Business Hazard Insurance For Eidl

Heres Why You Need Hazard Insurance for EIDL Loans and How to Get it. Typically the program is available in limited geographic regions that have experienced hurricanes tornados or other natural disasters.

110 What Can I Use The Eidl Loan For Youtube Loan I Can Hazard Insurance

Just like any other lender the SBA.

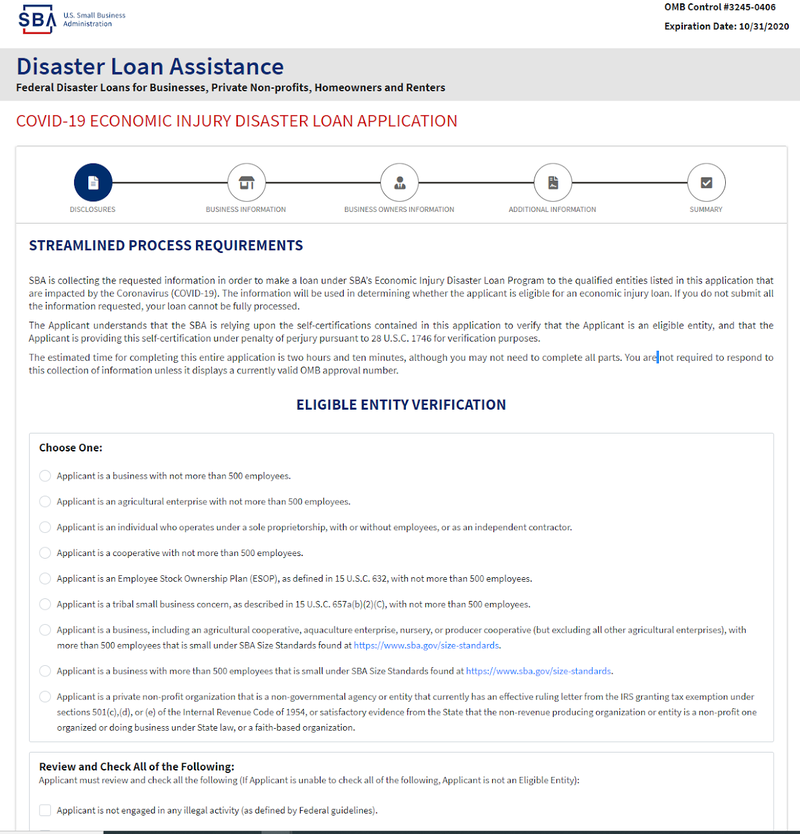

Business hazard insurance for eidl. Hazard Insurance for an SBA Loan The ongoing COVID-19 pandemic has affected millions of small businesses in the US. Borrower will not cancel such coverage and will. The Economic Injury Disaster Loan or EIDL program is administered by the SBA and has been helping small businesses recover from disasters for years.

The Small Business Administration is a lender. EIDL loans require debtors to acquire hazard insurance coverage inside 12 months of getting accepted. I sign on behalf of -company name- for the SBA EIDL Loan 000000000 for loan amount with your signature at the bottom.

Why Does the SBA Require Hazard Insurance For EIDL Loans. Economic Injury Disaster Loans EIDL Working capital loans to help small businesses small agricultural cooperatives small businesses engaged in aquaculture and most private non-profit organizations of all sizes meet their ordinary and necessary financial obligations that cannot be met as a direct result of the disaster. All theyre making an attempt to do is to guard the mortgages collateral or on this case your corporation.

Within 12 months from the date of this Loan Authorization and Agreement the Borrower will provide proof of an active and in effect hazard insurance policy including fire lightning and extended coverage on all items used to. Within 12 months from the date of this Loan Authorization and Agreement the Borrower will provide proof of an active and in effect hazard insurance policy including fire lightning and extended coverage on all items used to secure this loan to at least 80 of the insurable value. The EIDL documents require a Board Resolution to be submitted within 6 months of loan disbursement.

Hazard Insurance If loan proceeds will finance existing or new improvements on a leasehold interest in land the lease must include Lenders SBA or Assignees right to hazard insurance proceeds resulting from damage to improvements. In the case of EIDL the SBA requires the borrower maintain hazard insurance to protect collateral. As for the hazard insurance if you work from home and have homeowners insurance that could work just fine.

The SBA simply requires that Business Personal Property coverage be included in the policy. As well as you should preserve that protection all through the lifetime of the mortgage. The Small Business Administration SBA offers an economic injury disaster loan EIDL to provide relief to small businesses that experienced a.

I sent her my IRS PTIN my notary commission and my state General Lines license as an insurance agent addressed at the low-income location. And in this video Im going to go over how I got the. We have heard from a few owners who have an EIDL that they have received notices from an SBA case manager requesting them to submit a Resolution of Board of Directors and Hazard business liability insurance to the SBA.

Afterwards she didnt think it was sufficient. Borrowers must maintain this insurance for the full term of the EIDL. SBA Required Hazard Insurance on All Assets Borrowers are required to maintain hazard insurance covering all assets up to 80 of the value of the assets and provide proof of such insurance to the SBA.

Economic Injury Disaster Loans EIDLs Working capital loans to help small businesses small agricultural cooperatives small businesses engaged in aquaculture and most private non-profit organizations of all sizes meet their ordinary and necessary financial obligations that cannot be met as a direct result of the disaster. She then asked to see proof of business transactions - she told me to send check images that cleared my bank. Future Loans Must Repay EIDL.

If the primary activity of the business including its affiliates is as defined in Section 18b1 of the Small Business Act neither the business nor its affiliates are eligible for EIDL assistance Religious Organizations Charitable Organizations. The Duty to Maintain Hazard Insurance requirement may be found on page 4 of the Loan Authorization and Agreement which you signed the Borrower will provide proof of an active and in effect hazard insurance policy including fire lightning and extended coverage on all items used to secure this loan to at least 80 of the insurable value. DUTY TO MAINTAIN HAZARD INSURANCE.

In order to qualify for an Economic Injury Disaster Loan you need to show proof of hazard insurance at 80 of your business property value.

Eidl Loans For Small Businesses

Loan Increase Timeline After Confirmed Amount Eidl

5 Eidl Loan Terms And Requirements You Should Know The Blueprint

The Eidl For Sole Props And The Self Employed Bench Accounting

Sba Increases Eidl Maximum Loan Amounts Beginning April 6

![]()

Q A For Ppp And Eidl Tom Copeland S Taking Care Of Business

Sba Eidl Collateral Requirement Changes Sba Eidl Loan Updates Youtube

Eidl Loans Require Hazard Insurance Here S How To Get It Surfky Com

How To Use Your Eidl Funding Do S And Dont S Pandemic Assistance

Sba S Business Hazard Insurance Requirements For The Eidl Youtube

Applying For Sba Eidl Disaster Assistance

Economic Injury Disaster Loan Eidl Documents The Sba Requires

Eidl And Collateral Your Questions Answered Bench Accounting

How To Apply For The Economic Injury Disaster Loan Eidl Program Tom Copeland S Taking Care Of Business

Eidl Economic Injury Disaster Loan And Eidl Advances Hands On Help For Small Businesses Moneylion

Sba Pinged My Credit For Eidl Expansion Eidl

The Latest Wrinkle In The Eidl Saga Rosenberg Chesnov

Post a Comment for "Business Hazard Insurance For Eidl"