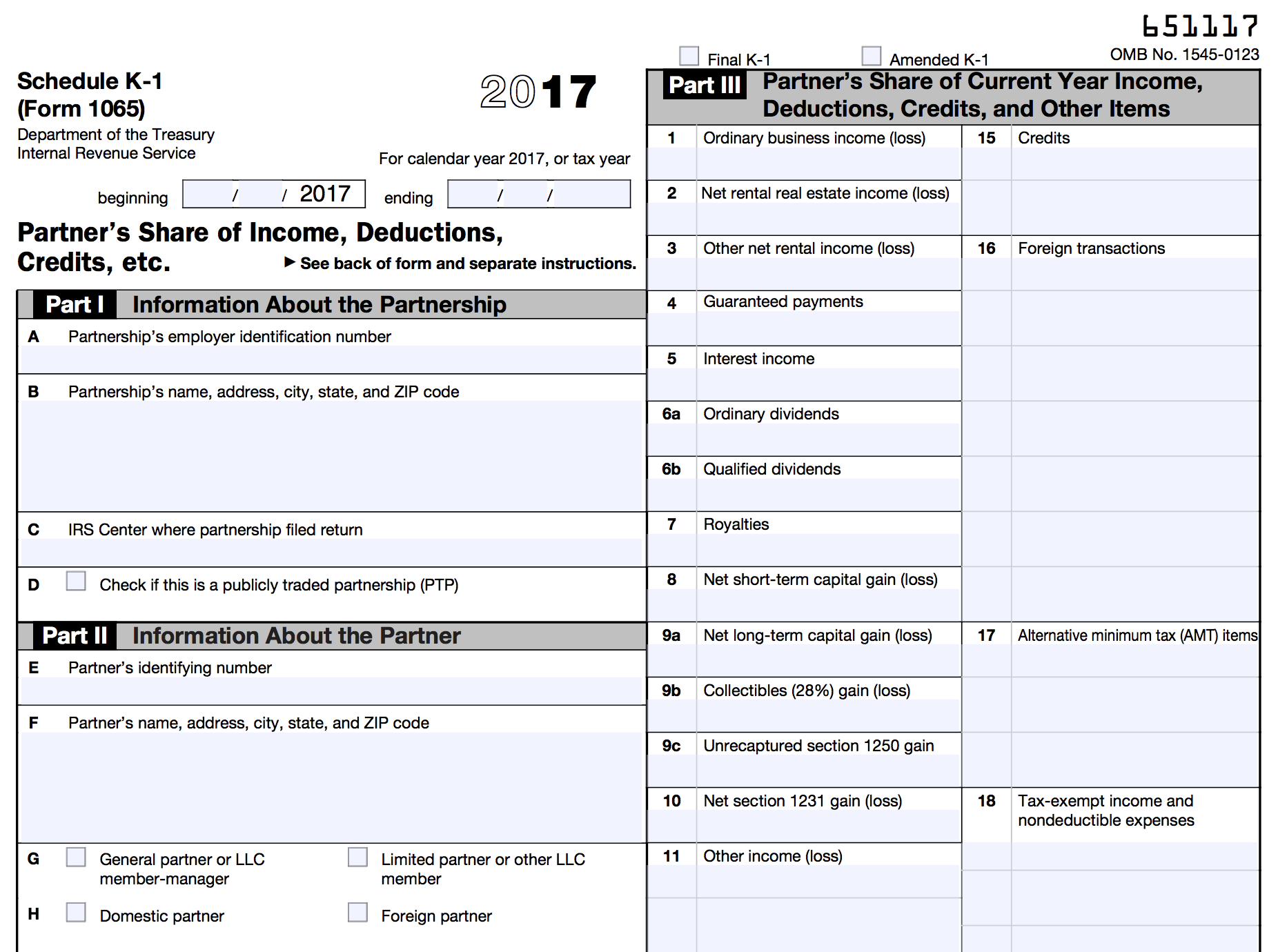

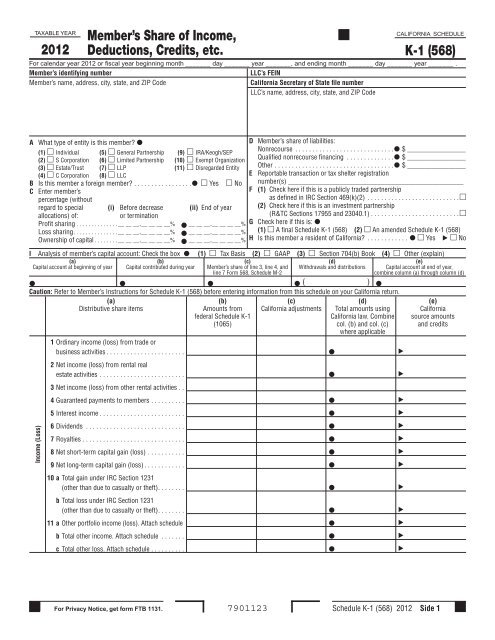

Page two of the K-1 gives a breakdown as to where each line item should be reported on the partners tax return. Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS.

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

When to file K-1s The trust needs to file a return if it has a gross income of 600 or more during the trust tax year or there is a nonresident alien beneficiary or if there is any taxable income.

What is distribution income on k1. This equals the Schedule K deferred obligation. This income is then reported to the beneficiary on a Schedule K-1 Form 1041 Beneficiarys Share of Income Deductions. Schedule K-1 is an Internal Revenue Service IRS tax form thats issued annually.

The Schedule K-1 income may then be included in the borrowers cash flow. Estates and Trusts are permitted to take a deduction on their tax return Form 1041 for certain income that is distributed to the beneficiaries. The following table provides verification of income requirements for Schedule K-1 borrowers with less than 25 ownership of a partnership an S corporation or an LLC.

Youll fill out Schedule K-1 as part of your Partnership Tax Return Form 1065 which reports your partnerships total net income. Yes earnings reported on a K-1 are taxable and need to be reported on your tax return. You see this on the Year End financial reports.

For each Form 6252 where line 5 is greater than 150000 figure the Schedule K-1 deferred obligation as follows. Video of the Day. If the Schedule K-1 reflects a documented stable history of receiving cash distributions of income from the business consistent with the level of business income being used to qualify then no further documentation of access to the income or adequate business liquidity is required.

If the Schedule K-1 does not reflect a documented stable history of receiving cash distributions of income from the business consistent with the level of business income being used to qualify then the lender must confirm the business has adequate liquidity to support the withdrawal of earnings. If a partner contributed section 704 c built-in gain property within the last 7 years and the partnership made a distribution of property to that. Each owner must report on his individual return and pay taxes on any net income listed on the owners K-1 see the K-1 form.

Code A shows the distributions the partnership made to you of cash and certain marketable securities. At the end of the year all income distributions made to beneficiaries must be reported on a Schedule K-1. Distribution subject to section 737.

Here is more detail of what the code means for box 19 on the K-1. Purposes the income upon which child support is calculated is not limited to the actual distributions made by the business entity. Keep it for your records.

Partnerships must distribute a Schedule K-1 Form 1065 to its partners. Dont file it with your tax return unless backup withholding is reported in box 13 using code O. Line 4 from the list above less the sum of lines 7 and 8.

I used a journal entry to allocate the 2018 retained earnings -5700000 to the partners based on their ownership Along with Net Income. The funds are simply paid back and the partner put its back in their savings account. The Distributions are only to.

In 2015 Fannie Mae reexamined the process of mortgage qualification for potential borrowers who receive a K1 income. See the instructions for Code O. The value you want.

This is because the income tax liability is being passed through the business or fiduciary entity to the ones who have a financial interest in it. For many years Fannie Mae and Freddie Mac required lenders to confirm that the income used in qualification from the Schedule K Form was supported by the cash distributions of a business. Because partnerships are so-called pass-through entitiesthey let the profits or.

There are a few other reasons but the bottom line is in no case do you use Distributions as the income amount for Freddie Fannie loans. The corporation uses Schedule K-1 to report your share of the corporations income deductions credits and other items. Verification of Schedule K-1 Income.

Distribution of income to partners. It reports the gains losses interest dividends earnings and other distributions from certain investments or. K-1 earnings never distributed and never will be.

Income or loss from the partnership is passed through to the individual partner where it is added to total income on Form 1040. Cash and marketable securities. Multiply the Schedule K deferred obligation by the partners profit percentage.

Are the k-1 earnings still taxable.

Dissecting And Understanding A Schedule K 1

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

Download Federal Income Tax Form 1040 Excel Spreadsheet Income Tax Calculator Tax Return Federal Income Tax Tax Forms

A Small Business Guide To The Schedule K 1 Tax Form The Blueprint

A Beginner S Guide To S Corporation Taxes The Blueprint

Mlp Tax Guide Intelligent Income By Simply Safe Dividends

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Https New Content Mortgageinsurance Genworth Com Documents Training Course Partnershipincome1065formk1 Presentation 0420 Pdf

Publication 570 2020 Tax Guide For Individuals With Income From U S Possessions Internal Revenue Service

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg)

Form 1099 Int Interest Income Definition

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

3 Changes You May See On Your 2019 Partnership K 1s And Why They Matter Cohen Company

2012 Schedule K 1 568 Member S Share Of Income Deductions

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

1065 Calculating Book Income Schedules M 1 And M 3 K1 M1 M3

1065 Calculating Book Income Schedules M 1 And M 3 K1 M1 M3

Post a Comment for "What Is Distribution Income On K1"