Capital First Business Loan Statement

As the demand for your products and services grow scaling your team with more skilled workers is crucial. A business loan can provide the capital for expansion of business or for meeting short or long term financial needs.

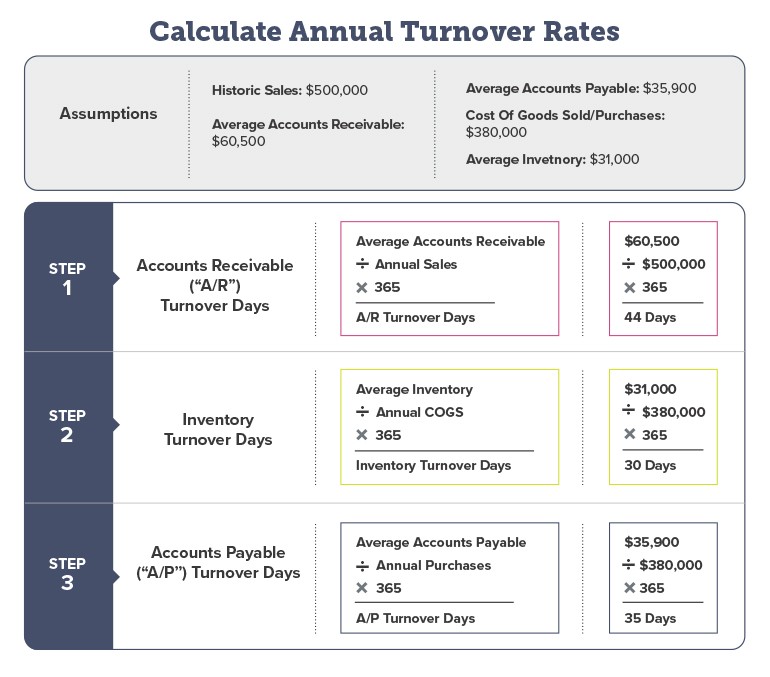

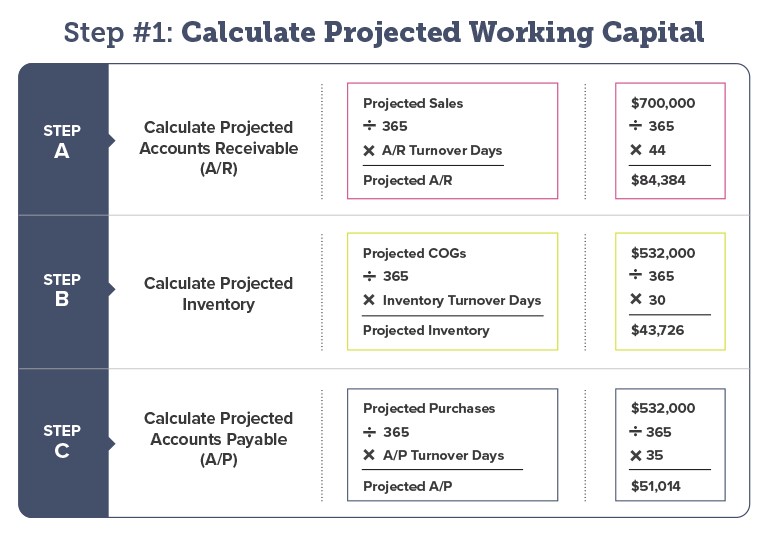

How Much Working Capital Is Needed To Grow Your Business Pursuit

Equipment Leasing Accounts Receivables Factoring SBA Loans and Business Lines of Credit.

Capital first business loan statement. Exceed 15 years for real estate financing or 10 years for machinery financing Exceed the term of the bank loan. Different phases of your business the initial phase or growth phase requires you to have the requisite financial wherewithal to maintain the growth momentum. Business banking is all about relationships.

Using a loan as means to start a business Default. It uses this to evaluate your businesss cash flow and to determine how much your business is eligible to borrow. Login to the Capital First Ltd.

A person who also signs for the loan and is responsible for payments if you default Debt Financing. The term on the Minority Business Direct Loan will be based upon. Total business experience should be 60 months.

Customer Portal and get access to your Account Details check your Account Statement and Outstanding Loans and Pay EMI online. Obtaining business loans for the first time is a big step for any business and its a step that shouldnt be taken lightly. The loan amount plus the fixed borrowing cost is called the total owed.

This is a term loan with competitive rates to address all your business requirements. Fill in the OTP and you shall be directed to the application page fill in the details and complete the form and submit. Use the capital raised from a quick business loan to hire top-notch employees.

Whether it is to expand to new markets buy new equipment upgrade existing facilities or meet the requirements of your working capital IDFC FIRST Bank provides you with unsecured business lending solutions that cater to your diverse needs. With IDFC FIRST Bank Business Loan we help you take your business to new heights. Personal or business property you own Capital.

Get Your First Business Loan in 4 Steps. The term on a Minority Business Direct Loan cannot. Appalachian Growth Capital will offer loans to small businesses at 2 percent interest.

Jenna Jaworski a junior majoring in music technology with a digital media minor from Norwalk Ohio. Determining how much you need how long you need to repay it and your best option for funding is a process that takes a bit of research. A Shopify Capital loan is a lump sum called the loan amount that you receive from Shopify Capital in return for a fixed borrowing cost.

Enter your Loan Account Number and your contact details email id and mobile number. GLOSSARY OF BUSINESS TERMS Assets. First Legacy Capital business loans to help you grow your business.

Our lenders are committed to helping clients succeed. Voice over and engineering talent by Capital. Created and performed by Columbus-based band Kid Runner which was born out of Capitals Conservatory of Music.

Current business experience requirement is of 48 months. IDFC FIRST Banks Business Instalment Loan. Kurt Keaner Fran Litterski and Scott Griffin are 2011 Capital graduates.

To apply for a personal loan from Capital First just fill in the form above. Business making profit for the last 1 year. The useful life of the assets being financed.

Hiring more skilled employees to keep up with demand. Click on Quick Pay EMI. You should be between the ages of 23 to 65 years.

Capital First Q2 net trebles to Rs 105 cr on strong core income 26102018 Capital First Standalone September 2018 Net Sales at Rs 110721 crore up 3118 Q-o-Q. Personal or business property assets used to secure a loan Cosigner. The loan amount is deposited into your business bank account and then a percentage of your daily sales is repaid to Shopify Capital.

The loan account information provided herein is only indicative in nature and no representation is given as to the accuracy of the whole or any part of this information due to reasons including payment realisation system updation in general and assume no liability for any errors omissions or inaccuracies on the statement herein provided. Business Instalment loan BIL is an unsecured loan which is provided to a self-employed individual and entity. Type in your phone number and an OTP would be generated.

The maximum loan amount is 500000 and businesses will have the ability to defer payment for up to six months. The Finance Buddha Team will contact you soon. Failing to pay back a loan that offers loans loan guaranties and.

It can be availed for any business upgrade or equipment purchase which is repaid in equal instalments at fixed monthly intervals. Hiring and training employees come with added overhead to your bottom line. The term of the bank loan in the project.

Shopify Capital merchant cash advances are available in Canada and all remaining US states. Apply for Working Capital Loan. Choose the payment option BilldeskPaytmMpesa and enter the CAPTCHA code and click on Proceed Next.

Eligibility to apply for Capital First Business loan depends on below factors. First Capital Business Finance only requires business owners to submit the most recent six months of business bank statements. Among the products offered are.

Whether you are buying a piece of equipment or need capital.

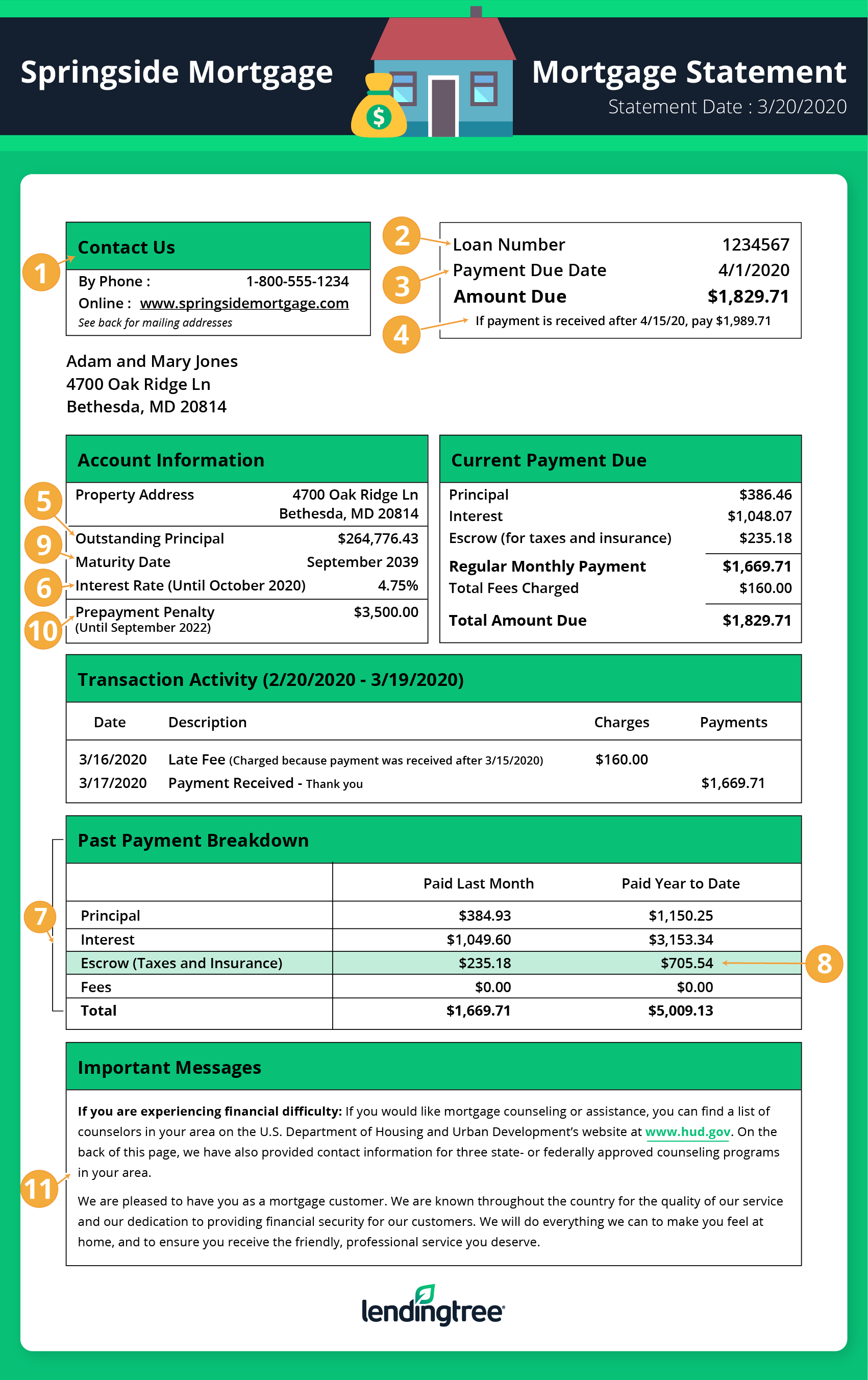

How To Read A Monthly Mortgage Statement Lendingtree

How Much Working Capital Is Needed To Grow Your Business Pursuit

![]()

Ucc Filing The Ins And Outs Of What A Ucc Is And Where To Look For One

A Small Business Guide To Common Sources Of Capital

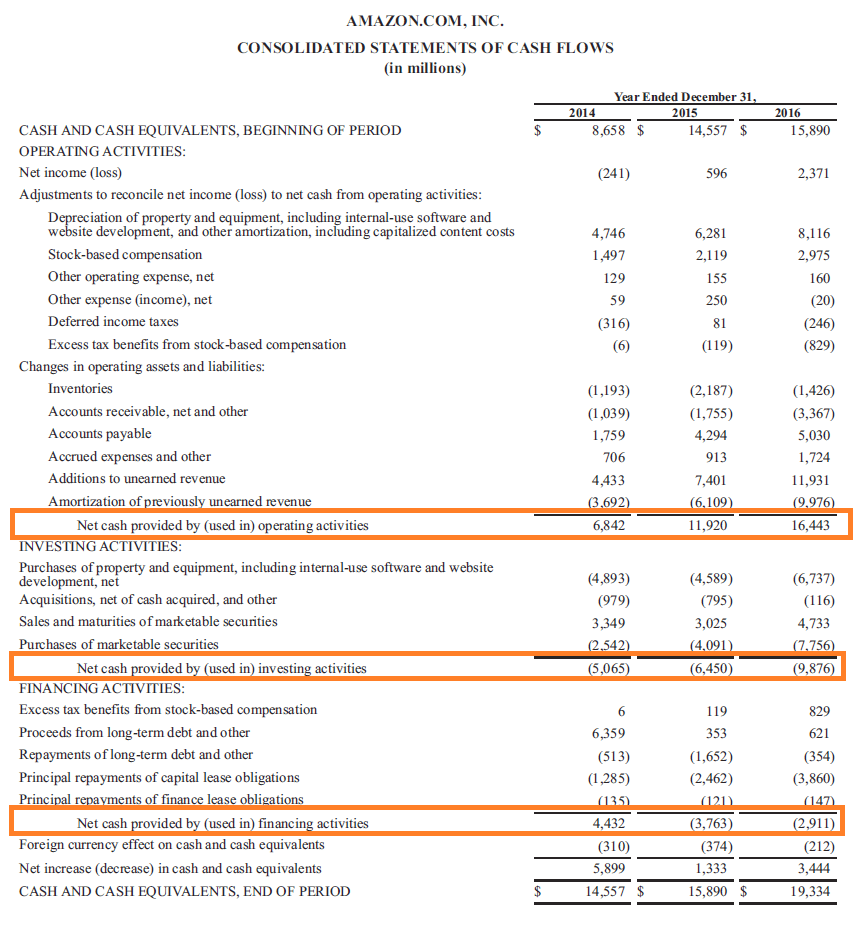

Cash Flow Statement Definition Example And Complete Guide Fourweekmba

![]()

Ucc Filing The Ins And Outs Of What A Ucc Is And Where To Look For One

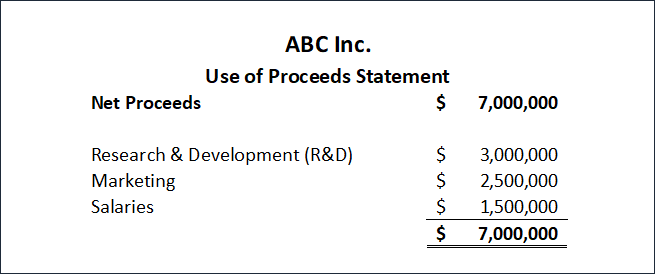

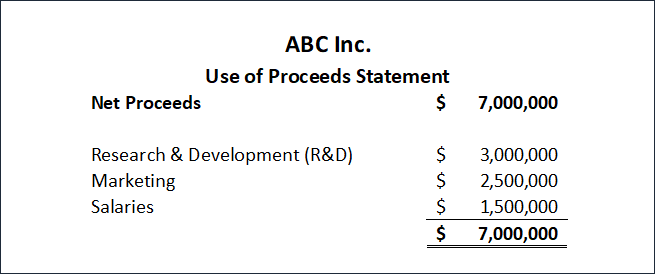

Use Of Proceeds Statement Overview How To Create Format

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

Equity Definition Formula Calculation Examples

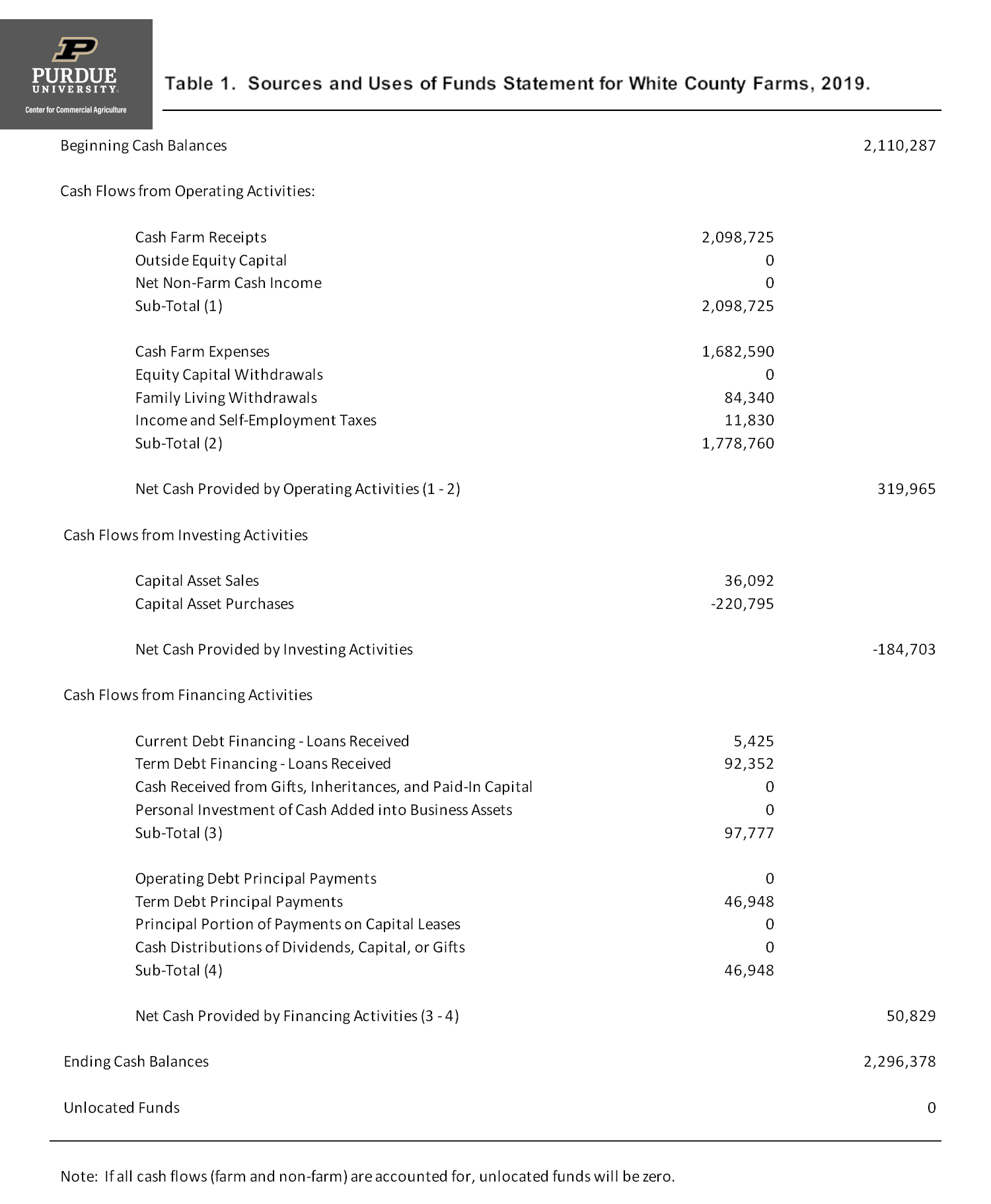

Sources And Uses Of Funds Statement Aka Cash Flow Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is Examples

How To Write A Convincing Business Loan Request Letter

How To Write A Convincing Business Loan Request Letter

Hybridge Sba Loan National Business Capital Business Capital Business Sba Loans

Usa Capital One Bank Statement Template Word And Pdf Format Doc And Pdf Statement Template Bank Statement First Bank

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Sources And Uses Of Funds Statement Center For Commercial Agriculture

How To Write A Convincing Business Loan Request Letter

Post a Comment for "Capital First Business Loan Statement"