Florida Business Quarterly Taxes

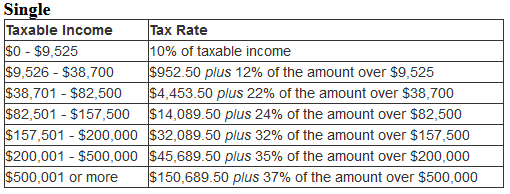

In the 2020 tax year for example The self-employment tax rate on net income up to 137700 is 153. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

3 Oversee property tax administration involving 109 million parcels of.

Florida business quarterly taxes. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. 1st Quarter returns and payments due on or before April 30. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

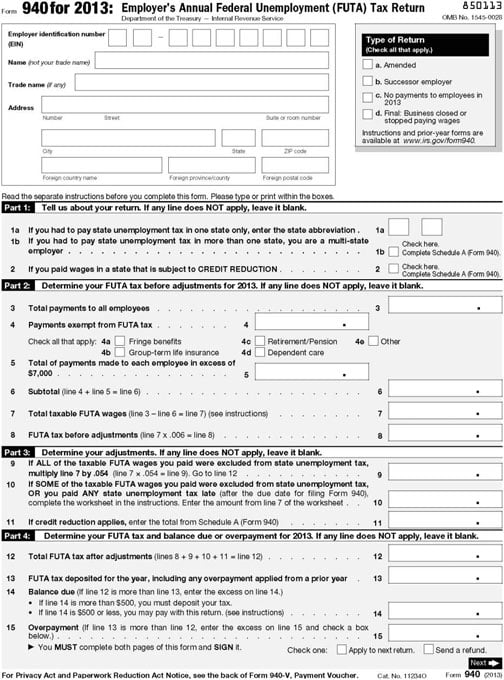

The data files correspond to the date the information was added to the Division of Corporations database. Learn your options for e-filing form 940 941 943 944 or 945 for Small Businesses. While the deadlines to file and pay certain taxes have been extended to May 17 the first quarter estimated tax payments for individuals are still due on April 15.

File names are case sensitive. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. The self-employment tax Social Security and Medicare Income tax on the profits that your business made and any other income.

We upload data files to the Division of Corporations FTP server quarterly. The self-employment tax is a social security and Medicare tax for individuals who work for themselves. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

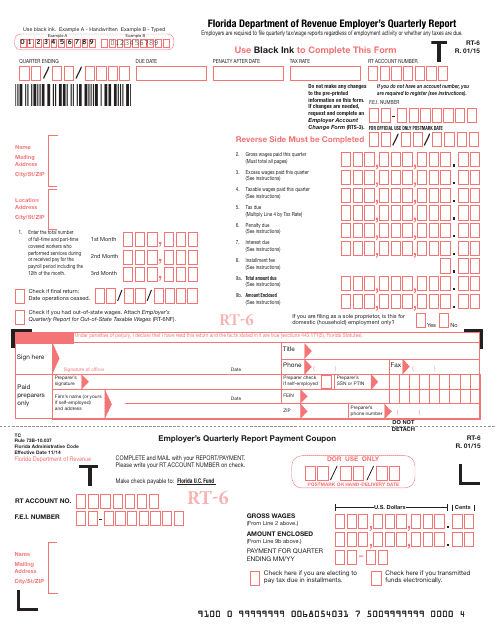

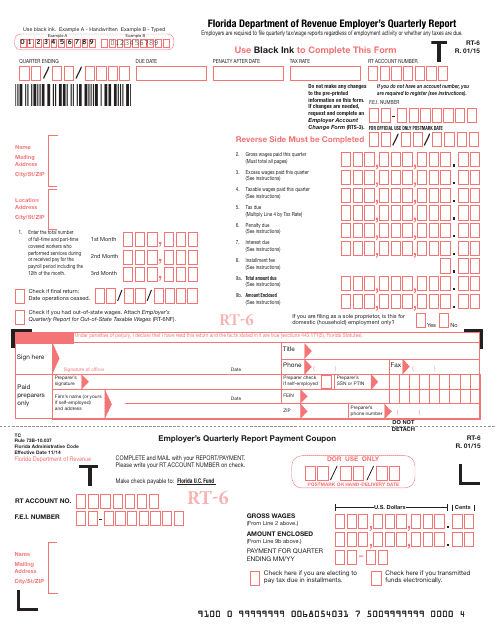

Florida Sales and Use Tax Florida businesses must collect sales tax for many products and services. Get details on the new tax deadlines and on coronavirus tax relief and Economic Impact Payments. Depending on the volume of sales taxes you collect and the status of your sales tax account with Florida you may be required to file sales tax returns on a monthly semi-monthly quarterly semi-annual or annual basis.

For example if your businesss net income in Florida is 50000 it will be taxed 2750. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. Private home or college club that paid 1000 cash in a quarter for domestic services in a calendar year.

If your business collects more than 100000 in sales tax per month then your business should file. 3 Oversee property tax administration involving 109 million parcels of. Before you decide not to file your tax.

Use tax preparation software to run a rough calculation of estimated taxes for the next year. Florida sales tax returns are always due by the 20th of the month following the reporting period. For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with Extension Request to 2021 Estimated Taxes.

Benefits of Forming a Florida LLC. In other words reports and payments are due by the following dates. The tax rate on this income is 55 percent.

Corporations usually use Form 1120-W to calculate their estimated tax. The format allows you to manipulate the data for your own purposes. Florida Department of State - Division of Corporations Business License.

You can use the estimated tax calculation worksheet provided by the IRS on Form 1040-ES or using the worksheets included in Publication 505. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Quarterly taxes generally fall into two categories.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. A corporation is required to pay the higher. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

The standard corporate tax in Florida on federal taxable income is 55 but exemptions often lower a corporations effective tax rate significantly. File Quarterly Reemployment Tax Reports and Payments. Each file contains basic filing information.

Quarterly payroll of 1500 or more in a calendar year. Small Business Administration - Florida State of Florida Agencies Florida Administrative Code. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

Department of Economic Opportunity Reemployment Tax - formerly Unemployment Tax New Hire Reporting Center. Your business may be required to file information returns to report certain types of payments made during the year. On this page we have compiled a calendar of all sales tax due dates for Florida broken down by filing frequency.

Department of Revenue - Businesses. If all of an employers employees perform domestic services exclusively and the employer is eligible for an earned tax rate the business may select an annual filing option. 3 Oversee property tax administration involving 109 million parcels of.

How often you are required to file sales tax in Florida follows this general rule. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

31 April 30 July 31 Oct. In Florida reemployment tax reports and payments must be submitted by the end of the month following the calendar quarter for which the report is due. 3 Oversee property tax administration involving 109.

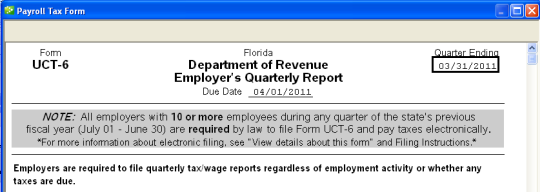

If your business collects between 50100 and 100000 in sales tax per month then your business should file returns on a quarterly basis. Taxes are paid quarterly on form UCT-6 to the Florida Department of Revenue. In Florida you will be required to file and remit sales tax either monthly quarterly semiannually or annually.

One or more employees for a day or portion of a day during any 20 weeks in a calendar year. Previously liable for reemployment tax in the State of Florida. Keep in mind that you can receive tax credits for providing salaries to Florida residents paying other taxes and assessments and making certain investments in your business.

Https Floridarevenue Com Forms Library Current Gt800041 Pdf

Http Floridarevenue Com Forms Library Current Dr1c Pdf

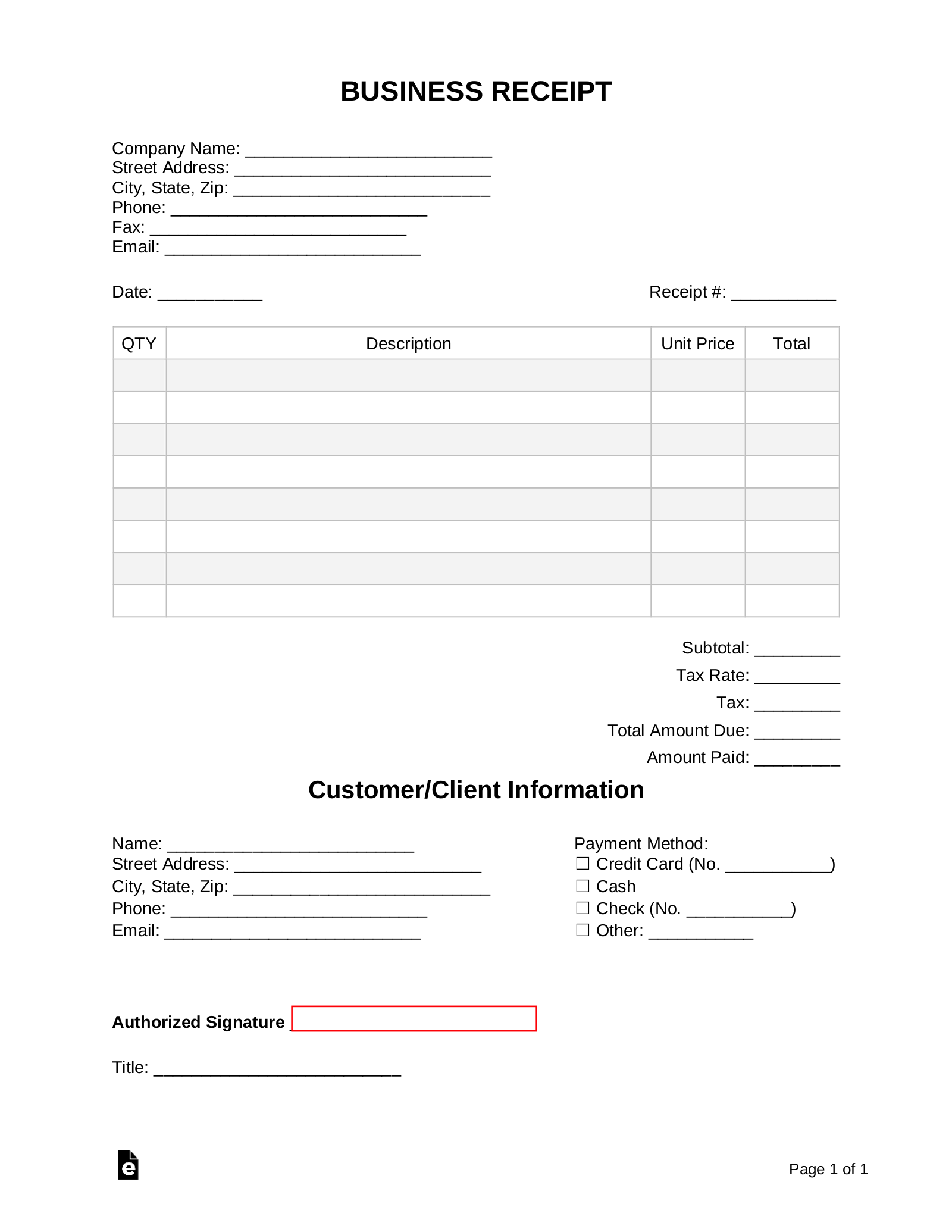

Free Business Receipt Template Word Pdf Eforms

How To Calculate Unemployment Tax Futa Dummies

How To File And Pay Sales Tax In Florida Taxvalet

How To File And Pay Sales Tax In Florida Taxvalet

Https Floridarevenue Com Forms Library Current Dr15ezn Pdf

Form Rt 6 Download Printable Pdf Or Fill Online Employer S Quarterly Report Florida Templateroller

Tax Information Floridajobs Org

Free Florida Independent Contractor Agreement Word Pdf Eforms

How To File And Pay Sales Tax In Florida Taxvalet

Sales Tax Guide For Shopify Sellers

Florida Dept Of Revenue Submit Corporate Income Tax Information

Https Floridarevenue Com Forms Library Current Dr15n Pdf

How To Use E File And E Pay In Florida

Business Tax Timeline Annual Vs Quarterly Filing Synovus

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

How To File And Pay Sales Tax In Florida Taxvalet

Post a Comment for "Florida Business Quarterly Taxes"